Matterport Inc (MTTR) Reports Strong Recurring Revenue Growth and Moves Closer to Profitability

Annualized Recurring Revenue: Reached a record $94.7 million, up 23% year-over-year.

Net Loss Improvement: Q4 net loss improved by 27% year-over-year, with non-GAAP net loss improving by 55%.

Operational Cash Flow: Q4 cash used in operating activities improved by 46% year-over-year.

Subscriber Growth: Total subscribers increased by 34% from the previous year.

Square Feet Under Management: Grew by 36% year-over-year, indicating expansion in service scope.

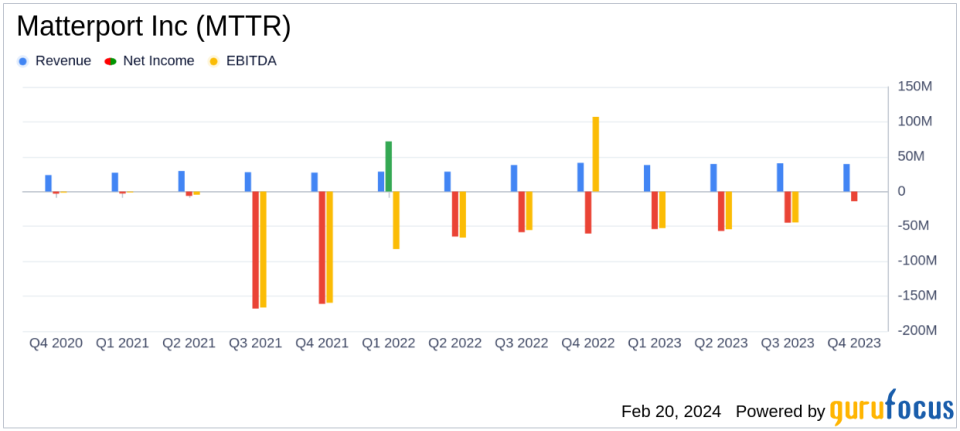

On February 20, 2024, Matterport Inc (NASDAQ:MTTR) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, known for its all-in-one 3D data platform that digitizes and indexes the built world, demonstrated significant strides towards its profitability targets with a strong performance in recurring revenue growth and operational efficiency improvements.

Financial Performance and Challenges

Matterport's Q4 revenue totaled $39.5 million, aligning with the company's guidance. The 23% year-over-year growth in subscription revenue, which reached $23.7 million, was a highlight, surpassing expectations. The company's net dollar expansion rate also saw an impressive increase to 109%, the highest in two years, indicating strong customer retention and upsell rates.

Despite these achievements, Matterport still faces challenges, including a net loss of $0.14 per share. However, this represents a 33% improvement compared to the previous year. The company's non-GAAP net loss per share also improved significantly by 56%, down to $0.04. These improvements are crucial as they reflect Matterport's ability to reduce costs and move closer to achieving profitability.

Key Financial Metrics

Important metrics from Matterport's financial statements include a 50% year-over-year improvement in cash used in operating activities, which is indicative of the company's enhanced cash management and operational efficiency. The balance sheet shows a robust cash and investments position of $423 million with no debt, providing the company with a solid financial foundation to support its growth initiatives.

For the full year 2023, Matterport reported total revenue of $157.7 million, a 16% increase from the prior year. The company also saw a significant increase in its customer base, with total subscribers reaching 938,000, a 34% increase from the previous year. The square feet under management also grew to 38.0 billion, up 36% year-over-year, reflecting the scalability of Matterport's platform.

Commentary from Leadership

"We closed 2023 on a high note with fourth quarter total revenue of $39.5 million, in line with our guidance range. Subscription revenue growth accelerated to 23% year-over-year, ahead of our expectations, driven by broad-based strength across our global customer base," said RJ Pittman, Chairman and Chief Executive Officer of Matterport.

"In 2024, our accelerating subscription revenue growth and continued focus on efficient investments are expected to drive rapid progress to cash flow from operations profitability later this year," added JD Fay, Chief Financial Officer of Matterport.

Outlook and Strategic Moves

Matterport provided guidance for Q1 2024 with total revenue expected to be between $39 million and $41 million, and subscription revenue projected to be between $24.0 million and $24.2 million. The company anticipates a non-GAAP loss per share of $(0.04) to $(0.02) for Q1 2024 and $(0.11) to $(0.07) for the full year.

Recent business highlights include the launch of the Matterport 2024 Winter Release, featuring AI-powered features and new capabilities for intelligent digital twins, and strategic partnerships with companies like Vacasa and Visiting Media. These initiatives are expected to bolster Matterport's position in the market and contribute to its growth trajectory.

Matterport's focus on innovation and strategic partnerships, combined with its robust financial position, suggests a promising outlook for the company as it continues to capitalize on the growing demand for digital twin technology in various industries.

For a detailed analysis of Matterport Inc (NASDAQ:MTTR)'s financial results and strategic direction, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive coverage and expert insights.

Explore the complete 8-K earnings release (here) from Matterport Inc for further details.

This article first appeared on GuruFocus.