Matson (MATX): Is it Priced Right? A Comprehensive Guide

Matson Inc (NYSE:MATX) has recently seen a daily gain of 3.21%, and a 3-month gain of 14.62%. Despite the promising rise, the question remains: is the stock fairly valued? With an Earnings Per Share (EPS) (EPS) of 12.19, the valuation analysis is crucial to understand the intrinsic worth of Matson Inc. Read on for an in-depth analysis of Matson's valuation.

Company Overview

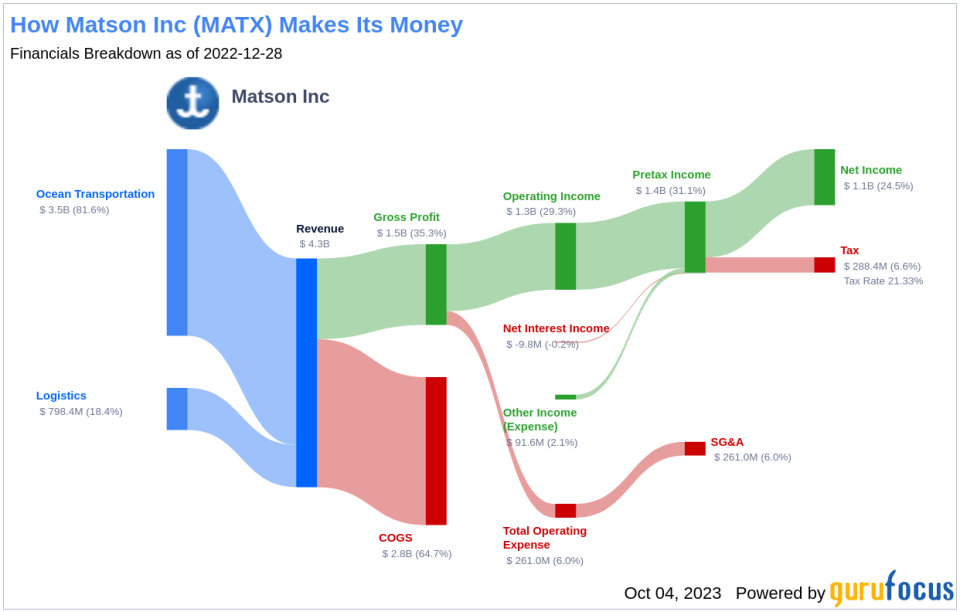

Matson Inc is a prominent player in the ocean transportation and logistics services sector. The company's operations span across non-contiguous economies of Hawaii, Alaska, California, Okinawa, and various islands in the South Pacific. Matson's logistics services include long haul and regional highway trucking services, warehousing and distribution services, supply chain management, and freight forwarding services. The majority of its revenue is generated from ocean transportation.

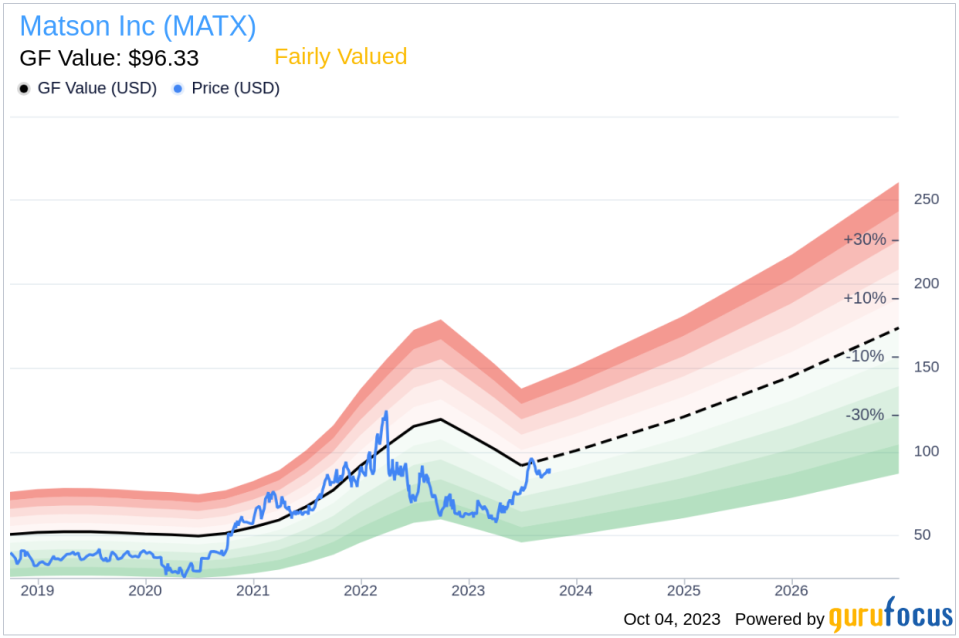

Matson's current stock price is $89.87 per share, with a market cap of $3.20 billion. The company's GF Value, a proprietary measure of intrinsic value, stands at $96.33, indicating that the stock is fairly valued.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line represents the fair value at which the stock should ideally be traded.

