Matthews International (MATW): A Comprehensive Analysis of Its Market Value

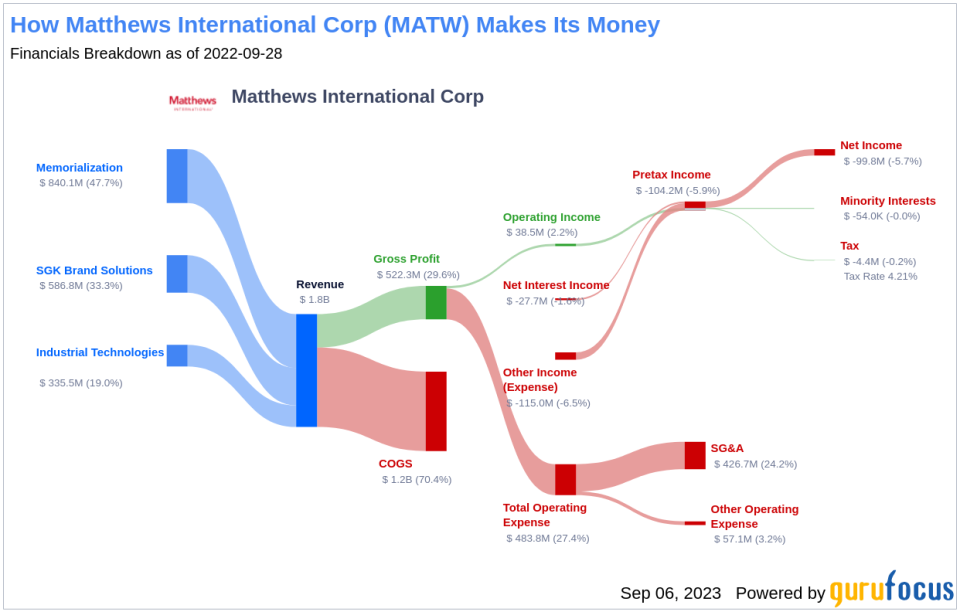

Matthews International Corp (NASDAQ:MATW) is a personal services company that primarily provides brand solution services, memorialization products, and industrial products in the United States and Europe. It recently experienced a daily gain of 3.15% and a 3-month gain of 4.69%. However, the stock has a Loss Per Share of 1.98. This raises the question: Is Matthews International's stock fairly valued? In this article, we will delve deeper into the valuation analysis of Matthews International.

Company Overview

Matthews International Corp has a significant presence in the consumer packaged goods and packaging industries, offering brand development services, printing equipment, creative design services, and embossing tools. The company also sells bronze and granite memorials, caskets, and cremation equipment to the cemetery and funeral home industries. Despite being based in the U.S., Matthews International also has a strong customer base in Europe.

Currently, Matthews International's stock price stands at $41.49 per share, with a market cap of $1.30 billion. When compared with the GF Value of $38.65, the stock appears to be fairly valued.

Understanding GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It is derived from historical multiples, GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at.

According to GuruFocus Value calculation, Matthews International's stock is fairly valued. This is based on the historical multiples that the stock has traded at, the past business growth, and analyst estimates of future business performance. If the price of a stock is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Financial Strength

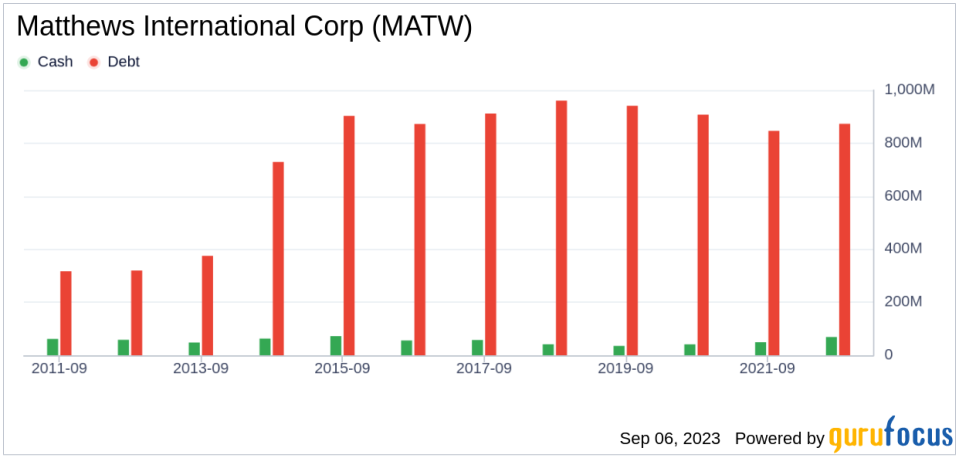

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it is crucial to review a company's financial strength before deciding to buy shares. Matthews International's cash-to-debt ratio stands at 0.05, ranking worse than 93.13% of 495 companies in the Conglomerates industry. This suggests that Matthews International has a fair balance sheet.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is usually less risky. Matthews International has been profitable 7 over the past 10 years. However, its operating margin of 3.83% ranks worse than 63.69% of 493 companies in the Conglomerates industry, indicating fair profitability.

Growth is a crucial factor in the valuation of a company. Matthews International's 3-year average revenue growth rate is worse than 51.39% of 467 companies in the Conglomerates industry. Its 3-year average EBITDA growth rate is -33.4%, which ranks worse than 94.4% of 411 companies in the Conglomerates industry.

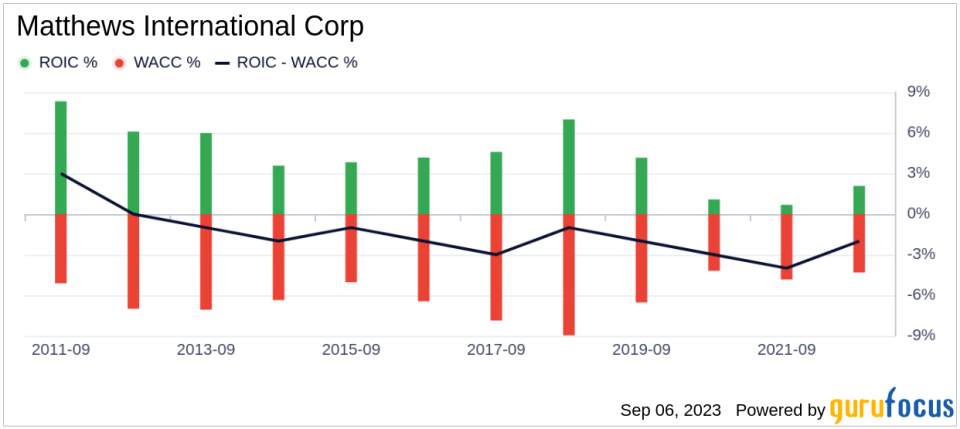

Return on Invested Capital (ROIC) vs Weighted Average Cost of Capital (WACC)

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. Over the past 12 months, Matthews International's ROIC was 4.26, while its WACC came in at 7.86.

Conclusion

In conclusion, Matthews International's stock appears to be fairly valued. The company's financial condition is fair, and its profitability is fair. However, its growth ranks worse than 94.4% of 411 companies in the Conglomerates industry. To learn more about Matthews International stock, check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.