Matthews Pacific Tiger Fund Picks Up 3 New Stocks, Drops 1 in 4th Quarter

- By Sydnee Gatewood

The Matthews Pacific Tiger Fund (Trades, Portfolio) released its fourth-quarter portfolio last week, disclosing it established three new positions and closed one position.

Warning! GuruFocus has detected 6 Warning Signs with ISX:SCMA. Click here to check it out.

The intrinsic value of ISX:SCMA

Portfolio managers Sharat Shroff and Rahul Gupta seek long-term capital appreciation by investing in Asian companies, excluding Japan, that are capable of producing sustainable growth. The current portfolio of 68 stocks is largely composed of securities in the financial services and consumer defensive sectors. According to its fact sheet, the fund returned 39.96% in 2017, slightly underperforming its benchmark, which is the MSCI All Country Asia ex Japan Index.

The fund's new positions are Surya Citra Media Tbk (ISX:SCMA), S-1 Corp. (012750.KS) and China Literature Ltd. (HKSE:00772). It exited its Swire Pacific Ltd. (HKSE:00019) holding.

Surya Citra Media

The fund invested in 285 million shares of Surya Citra for an average price of 2,214.92 Indonesian rupiahs (16 cents) per share, giving it 0.55% portfolio space.

The Indonesian media company has a market cap of 41.38 trillion rupiahs; its shares were trading around 2,830 rupiahs on Monday with a price-earnings (P/E) ratio of 28.75, a price-book (P/B) ratio of 9.72 and a price-sales (P/S) ratio of 9.11.

The Peter Lynch chart below shows the stock is overpriced as it is trading above its fair value.

GuruFocus rated Surya Citra's financial strength 9 of 10 and its profitability and growth 7 of 10. The company's trailing dividend yield is 2.06% and its forward dividend yield is 2.85%. The dividend payout ratio is 74%.

The fund holds 1.95% of the company's outstanding shares.

S-1

The fund managers purchased 239,810 shares of S-1 for an average price of 96,038.7 won ($88.36) per share, expanding the portfolio 0.25%.

The South Korean security company has a market cap of 3.36 trillion won; its shares were trading around 99,500 won on Monday with a price-earnings ratio of 22.56, a price-book ratio of 2.85 and a price-sales ratio of 1.73.

According to the Peter Lynch chart below, the stock is overpriced as it is trading above its fair value.

S-1's financial strength was rated 10 of 10 by GuruFocus. Its profitability and growth was rated 8 of 10. The company's trailing dividend yield and forward dividend yield are both 2.54%. The payout ratio is 28%.

The fund owns 0.71% of the company's outstanding shares.

China Literature

The fund bought a 527,091-share holding in China Literature, which went public in November, for an average price of 89.36 Hong Kong dollars ($11.42) per share. The trade had an impact of 0.06% on the portfolio.

The Chinese company, which operates an online literature platform, has a market cap of HK$72.29 billion; its shares were trading around HK$79.75 on Monday with a price-earnings ratio of 295.36, a price-book ratio of 10.34 and a price-sales ratio of 25.22.

Based on the Peter Lynch chart below, the stock appears to be trading above its fair value, suggesting it is overpriced.

China Literature's financial strength was rated 7 of 10 and its profitability and growth was rated 6 of 10 by GuruFocus. The company does not pay a dividend.

The fund holds 0.06% of China Literature's outstanding shares.

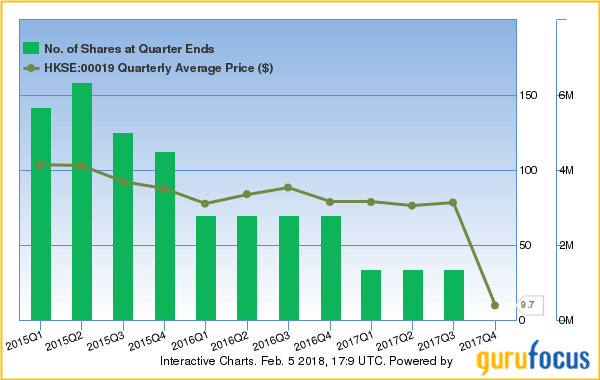

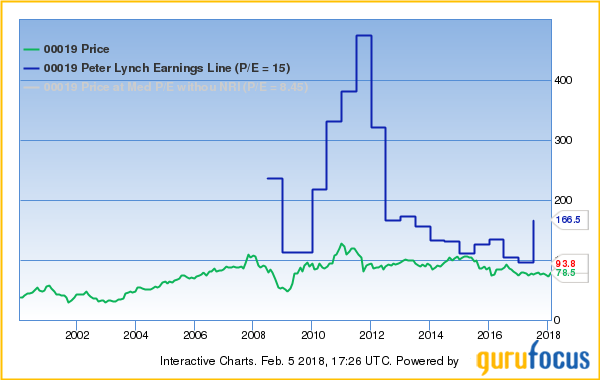

Swire Pacific

The fund managers sold the remaining 1.36 million shares of Swire Pacific for an average price of HK$9.71 per share. The trade had an impact of -0.16% on the portfolio. GuruFocus estimates the fund lost 37% on the investment since the second quarter of 2015.

The Hong Kong-based investment holding company, which is mainly involved in commercial real estate, has a market cap of HK$109.01 billion; its shares were trading around $76.75 on Monday with a price-earnings ratio of 6.96, a price-book ratio of 0.50 and a price-sales ratio of 1.86.

The Peter Lynch chart below suggests the stock is undervalued as it is trading below its fair value.

GuruFocus rated Swire Pacific's financial strength 5 of 10 and its profitability and growth 8 of 10. The company's trailing dividend yield and forward dividend yield are both 2.68%. The payout ratio is 19%.

No other gurus own the stock.

Disclosure: No positions.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 6 Warning Signs with ISX:SCMA. Click here to check it out.

The intrinsic value of ISX:SCMA