Matthews Emerging Markets Small Companies Fund Adjusts Portfolio, Ecopro BM Sees Major Cut

Insight into the Latest 13F Filing Reveals Significant Portfolio Changes

Matthews Emerging Markets Small Companies Fund (Trades, Portfolio), known for its strategic investments in Asia's burgeoning small-cap market, has revealed its 13F holdings for the third quarter of 2023. The fund, which operates under a philosophy of active management, long-term focus on Asia, bottom-up research, and defining Asia investment strategies, has made notable changes to its portfolio during this period. With a keen eye for sustainable growth and a commitment to identifying undervalued companies, the fund's latest moves offer a glimpse into its strategic adjustments amidst the evolving market landscape.

New Additions to the Portfolio

Matthews Emerging Markets Small Companies Fund (Trades, Portfolio) has expanded its portfolio with the addition of 6 new stocks. The most significant new positions include:

Saudi Tadawul Group Holding Co (SAU:1111) with 259,327 shares, making up 2.32% of the portfolio and valued at ?13.36 million.

Grupo SBF SA (BSP:SBFG3) with 3,709,900 shares, representing 0.88% of the portfolio, and a total value of R$5.03 million.

Hindware Home Innovation Ltd (BOM:542905) with 728,123 shares, accounting for 0.84% of the portfolio and valued at ?4.82 million.

Key Position Increases

The fund has also increased its stakes in 35 stocks, with the most notable increases being:

Vamos Locacao De Caminhoes Maquinas E Equipamentos SA (BSP:VAMO3), with an additional 3,814,700 shares, bringing the total to 7,756,900 shares. This represents a 96.77% increase in share count and a 1.29% impact on the current portfolio, valued at R$15.05 million.

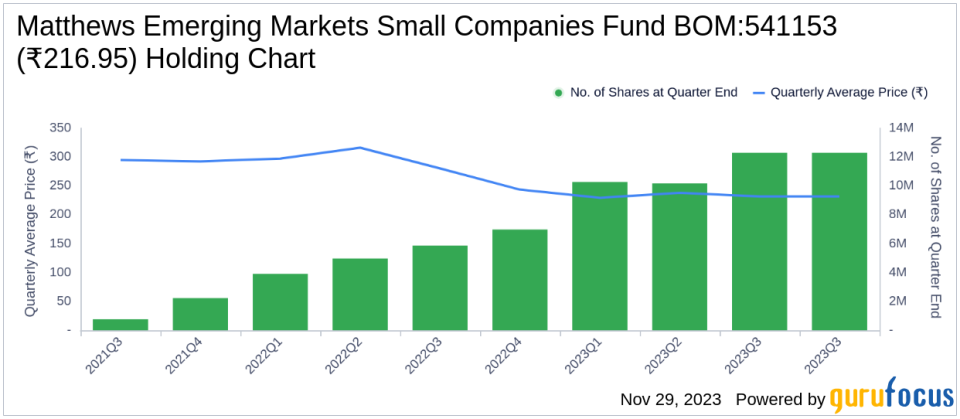

Full Truck Alliance Co Ltd (NYSE:YMM), with an additional 941,487 shares, bringing the total to 3,186,912. This adjustment marks a 41.93% increase in share count, with a total value of $22.44 million.

Positions Sold Out

The fund has completely exited its position in:

Tam Jai International Co Ltd (HKSE:02217), selling all 3,447,000 shares, which had a -0.16% impact on the portfolio.

Significant Reductions in Holdings

Matthews Emerging Markets Small Companies Fund (Trades, Portfolio) has reduced its position in 5 stocks, with the most significant reductions being:

Ecopro BM Co Ltd (XKRX:247540) by 91,797 shares, resulting in a -75.28% decrease in shares and a -3.49% impact on the portfolio. The stock traded at an average price of ?319,108 during the quarter and has seen a -29.03% return over the past 3 months and a 165.47% year-to-date return.

Network International Holdings PLC (LSE:NETW) by 985,197 shares, resulting in a -56.13% reduction in shares and a -0.96% impact on the portfolio. The stock traded at an average price of 3.88 during the quarter and has returned 1.70% over the past 3 months and 32.21% year-to-date.

