Mawer Canadian Equity Fund's Top 5 Buys of the 4th Quarter

- By James Li

The Mawer Canadian Equity Fund (Trades, Portfolio) disclosed this week its top five buys for fourth-quarter 2018 included new positions in George Weston Ltd. (WN.TO) and ARC Resources Ltd. (ARX.TO) and three position boosts: TELUS Corp. (TU)(TSX:T), First Capital Realty Inc. (FCR.TO) and Enbridge Inc. (ENB)(ENB.TO).

Warning! GuruFocus has detected 3 Warning Signs with TSX:WN. Click here to check it out.

The intrinsic value of TSX:WN

Managed by Jim Hall and Vijay Viswanathan, the fund seeks long-term capital appreciation through investments in equity securities of Canadian companies, primarily those with market caps of at least 500 million Canadian dollars ($373.45 million), with strong competitive advantages and attractive prices based on the discounted cash flow model. The equity portfolio contains 41 stocks as of quarter end, with high exposure to the financial services, industrials and communication services sectors.

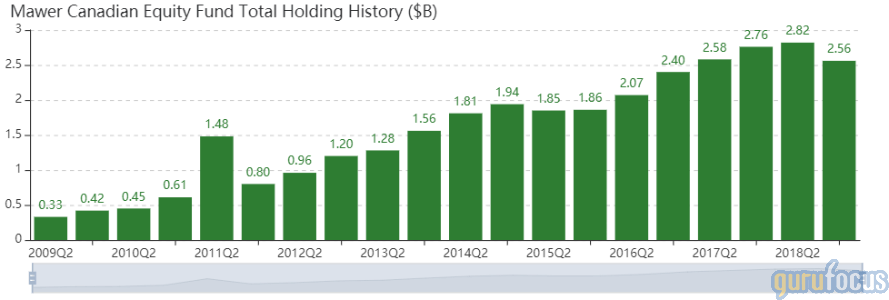

The fund said in its 2018 annual report that net assets of $2.668 billion as of December 2018 represented a 7.6% decline from the net assets of $2.909 billion as of December 2017. Security selection negatively impacted the fund's performance, especially in industrials, energy and financial services. Despite this, the fund's 12-month return prior to management fees of -8.8% outperformed the TSX index by 0.1%.

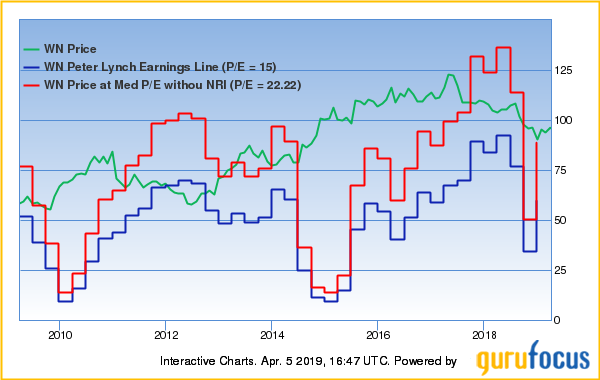

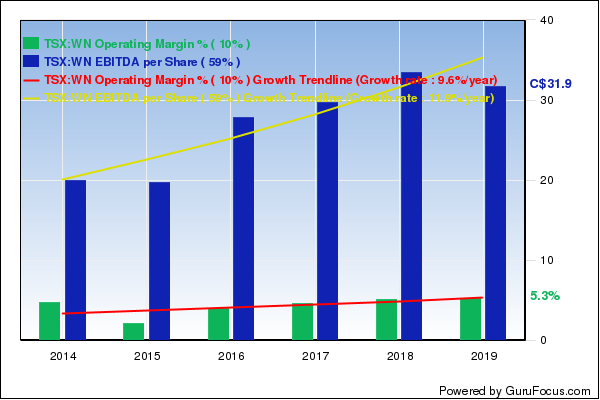

George Weston

The fund invested in 135,701 shares of George Weston for an average price of CA$98.4 per share, giving the position 0.48% equity portfolio space.

The Toronto-based company engages in food and drug retail through its 47% stake in Loblaw Companies Ltd. (TSX:L), a major provider of pharmacy, health, apparel, general merchandise, banking and credit card services. GuruFocus ranks George Weston's profitability 7 out of 10 on several positive investing signs, which include expanding profit margins and a three-year EBITDA growth rate that outperforms 78% of global competitors.

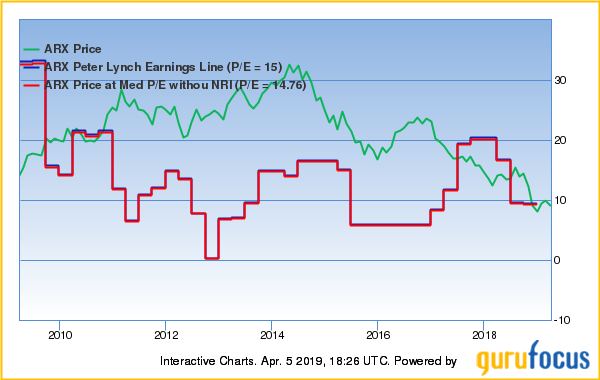

ARC Resources

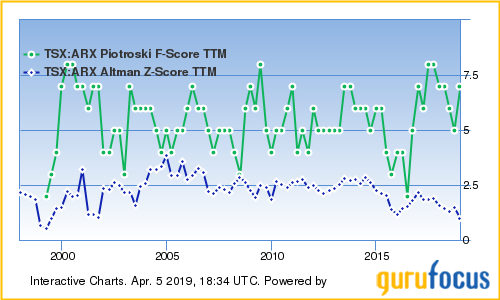

The fund invested in 1,482,500 shares of ARC Resources for an average price of CA$10.85 per share, giving the stake 0.47% equity portfolio space.

