Mawer New Canada Fund Bolsters Position in Wajax Corp by 454.66%

Insightful Fourth Quarter Moves Highlight Strategic Portfolio Adjustments

Mawer New Canada Fund (Trades, Portfolio), known for its focus on smaller Canadian companies, has revealed its investment activities for the fourth quarter of 2023. The fund's strategy is to construct a diversified portfolio of wealth-creating companies with strong management teams, purchased at prices less than their intrinsic values. The fund's approach is characterized by a rigorous, research-intensive, bottom-up process, with a preference for long-term holdings to capitalize on market recognition and corporate growth, while also aiming to reduce transaction costs.

Summary of New Buy

Mawer New Canada Fund (Trades, Portfolio) initiated a position in one new stock during the quarter:

Pet Valu Holdings Ltd (TSX:PET) was the notable new addition with 82,591 shares, representing 0.17% of the portfolio and a total value of C$2.38 million.

Key Position Increases

The fund also increased its stakes in 14 stocks, with significant adjustments in:

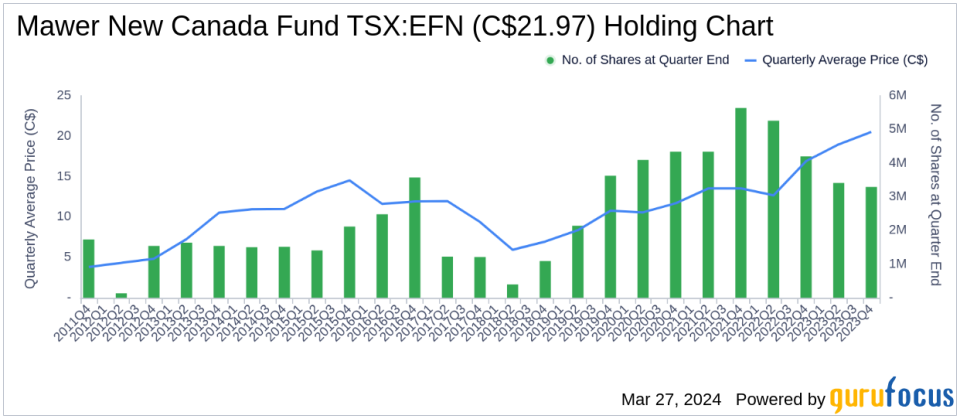

Wajax Corp (TSX:WJX) saw an additional 925,256 shares, bringing the total to 1,128,761 shares. This change marks a substantial 454.66% increase in share count and a 2.03% impact on the current portfolio, with a total value of C$34.17 million.

Converge Technology Solutions Corp (TSX:CTS) with an additional 4,425,200 shares, bringing the total to 12,382,353 shares. This represents a 55.61% increase in share count, with a total value of C$51.26 million.

Summary of Sold Out Positions

The fund exited two holdings entirely in the fourth quarter of 2023:

International Petroleum Corp (TSX:IPCO) saw the sale of all 1,937,229 shares, impacting the portfolio by -1.56%.

Uni-Select Inc (TSX:UNS) was completely liquidated with all 193,200 shares sold, resulting in a -0.67% impact on the portfolio.

Key Position Reductions

Reductions were made in 21 stocks, with the most notable being:

MTY Food Group Inc (TSX:MTY) was reduced by 315,200 shares, leading to a -48.49% decrease in shares and a -1.42% impact on the portfolio. The stock traded at an average price of C$58.34 during the quarter and has seen a -6.10% return over the past three months and -8.17% year-to-date.

Parkland Corp (TSX:PKI) was reduced by 476,200 shares, a -28.15% reduction, and a -1.17% impact on the portfolio. The stock's average trading price was C$39.64 for the quarter, with a 0.88% return over the past three months and 1.78% year-to-date.

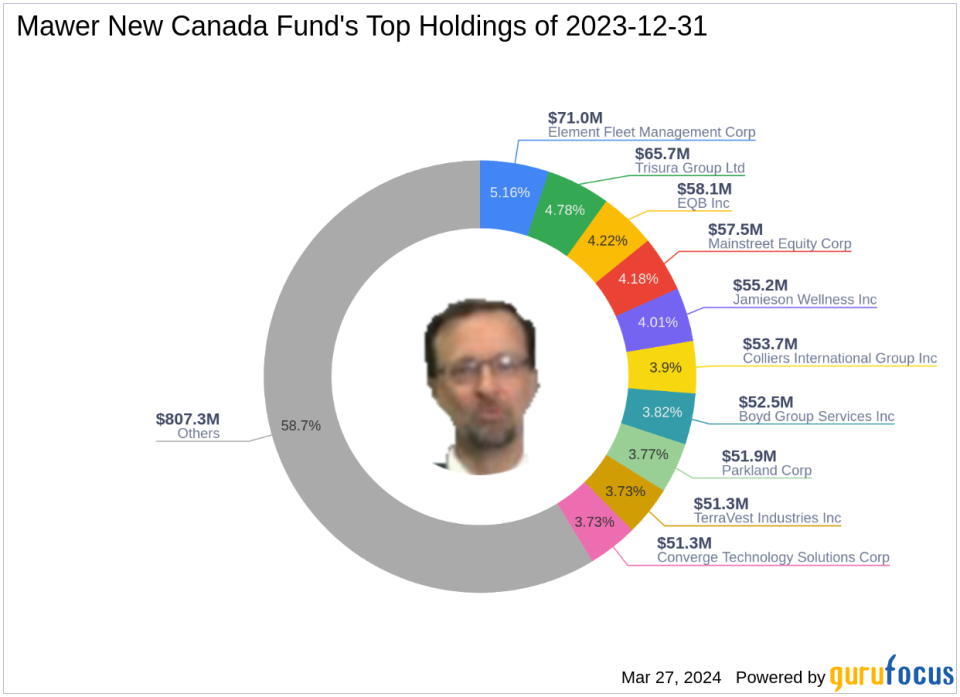

Portfolio Overview

As of the fourth quarter of 2023, Mawer New Canada Fund (Trades, Portfolio)'s portfolio comprised 41 stocks. The top holdings included 5.16% in Element Fleet Management Corp (TSX:EFN), 4.78% in Trisura Group Ltd (TSX:TSU), 4.22% in EQB Inc (TSX:EQB), 4.18% in Mainstreet Equity Corp (TSX:MEQ), and 4.01% in Jamieson Wellness Inc (TSX:JWEL). The holdings are primarily concentrated across 10 industries, including Energy, Industrials, Consumer Cyclical, Financial Services, Technology, Real Estate, Basic Materials, Consumer Defensive, Communication Services, and Healthcare.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.