Portfolio Overview

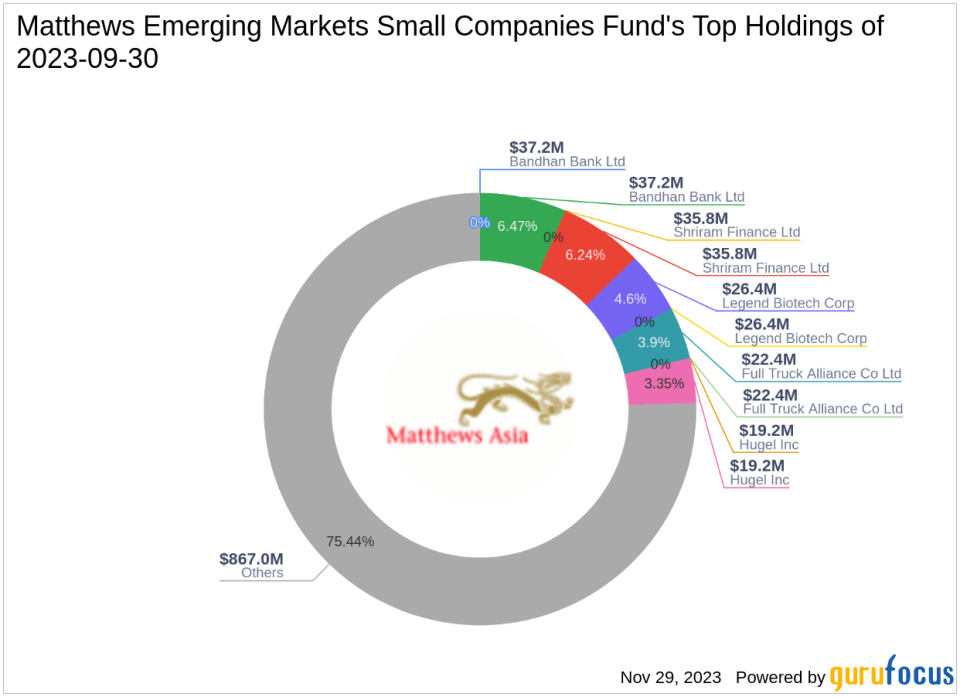

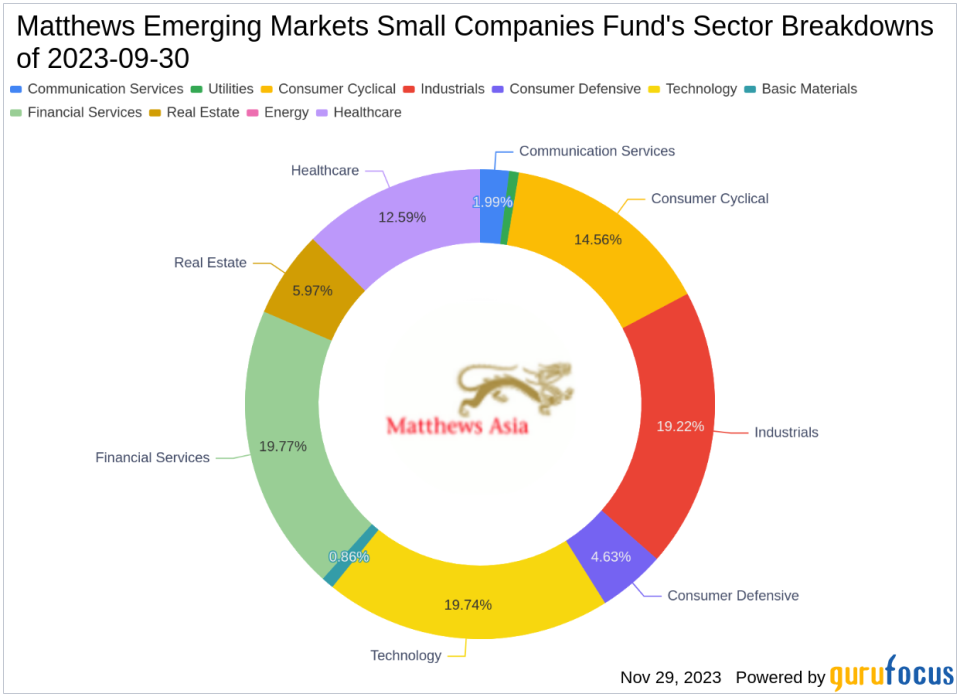

As of the third quarter of 2023, Matthews Emerging Markets Small Companies Fund (Trades, Portfolio)'s portfolio comprises 151 stocks. The top holdings include 6.47% in Bandhan Bank Ltd (BOM:541153), 6.24% in Shriram Finance Ltd (NSE:SHRIRAMFIN), 4.6% in Legend Biotech Corp (NASDAQ:LEGN), 3.9% in Full Truck Alliance Co Ltd (NYSE:YMM), and 3.35% in Hugel Inc (XKRX:145020). The holdings are primarily concentrated across 10 of the 11 industries, showcasing a diverse yet focused investment approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.