Matthews Japan Fund Picks Up 6 Stocks

The Matthews Japan Fund (Trades, Portfolio) released its first-quarter portfolio last week, listing six new holdings.

Part of San Francisco-based investment firm Matthews Asia, the fund is managed by Taizo Ishida and Shuntaro Takeuchi. It invests in Japanese companies that have sustainable growth in order to generate long-term capital appreciation.

Based on these criteria, the fund established positions in Fast Retailing Co. Ltd. (TSE:9983), Santen Pharmaceutical Co. Ltd. (TSE:4536), Shin-Etsu Chemical Co. Ltd. (TSE:4063), Fujifilm Holdings Corp. (TSE:4901), Pan Pacific International Holdings Corp. (TSE:7532) and Freee KK (TSE:4478).

Fast Retailing

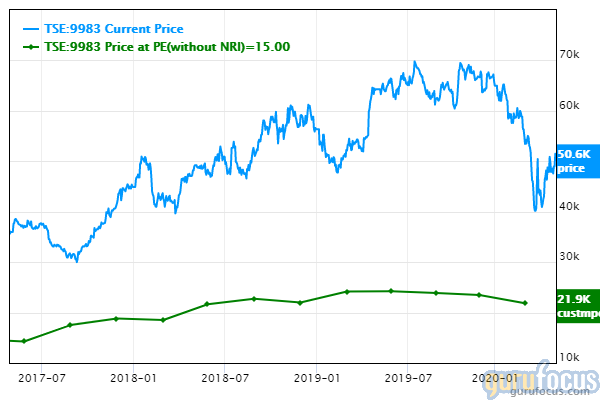

Having previously sold out of Fast Retailing in the second quarter of 2015, the fund entered a new 59,700-share holding, which was given 1.55% space in the equity portfolio. The stock traded for an average price of 56,168.6 yen ($527.42) per share during the quarter.

The retail holding company has a market cap of 5.16 trillion yen; its shares closed at 50,580 yen on Tuesday with a price-earnings ratio of 34.7, a price-book ratio of 5.07 and a price-sales ratio of 2.32.

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced. The GuruFocus valuation rank of 3 out of 10 also leans toward overvaluation.

GuruFocus rated Fast Retailing's financial strength 7 out of 10. Although the company has issued approximately 205.8 billion yen in new long-term debt over the past three years, it is at a manageable level due to adequate interest coverage. The Altman Z-Score of 4.55 also indicates the company is in good standing.

The company's profitability fared a bit better, scoring a 9 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of competitors and a moderate Piotroski F-Score of 4, which implies operations are stable. Fast Retailing also has a business predictability rank of 4.5 out of five stars. According to GuruFocus, companies with this rank typically see their stocks return an average of 10.6% per annum over a 10-year period.

With its purchased of 0.06% of outstanding shares, Matthews is now the company's largest guru shareholder. The Hennessy Japan Fund (Trades, Portfolio) and the T. Rowe Price Japan Fund (Trades, Portfolio) also have positions in the stock.

Santen Pharmaceutical

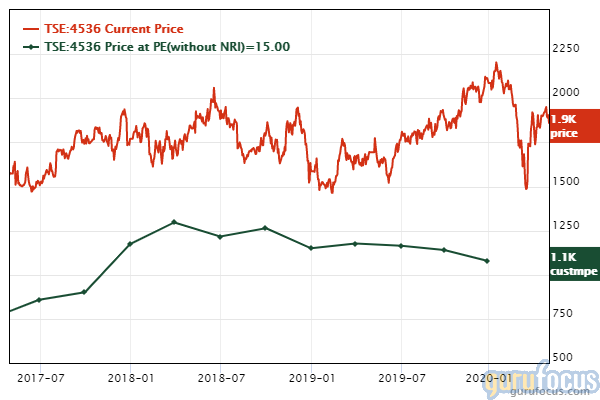

The Japan Fund invested in 1.35 million shares of Santen Pharmaceutical, allocating 1.48% of the equity portfolio to the stake. During the quarter, shares traded for an average price of 1,937.86 yen each.

The pharmaceutical company, which specializes in ophthalmology, has a market cap of 742.73 billion yen; its shares closed at 1,860 yen on Tuesday with a price-earnings ratio of 25.88, a price-book ratio of 2.46 and a price-sales ratio of 3.07.

According to the Peter Lynch chart, the stock is overvalued. The GuruFocus valuation rank of 3 out of 10 also supports this assessment.

Santen's financial strength and profitability were both rated 9 out of 10 by GuruFocus. In addition to having adequate interest coverage as well as no long-term debt, the company is supported by a robust Altman Z-Score of 6.59. As its assets are building up at a faster rate than its revenue is growing, however, the company may be becoming less efficient.

