RE/MAX Holdings Inc (RMAX) Faces Headwinds: A Dive into Q4 and Full-Year 2023 Results

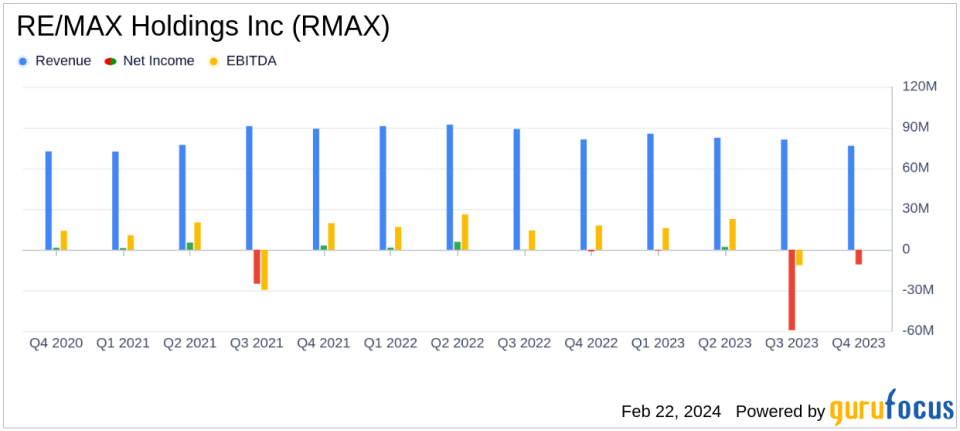

Total Revenue: Decreased by 5.7% in Q4 and 7.8% for the full year.

Adjusted EBITDA: Dropped by 13.4% in Q4 and 20.8% for the full year.

Net Loss: Reported at $10.9 million for Q4 and $69.0 million for the full year.

Agent Count: Slight increase of 0.6% to 144,835 agents globally.

Motto Mortgage Franchises: Grew by 6.5% to 246 offices.

Stock Repurchase: No shares repurchased in Q4; $62.5 million remains available under the program.

On February 22, 2024, RE/MAX Holdings Inc (NYSE:RMAX) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a global franchisor of real estate and mortgage brokerage services, reported a decrease in total revenue and adjusted EBITDA, alongside a net loss for both periods. Despite these challenges, RE/MAX Holdings saw a marginal increase in its agent count.

RE/MAX Holdings operates as a franchisor of real estate brokerage services, with its business model focusing on recruiting and retaining agents and selling franchises. The company's operating segments include Real Estate, Mortgage, Marketing Funds, and Other, with the Real Estate segment being the primary revenue driver.

Financial Performance and Challenges

The company's Q4 revenue fell to $76.6 million, a 5.7% decrease from the previous year, primarily due to a 5.6% negative organic growth and a slight impact from adverse foreign currency movements. The full-year revenue also saw a decline, dropping 7.8% to $325.7 million. The net loss attributable to RE/MAX Holdings was significant, with Q4 reporting a $10.9 million loss and the full year at $69.0 million. Adjusted EBITDA for Q4 decreased by 13.4% to $23.0 million, with a margin of 30.0%, and for the full year, it decreased by 20.8% to $96.3 million, with a margin of 29.6%.

Despite these financial setbacks, the company's total agent count experienced a slight increase of 0.6% to 144,835 agents. However, the U.S. and Canada combined agent count decreased by 4.2% to 80,299 agents. The total open Motto Mortgage franchises grew by 6.5% to 246 offices, indicating some growth in the company's network.

Financial Achievements and Importance

The growth in agent count and Motto Mortgage franchises are positive signs for RE/MAX Holdings, as they suggest potential for future revenue growth and market penetration. In the real estate industry, a larger network of agents can lead to increased transaction volumes and market share.

Key Financial Metrics

Important metrics from the financial statements include the decrease in recurring revenue streams, which fell by 4.0% compared to Q4 of the previous year. Operating expenses increased by 18.5% to $86.3 million for Q4, primarily due to higher impairment charges and selling, operating, and administrative expenses. As of December 31, 2023, the company had cash and cash equivalents of $82.6 million and outstanding debt of $444.6 million.

"We generated better-than-expected margins in the fourth quarter, driven by our ongoing focus on effective cost management amidst what continues to be a very difficult housing market," said Erik Carlson, RE/MAX Holdings Chief Executive Officer. "Looking ahead to 2024, we believe there are many reasons to be optimistic encouraging interest rate trends, improving customer sentiment, and ongoing pent-up demand bode well for progressively better housing market performance moving forward."

Analysis of Company's Performance

RE/MAX Holdings' performance in Q4 and the full year of 2023 reflects the broader challenges faced by the real estate industry, including a difficult housing market and economic headwinds. The company's ability to maintain a slight growth in agent count and expand its Motto Mortgage franchise network demonstrates resilience and strategic focus on long-term growth opportunities. However, the reported net losses and decline in revenue and adjusted EBITDA highlight the need for continued cost management and strategic initiatives to navigate the current market conditions.

The company's outlook for 2024 is cautiously optimistic, with expectations of a stabilizing housing market and potential for improved performance. The leadership changes announced, including the promotion of Amy Lessinger to President of RE/MAX, LLC, signal a strategic realignment that could further position the company for success in a recovering market.

For value investors and potential GuruFocus.com members, RE/MAX Holdings' latest earnings report provides a comprehensive view of the company's current financial health and future prospects. While there are certainly challenges ahead, the company's strategic initiatives and market positioning could offer opportunities for growth as the industry environment improves.

Explore the complete 8-K earnings release (here) from RE/MAX Holdings Inc for further details.

This article first appeared on GuruFocus.