Matthews Emerging Markets Small Companies Fund Bolsters Position in CarTrade Tech Ltd

Insightful 13F Filing Update Reveals Strategic Portfolio Adjustments

Matthews Emerging Markets Small Companies Fund (Trades, Portfolio), known for its strategic investments in Asia's burgeoning small-cap market, has disclosed its N-PORT filing for the fourth quarter of 2023. The fund, which operates under a bottom-up, fundamental investment philosophy, focuses on long-term growth by investing in small companies with strong potential. With a history of investing in Asia since 1991, Matthews Asia Small Companies Fund leverages its extensive experience to identify undervalued companies that are poised for success in the evolving Asian markets.

Summary of New Buy

Matthews Emerging Markets Small Companies Fund (Trades, Portfolio) expanded its portfolio with a new addition:

WuXi XDC Cayman Inc (HKSE:02268) was the standout new buy, with the fund purchasing 7,000 shares valued at HK$28.69 million.

Key Position Increases

The fund also significantly increased its stakes in 24 stocks, with notable adjustments including:

CarTrade Tech Ltd (BOM:543333) saw an impressive 2,477.87% increase in share count, with an additional 660,254 shares bringing the total to 686,900. This move had a 0.93% impact on the current portfolio, amounting to a total value of ?58,877,710.

Grupo SBF SA (BSP:SBFG3) was the second-largest increase, with an additional 2,046,400 shares bringing the total to 5,756,300. This adjustment represents a 55.16% increase in share count, with a total value of R$13,913,300.

Summary of Sold Out

The fund completely exited one holding in the fourth quarter of 2023:

AP Memory Technology Corp (TPE:6531) was sold off entirely, with 188,000 shares liquidated, resulting in a -0.39% impact on the portfolio.

Key Position Reduces

Matthews Emerging Markets Small Companies Fund (Trades, Portfolio) also reduced its position in 46 stocks. The most significant reductions include:

Legend Biotech Corp (NASDAQ:LEGN) was reduced by 79,289 shares, leading to a -20.16% decrease in shares and a -0.93% impact on the portfolio. The stock traded at an average price of $63.37 during the quarter and has seen a -9.85% return over the past three months and -1.26% year-to-date.

Hugel Inc (XKRX:145020) saw a reduction of 49,280 shares, a -23.66% decrease, impacting the portfolio by -0.79%. The stock's average trading price was ?144,994 during the quarter, with a 12.27% return over the past three months and a 5.96% year-to-date increase.