Matson's stock is believed to be fairly valued according to the GF Value calculation. Since the stock is fairly valued, the long-term return of Matson's stock is likely to be close to the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

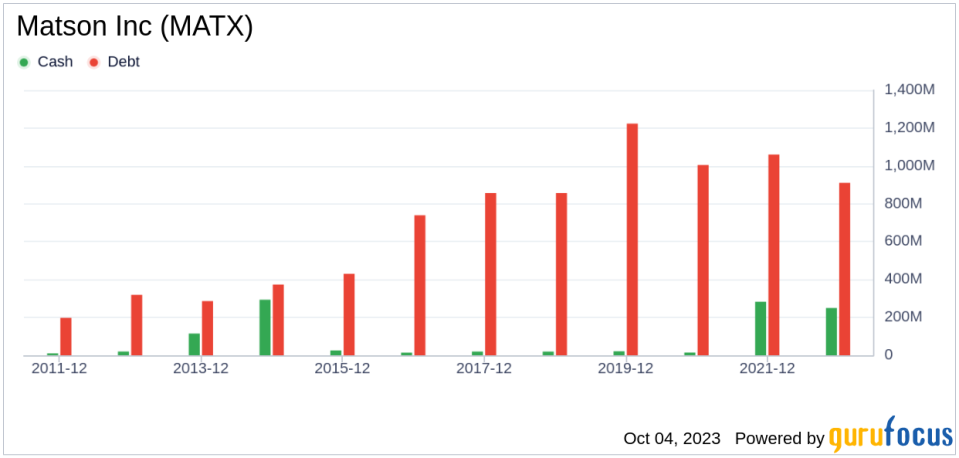

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. Matson's cash-to-debt ratio of 0.15 is lower than 76.45% of 934 companies in the Transportation industry. However, its overall financial strength is ranked 7 out of 10 by GuruFocus, indicating fair financial strength.

Profitability and Growth

Consistent profitability over the long term reduces the risk for investors. Matson has been profitable for 10 out of the past 10 years. Its operating margin of 15.97% ranks better than 72.59% of 945 companies in the Transportation industry, indicating strong profitability.

Growth is a crucial factor in a company's valuation. Matson's 3-year average revenue growth rate is better than 88.12% of 909 companies in the Transportation industry. Its 3-year average EBITDA growth rate is 84.6%, which ranks better than 93.64% of 817 companies in the Transportation industry.

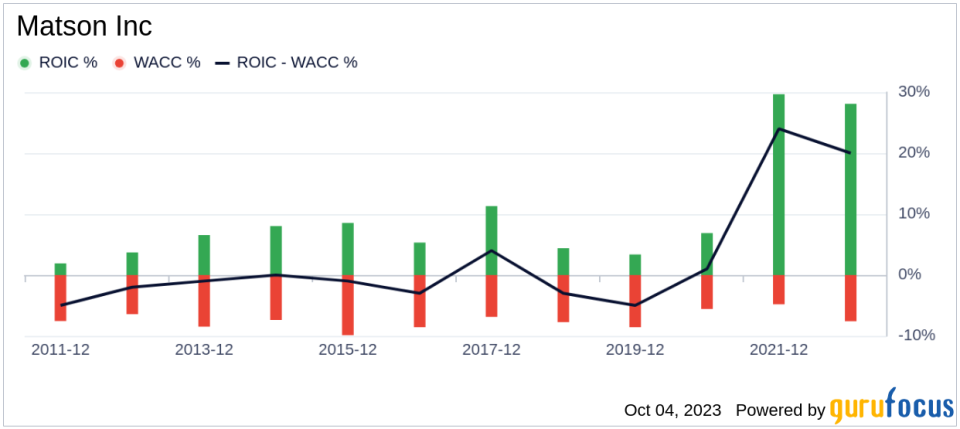

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is another way to evaluate its profitability. Over the past 12 months, Matson's ROIC was 11.27, while its WACC came in at 9.8, indicating that the company is creating value for shareholders.

Conclusion

Overall, the stock of Matson Inc (NYSE:MATX) is believed to be fairly valued. The company's financial condition is fair, and its profitability is strong. Its growth ranks better than 93.64% of 817 companies in the Transportation industry. To learn more about Matson stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.