Although the operating margin is in decline, it still outperforms a majority of industry peers. Santen also has strong margins, a high Piotroski F-Score of 7, which suggests operations are healthy, and a 2.5-star business predictability rank. GuruFocus says companies with this rank typically return an average of 7.3% per year.

The fund holds 0.34% of its outstanding shares. The Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) also has a position in the stock.

Shin-Etsu Chemical

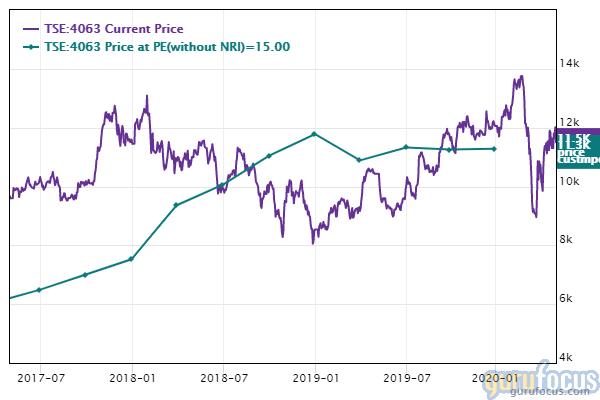

After divesting of a position in Shin-Etsu Chemical in the first quarter of 2019, the fund established a new holding of 210,200 shares, expanding the equity portfolio by 1.31%. The stock traded for an average per-share price of 11,995.3 yen during the quarter.

The chemical company has a market cap of 4.79 trillion yen; its shares closed at 11,510 yen on Tuesday with a price-earnings ratio of 15.31, a price-book ratio of 1.86 and a price-sales ratio of 3.08.

Based on the Peter Lynch chart, the stock appears to be trading near its fair value.

GuruFocus rated Shin-Etsu's financial strength 9 out of 10, driven by a high cash-debt ratio of 47.38 and a comfortable level of interest coverage. In addition, the Altman Z-Score is strong at 8.75.

The company's profitability scored an 8 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of competitors and a moderate Piotroski F-Score of 4. Since Shin-Etsu has recorded a slowdown in revenue per share growth over the past 12 months, the one-star business predictability rank is on watch. GuruFocus data shows companies with this rank typically return an average of 1.1% annually.

The Japan Fund holds 0.05% of the company's outstanding shares.

Fujifilm Holdings

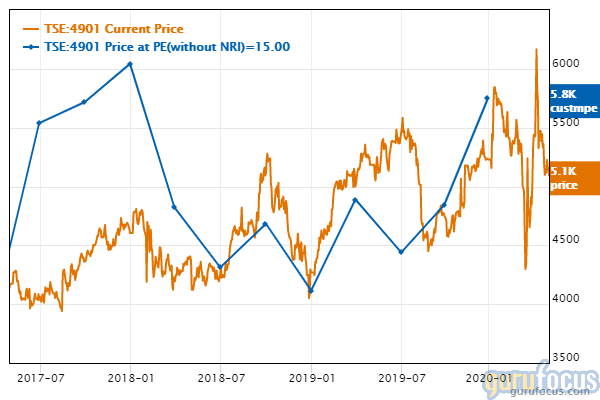

Matthews picked up 357,400 shares of Fujifilm Holdings, dedicating 1.12% of the equity portfolio to the holding. The stock traded for an average price of 5,321 yen during the quarter.

The well-known photography and imaging company has a market cap of 2.04 trillion yen; its shares closed at 5,095 yen on Tuesday with a price-earnings ratio of 13.29, a price-book ratio of 1.02 and a price-sales ratio of 0.9.

The Peter Lynch chart suggests the stock is undervalued. The GuruFocus valuation rank of 3 out of 10, however, leans toward overvaluation.

Fujifilm's financial strength was rated 7 out of 10 by GuruFocus. Strong interest coverage and a high Altman Z-Score of 3.12 indicate the company is able to cover its debt obligations even though revenue per share growth has slowed down over the past year.

The company's profitability scored a 6 out of 10 rating, driven by operating margin expansion, strong returns that outperform over half of its industry peers and a high Piotroski F-Score of 7. Fujifilm also has a one-star business predictability rank.

The fund holds 0.09% of the company's outstanding shares.

