Matthews International Corp Reports Modest Sales Growth Amidst Challenges in Fiscal Q1 2024

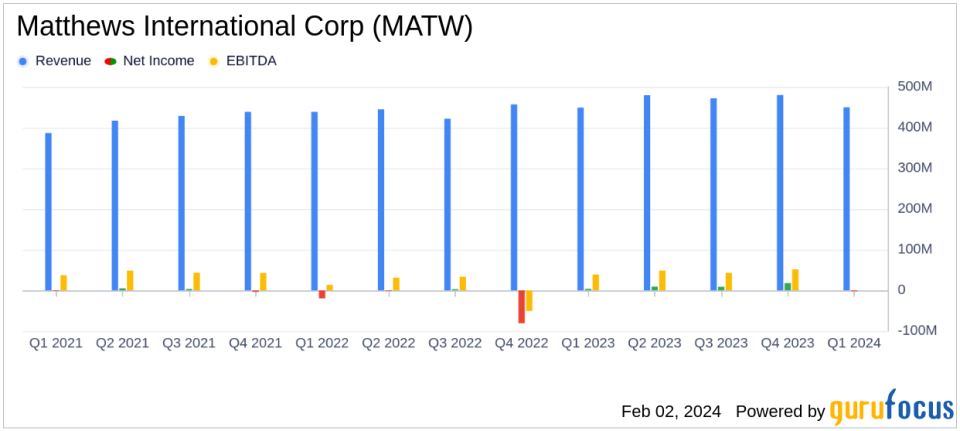

Consolidated Sales: Slight increase to $450.0 million from $449.2 million in the previous year.

Net Loss: Reported a net loss of $2.3 million compared to a net income of $3.7 million in the prior year.

Adjusted EBITDA: Decreased to $45.5 million from $49.3 million year-over-year.

Adjusted EPS: Fell to $0.37 from $0.53 in the same quarter last year.

Energy Business: Sales below anticipated levels due to customer readiness and timing of equipment projects.

Credit Facility Renewal: Company renewed a $750 million revolving credit facility in January 2024.

Fiscal 2024 Outlook: Unchanged with expectations for growth in consolidated sales and adjusted EBITDA over fiscal 2023.

Matthews International Corp (NASDAQ:MATW) released its 8-K filing on February 1, 2024, disclosing the financial results for the first quarter of fiscal 2024. The company, a global provider of brand solutions, memorialization products, and industrial technologies, reported a marginal increase in consolidated sales to $450.0 million, up from $449.2 million in the same quarter a year ago. However, the company faced a net loss of $2.3 million, or $0.07 per diluted share, a significant downturn from the net income of $3.7 million, or $0.12 per diluted share, reported in the prior year.

Despite the overall net loss, Matthews International's Industrial Technologies and Memorialization segments reported sales growth. The Industrial Technologies segment's performance was bolstered by the energy business, although sales were below expected levels due to delays in customer readiness and timing of equipment projects. The Memorialization segment saw an increase in sales of granite memorial products, aided by the acquisition of Eagle Granite, while casket sales declined due to lower death rates compared to the previous year.

The SGK Brand Solutions segment also performed well, with adjusted EBITDA higher than the previous year, reflecting improved pricing and benefits from cost reduction actions. However, the segment experienced softness in European brand markets and a change in the timing of retail-based business projects.

Financial Performance and Challenges

Joseph C. Bartolacci, President and CEO of Matthews International, commented on the results, stating that the company's operating performance was generally in line with expectations, except for the energy solutions business. He noted that the timing of activity in the energy business significantly influenced the quarterly results. Despite the challenges, the company expects the timing issues to be resolved within the fiscal year.

"Our operating performance for the fiscal 2024 first quarter was generally in line with our expectations across our businesses, except energy solutions... Although higher than a year ago, energy sales for the current quarter were well below anticipated levels."

Matthews International also renewed its $750 million domestic revolving credit facility in January 2024, with a maturity set for January 2029. The terms and conditions of the renewed facility remain generally the same as the previous one.

Outlook and Analysis

Looking forward, Matthews International's fiscal 2024 outlook remains unchanged, with the company targeting growth in consolidated sales and adjusted EBITDA over fiscal 2023. The backlog for the energy storage solutions business exceeded $100 million at the end of the quarter, indicating strong customer interest. However, the company cautions that the timing of order execution can significantly influence quarterly results due to the increasing level of larger, longer-term projects.

For value investors and potential GuruFocus.com members, the resilience of Matthews International's Industrial Technologies and Memorialization segments, combined with the company's strategic actions to improve pricing and reduce costs, may present a compelling narrative. While the net loss in the first quarter poses a challenge, the unchanged outlook and strong backlog in the energy business suggest potential for recovery and growth in the upcoming quarters.

For a detailed analysis of Matthews International Corp's financials and future prospects, investors are encouraged to visit GuruFocus.com for comprehensive research tools and expert commentary.

Explore the complete 8-K earnings release (here) from Matthews International Corp for further details.

This article first appeared on GuruFocus.