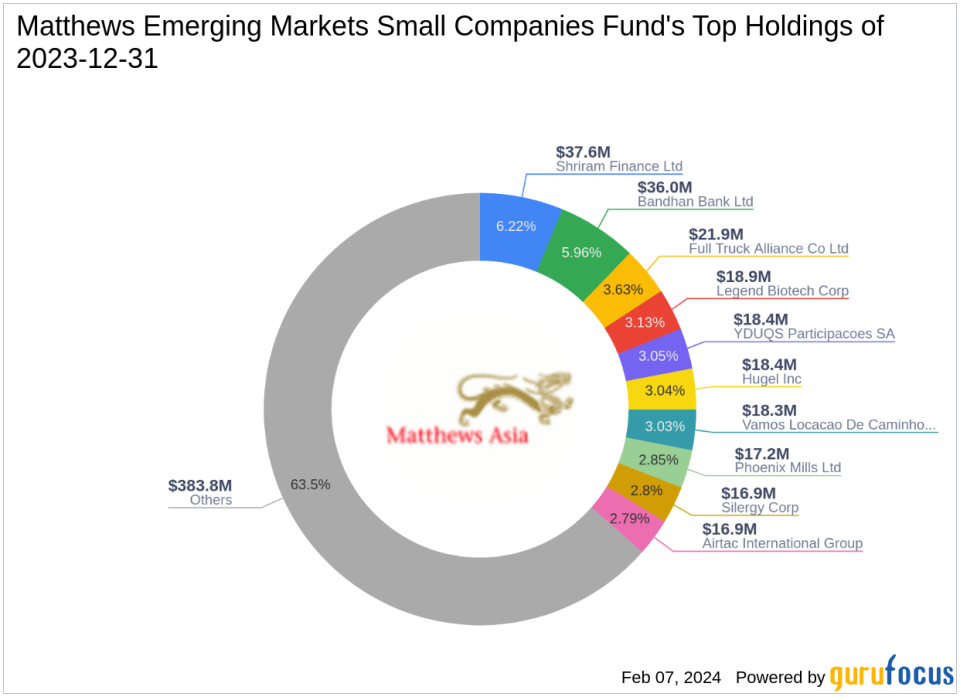

Portfolio Overview

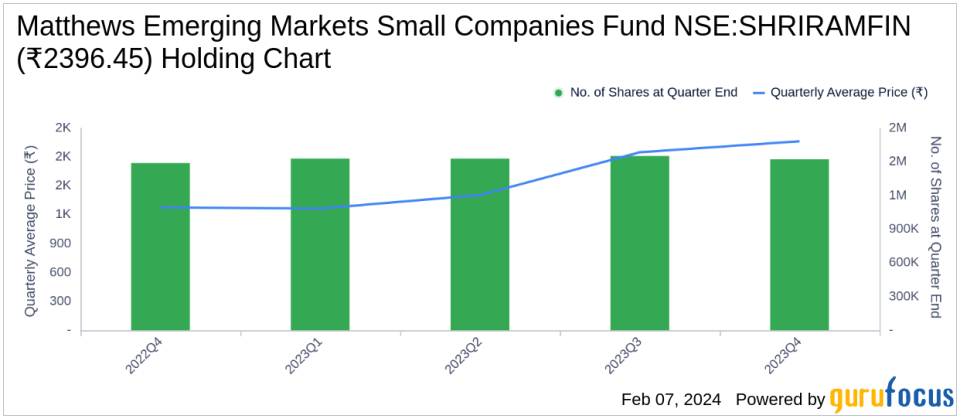

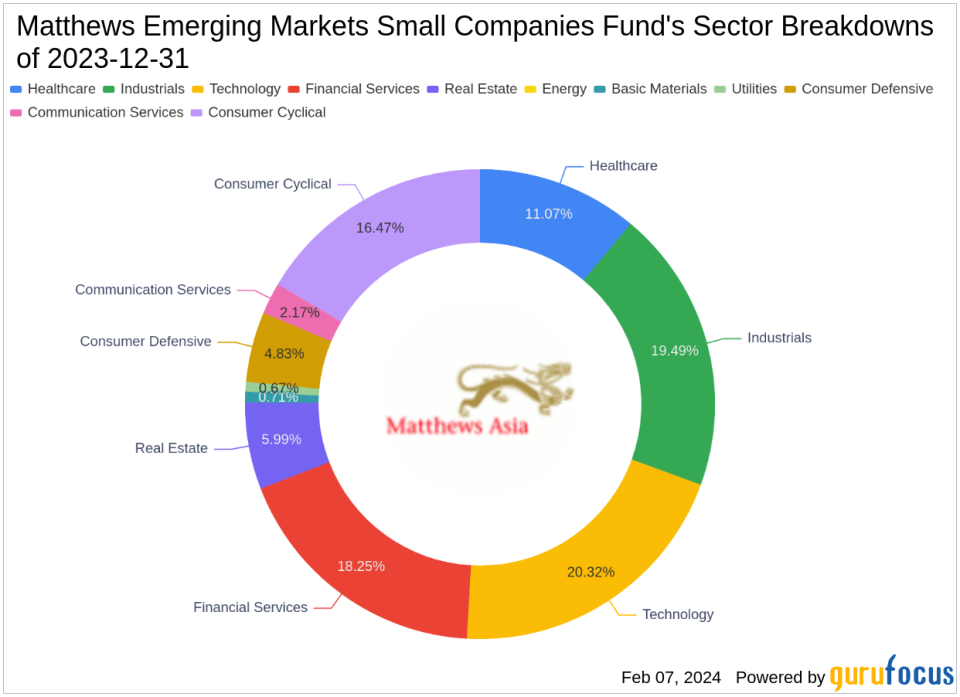

As of the fourth quarter of 2023, Matthews Emerging Markets Small Companies Fund (Trades, Portfolio)'s portfolio comprised 74 stocks. The top holdings included 6.22% in Shriram Finance Ltd (NSE:SHRIRAMFIN), 5.96% in Bandhan Bank Ltd (BOM:541153), 3.63% in Full Truck Alliance Co Ltd (NYSE:YMM), 3.13% in Legend Biotech Corp (NASDAQ:LEGN), and 3.05% in YDUQS Participacoes SA (BSP:YDUQ3). The investments are predominantly spread across 10 of the 11 industries, showcasing a diverse yet focused approach to value creation in the emerging markets.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.