Pan Pacific International

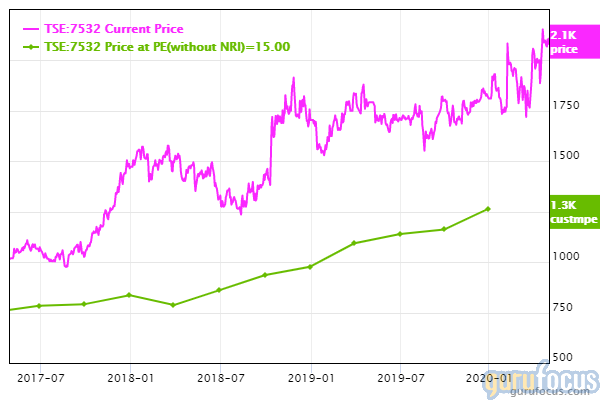

The fund purchased 481,700 shares of Pan Pacific International, giving it 0.58% space in the equity portfolio. During the quarter, shares traded for an average price of 1,868.54 yen each.

The retail company, which operates a chain of discount stores, has a market cap of 1.34 trillion yen; its shares closed at 2,108 yen on Tuesday with a price-earnings ratio of 25.02, a price-book ratio of 3.81 and a price-sales ratio of 0.8.

According to the Peter Lynch chart, the stock is overvalued. The GuruFocus valuation rank of 3 out of 10 also favors overvaluation as the share price and price-earnings ratio are near 10-year highs.

GuruFocus rated Pan Pacific's financial strength 5 out of 10. Although the company has issued approximately 175.5 billion yen in new long-term debt over the past three years, it is at a manageable level due to having adequate interest coverage. The Altman Z-Score of 2.78, however, indicates it is under some financial pressure since its assets are building up at a faster rate than revenue is growing.

The company's profitability fared even better, scoring an 8 out of 10 rating. Despite the operating margin being in decline, Pan Pacific's returns outperform more than half of its competitors. It is also supported by a moderate Piotroski F-Score of 6, steady earnings and revenue growth and a four-star business predictability rank. GuruFocus says companies with this rank typically return an average of 9.8% per year.

Matthews is the company's largest guru shareholder with 0.08% of outstanding shares. The T Rowe Price Japan Fund also owns the stock.

Freee

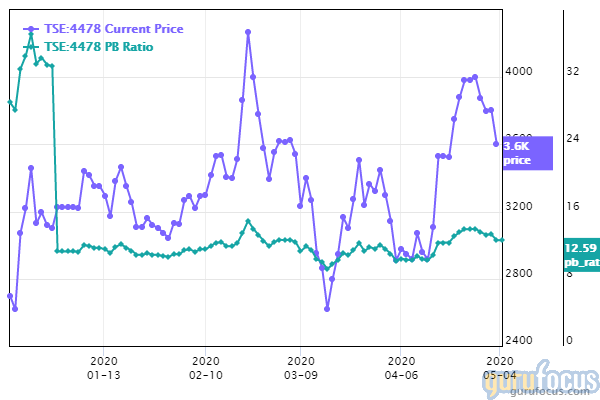

The Japan Fund bought 152,600 shares of Freee, impacting the equity portfolio by 0.31%. The stock traded for an average per-share price of 3,326.16 yen during the quarter.

The software company has a market cap of 173.53 billion yen; its shares closed at 3,605 yen on Tuesday with a price-book ratio of 12.59.

Based on the price-book chart, the stock appears to be overvalued.

Driven by no long-term debt and strong interest coverage, Freee's financial strength was rated 8 out of 10 by GuruFocus.

The company is being weighed down, however, by negative margins and returns that underperform a majority of industry peers.

Matthews holds 0.32% of Freee's outstanding shares. T Rowe Price also has a position in the stock.

Additional trades and portfolio performance

During the quarter, the Japan Fund also added to several positions, including Sansan Inc. (TSE:4443), Mitsui Fudosan Co. Ltd. (TSE:8801), Hikari Tsushin Inc. (TSE:9435) and Shionogi & Co. Ltd. (TSE:4507).

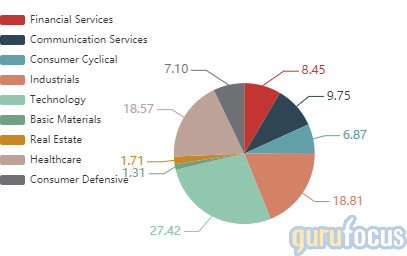

Matthews' $1.57 billion equity portfolio, which is composed of 49 stocks, is largely invested in the technology sector, followed by smaller holdings in the industrials and health care spaces.

According to its fact sheet, the fund returned 26.08% in 2019, outperforming the MSCI Japan Index's 20.07% return.

Disclosure: No positions.

Read more here:

Mario Cibelli Blots Stake in Cosmetics Company e.l.f. Beauty

Eaton Vance Worldwide Health Sciences Fund Adds 3 Stocks to Portfolio

Bruce Berkowitz's Fairholme Fund Dumps Vista Outdoor in Favor of Berkshire Hathaway

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.