RE/MAX (NYSE:RMAX) Reports Sales Below Analyst Estimates In Q4 Earnings

Real estate franchise company RE/MAX (NYSE:RMAX) fell short of analysts' expectations in Q4 FY2023, with revenue down 5.7% year on year to $76.6 million. Next quarter's revenue guidance of $77.5 million also underwhelmed, coming in 7.5% below analysts' estimates. It made a non-GAAP profit of $0.30 per share, improving from its loss of $0.04 per share in the same quarter last year.

Is now the time to buy RE/MAX? Find out by accessing our full research report, it's free.

RE/MAX (RMAX) Q4 FY2023 Highlights:

Revenue: $76.6 million vs analyst estimates of $77.1 million (0.6% miss)

EPS (non-GAAP): $0.30 vs analyst estimates of $0.28 (5.3% beat)

Revenue Guidance for Q1 2024 is $77.5 million at the midpoint, below analyst estimates of $83.75 million

Management's revenue guidance for the upcoming financial year 2024 is $310 million at the midpoint, missing analyst estimates by 5.3% and implying -4.8% growth (vs -7.8% in FY2023)

Free Cash Flow of $6.47 million, down 59.5% from the previous quarter

Gross Margin (GAAP): 73.1%, down from NaN% in the same quarter last year

Agents: 144,835

Market Capitalization: $165 million

"We generated better-than-expected margins in the fourth quarter, driven by our ongoing focus on effective cost management amidst what continues to be a very difficult housing market. Despite macro conditions beyond our control, our expense discipline has allowed us to remain nimble, able to pursue and seize those growth opportunities that we identify as having the greatest potential," said Erik Carlson, RE/MAX Holdings Chief Executive Officer.

Short for Real Estate Maximums, RE/MAX (NYSE:RMAX) operates a real estate franchise network spanning over 100 countries and territories.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Sales Growth

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. RE/MAX's annualized revenue growth rate of 8.9% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. RE/MAX's recent history shines a dimmer light on the company as its revenue was flat over the last two years. We can better understand the company's revenue dynamics by analyzing its number of agents, which reached 144,835 in the latest quarter. Over the last two years, RE/MAX's agents averaged 1.3% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's average selling price has fallen.

This quarter, RE/MAX missed Wall Street's estimates and reported a rather uninspiring 5.7% year-on-year revenue decline, generating $76.6 million of revenue. The company is guiding for a 9.3% year-on-year revenue decline next quarter to $77.5 million, a deceleration from the 6.2% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

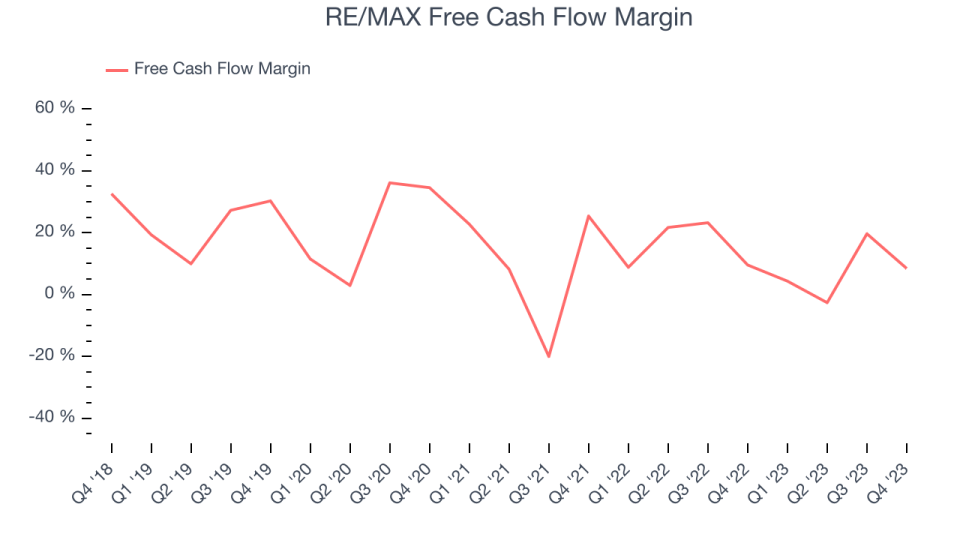

Over the last two years, RE/MAX has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 11.8%, slightly better than the broader consumer discretionary sector.

RE/MAX's free cash flow came in at $6.47 million in Q4, equivalent to a 8.4% margin and down 16.8% year on year. Over the next year, analysts predict RE/MAX's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 7.4% will decrease to 1.9%.

Key Takeaways from RE/MAX's Q4 Results

It was encouraging to see RE/MAX slightly top analysts' EPS expectations this quarter. That stood out as a positive in these results. On the other hand, its full-year revenue guidance missed and its operating margin fell short of Wall Street's estimates. Overall, this was a mixed quarter for RE/MAX. The company is down 2.6% on the results and currently trades at $8.68 per share, likely reflecting the weak guidance.

RE/MAX may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.