MaxCyte Inc (MXCT) Reports Mixed Financial Results for Q4 and Full Year 2023

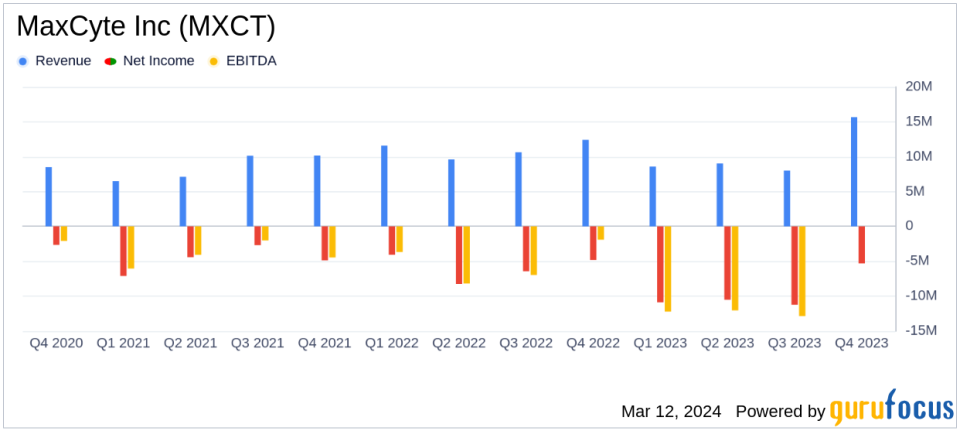

Total Revenue: Q4 saw a 26% increase year-over-year, but full year revenue declined by 7%.

Core Business Revenue: Experienced a 32% decrease in Q4 and a 25% decline for the full year.

Cell Therapy Revenue: Dropped by 27% in Q4 and 25% for the full year.

SPL Program-related Revenue: Increased significantly in Q4 by 359% and 148% for the full year.

Net Loss: Widened to $5.3 million in Q4 and $37.9 million for the full year.

EBITDA: Reported a loss of $7.0 million in Q4 and $44.1 million for the full year.

2024 Revenue Guidance: Management expects flat to 5% growth for core business revenue.

On March 12, 2024, MaxCyte Inc (NASDAQ:MXCT) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. The company, a leader in cell-engineering platform technologies, faced a challenging operating environment, which included increased capital conservatism and pipeline portfolio reevaluation among customers.

MaxCyte Inc (NASDAQ:MXCT) is a commercial cell engineering company that has developed a proprietary Flow Electroporation platform, which is instrumental in the engineering of a wide variety of cells. The company generates revenue through the sale and licensing of its instruments, as well as sales of single-use disposable processing assemblies.

Financial Performance and Challenges

MaxCyte's financial performance in 2023 reflected the broader industry's cautious stance, with a notable decline in cell therapy and drug discovery revenues. Despite these challenges, the company's SPL Program-related revenue saw a significant increase, which underscores the potential of strategic partnerships in driving growth. This mixed performance highlights the importance of diversification and the ability to adapt to market conditions for companies in the Medical Devices & Instruments industry.

Financial Achievements and Industry Significance

The company's SPL Program-related revenue growth is a testament to the strategic value of its partnerships and the robust pipeline of potential clients. The increase in SPL Program-related revenue is particularly important as it demonstrates MaxCyte's ability to leverage its platform technology to secure and grow revenue streams, which is crucial for sustaining operations and investing in future growth.

Key Financial Metrics

MaxCyte's installed base of instruments grew to 683, up from 616 in the previous year, indicating a solid expansion of its operational footprint. Core Revenue Generated by SPL Clients as a percentage of Core Revenue increased to 48%, up from 42% in the previous year, highlighting the growing importance of SPL clients to the company's core business. The number of active SPLs also increased to 23, from 18 in the previous year, further emphasizing the company's successful partnership strategy.

"In 2023, we navigated a challenging operating environment in our industry, that included increased capital conservatism and pipeline portfolio reevaluation among our customers. Our team adapted well to the changing environment last year, and I am confident in our ability to execute across the business this year," said Maher Masoud, President and CEO of MaxCyte.

Analysis of Company's Performance

MaxCyte's ability to grow its SPL Program-related revenue in a difficult year is commendable and suggests resilience in its business model. However, the declines in core business revenue and the wider net loss year-over-year raise concerns about the company's near-term profitability and cash flow sustainability. The reiteration of the 2024 revenue guidance indicates management's confidence in the company's strategic direction and potential for recovery.

MaxCyte ended the year with $211.2 million in cash, cash equivalents, and investments, a slight decrease from $227.3 million in the previous year, which provides a cushion for the company to navigate the upcoming fiscal year. The company's focus on maintaining a robust cash position is crucial for value investors who prioritize financial stability and the ability to weather economic downturns.

For more detailed financial information and future updates on MaxCyte Inc (NASDAQ:MXCT), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from MaxCyte Inc for further details.

This article first appeared on GuruFocus.