Calgary, Alberta-based ARC Resources engages in the acquisition, exploration and development of conventional oil and natural gas in Western Canada. GuruFocus ranks the company's financial strength 6 out of 10: even though the Altman Z-score of 1.10 suggests possible financial distress, ARC Resources' debt-to-EBITDA ratio outperforms 85% global competitors. Additionally, the company's Piotroski F-score of 7 suggests strong business operations.

TELUS

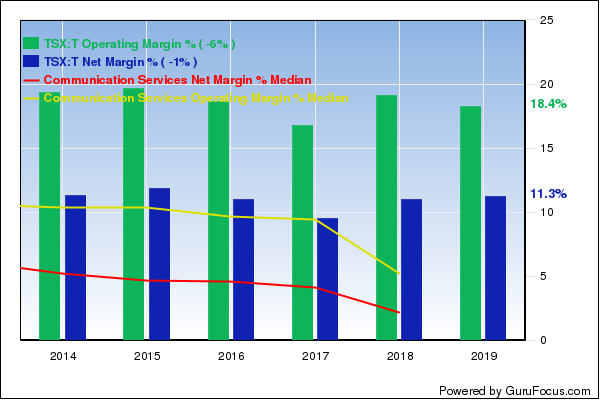

The fund added 603,614 shares of TELUS for an average price of CA$46.9 per share, boosting the position 31.37% and the equity portfolio 1.07%.

The Vancouver, British Columbia-based company provides phone, internet access and television services in western Canada. The company said in a Feb. 14 press release that total wireless subscribers as of December 2018 were 9.2 million, up 3.6% from the total wireless subscribers as of December 2017.

GuruFocus ranks TELUS' profitability 8 out of 10 on several positive indicators, which include consistent revenue growth and a strong Piotroski F-score of 7. The company's business predictability ranks 3.5 stars out of five.

Even though operating margins have declined approximately 1.4% per year over the past five years, TELUS' profit margins are still outperforming over 70% of global competitors.

Jim Simons (Trades, Portfolio), Pioneer Investments (Trades, Portfolio) and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates own U.S.-listed shares of TELUS.

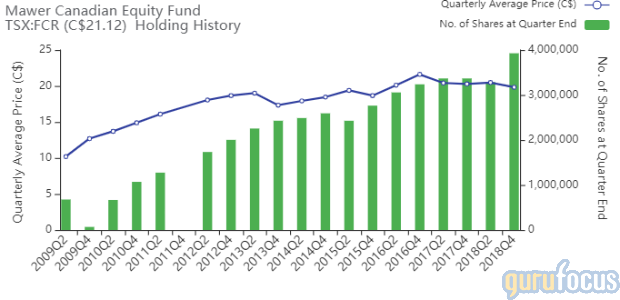

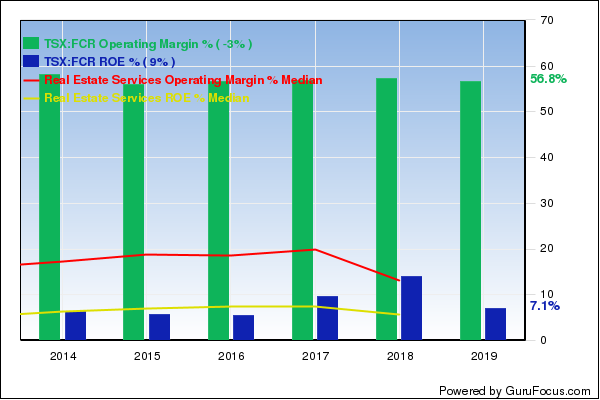

First Capital Realty

The fund added 640,800 shares of First Capital Realty for an average price of CA$19.83 per share, boosting the position 19.5% and the equity portfolio 0.47%.

The Toronto-based company acquires, develops and manages well-located, urban retail-centered properties. GuruFocus ranks the company's financial strength 5 out of 10: although the debt-to-equity ratio is near a 10-year low, First Capital Realty's Altman Z-score of 1.04 suggests possible financial distress. Despite this, the company's profitability ranks 6 out of 10 as strong profit margins offset modest returns on equity compared to global competitors.

Enbridge

The fund invested in 682,188 shares of Enbridge for an average price of CA$42.49 per share, boosting the position 69.7% and the equity portfolio 0.46%.

The Calgary, Alberta-based midstream energy company distributes and transports crude oil and natural gas through its pipeline network, which consists of the Canadian Mainline system, regional oil sands pipelines and natural gas pipelines. GuruFocus ranks Enbridge's financial strength and profitability 5 out of 10: although the company has expanding profit margins, it has declining revenue and increasing long-term debt.

Disclosure: No positions.

Read more here:

Francis Chou's RRSP Fund Buys 5 in 4th Quarter

4 High-Quality Semiconductor Companies to Consider on Improving Trade Talks

Spiros Segalas Trims Buffett's Apple, Buys 2 Stocks in 1st Quarter

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Signs with TSX:WN. Click here to check it out.

The intrinsic value of TSX:WN