Maximus Inc (MMS): A High-Performing Stock with a GF Score of 93

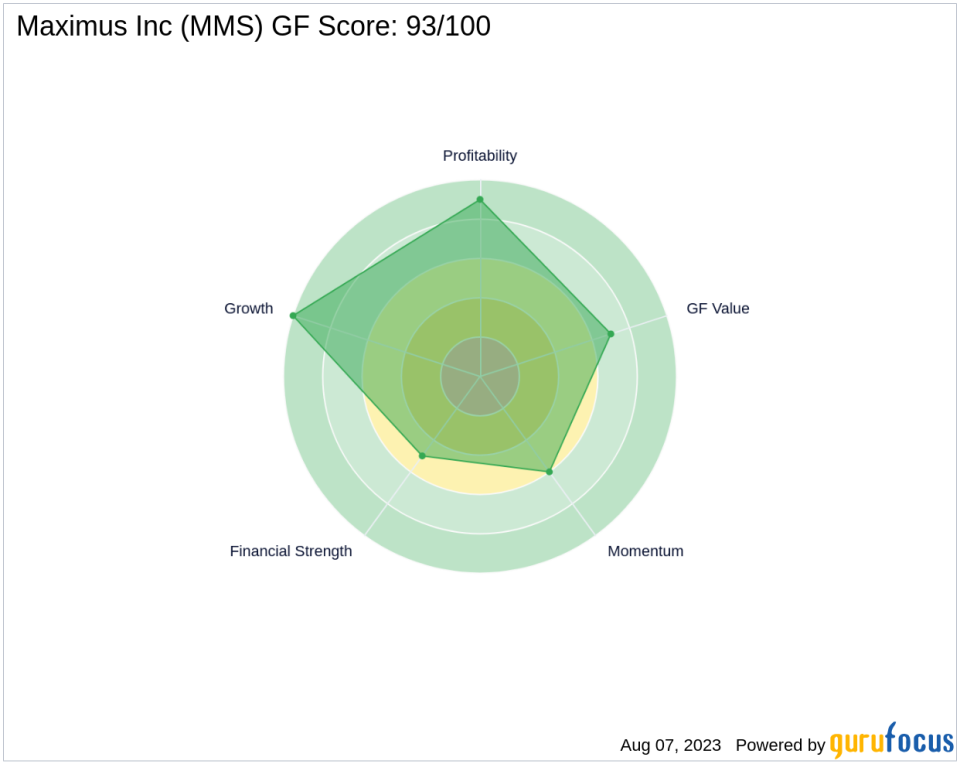

Maximus Inc (NYSE:MMS), a prominent player in the Business Services industry, is currently trading at $82.53 with a market capitalization of $5.02 billion. The company's stock price has seen a gain of 3.69% today, despite a slight dip of -2.72% over the past four weeks. In this article, we will delve into the company's GF Score of 93/100, which indicates the highest outperformance potential, and explore its financial strength, profitability, growth, GF value, and momentum ranks.

Financial Strength Analysis of Maximus Inc

Maximus Inc's Financial Strength Rank stands at 5/10. This score is derived from several factors, including its interest coverage of 3.75, indicating a manageable debt burden, and a debt to revenue ratio of 0.31, which is relatively low. The company's Altman Z score of 3.22 further attests to its financial stability.

Profitability Rank Analysis

The company's Profitability Rank is an impressive 9/10. This high score is supported by an operating margin of 6.20%, a Piotroski F-Score of 7, and a consistent profitability record over the past 10 years. However, the company's 5-year average operating margin trend of -11.40% warrants attention.

Growth Rank Analysis

Maximus Inc's Growth Rank is a perfect 10/10, reflecting robust growth in terms of revenue and profitability. The company's 5-year revenue growth rate is 17.40%, and its 3-year revenue growth rate is 18.80%. The 5-year EBITDA growth rate of 6.60% further underscores the company's strong growth trajectory.

GF Value Rank Analysis

The company's GF Value Rank is 7/10, indicating a fair valuation. This rank is determined by the price-to-GF-Value ratio, which takes into account historical multiples and an adjustment factor based on past returns, growth, and future business performance estimates.

Momentum Rank Analysis

Maximus Inc's Momentum Rank is 6/10, reflecting a moderate momentum based on the standardized momentum ratio and other momentum indicators. This score suggests that the company's stock price performance is relatively stable.

Competitive Analysis

When compared to its competitors in the Business Services industry, Maximus Inc holds a strong position. ABM Industries Inc (NYSE:ABM) has a GF Score of 79, UniFirst Corp (NYSE:UNF) has a GF Score of 85, and LegalZoom.com Inc (NASDAQ:LZ) has a GF Score of 36. These scores indicate that Maximus Inc, with a GF Score of 93, outperforms its competitors. For more details, please visit the competitors page.

In conclusion, Maximus Inc's high GF Score, strong growth, and profitability ranks, coupled with its fair valuation and moderate momentum, make it a compelling choice for investors. However, its financial strength rank of 5/10 suggests that investors should keep an eye on the company's debt levels and financial stability.

This article first appeared on GuruFocus.