Maximus (MMS) Q4 Earnings Fall Short of Estimates, Decline Y/Y

Maximus, Inc.’s MMS fourth-quarter fiscal 2023 earnings and revenues missed the Zacks Consensus Estimate.

Quarterly adjusted earnings (excluding 33 cents from non-recurring items) of $1.29 per share missed the Zacks Consensus Estimate by 3.7% and decreased 7.9% year over year. Revenues of $1.26 billion lagged the consensus mark by 1% but increased 7.1% year over year.

Segmental Revenues

The U.S. Services segment’s revenues of $473.8 million grew 11.8% year over year but missed our estimate of $483.6 million. The U.S. Federal Services segment’s revenues of $617.4 million increased 6.6% from the year-ago reported number and surpassed our estimate of $604.3 million. The Outside the U.S. segment’s revenues of $168.7 million decreased 3.2% year over year and lagged our estimate of $182.9 million.

Sales and Pipeline

Year-to-date signed contract awards, as of Sep 30, totaled $6.1 billion. Contracts pending (awarded but unsigned) amounted to $878 million. The sales pipeline, as of Sep 30, was $37.1 billion. This included $1.2 billion in pending proposals, $0.97 billion in proposals in preparation and $34.9 billion in opportunities tracking.

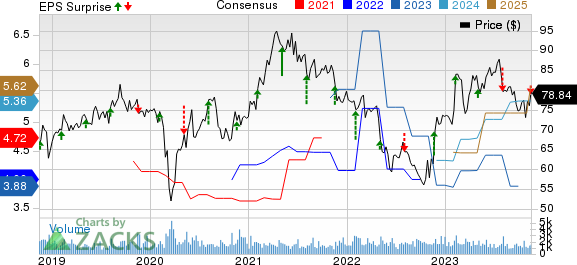

Maximus, Inc. Price, Consensus and EPS Surprise

Maximus, Inc. price-consensus-eps-surprise-chart | Maximus, Inc. Quote

The book-to-bill ratio, as of Sep 30, 2023, was 1.2 on a trailing 12-month basis.

Operating Performance

Adjusted operating income of $125.98 million decreased 8% year over year. This compares with our expected adjusted operating income of $132.1 million, down 3.6% year over year. Adjusted operating income margin of 10% decreased 160 basis points year over year.

Balance Sheet and Cash Flow

Maximus ended the quarter with a cash and cash equivalents balance of $65.4 million compared with $35 million reported at the end of the prior quarter.

The company used $144.6 million in cash from operations. Capital expenditures were $31.8 million and free cash flow amounted to $112.8 million.

Currently, Maximus carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Fiscal 2024 Guidance

Total revenues are expected to be between $5.05 billion and $5.20 billion. The midpoint of the guided range ($1.965 billion) is below the Zacks Consensus Estimate of $1.97 billion.

Earnings (on an adjusted basis) are anticipated in the range of $5.05-$5.35 per share. The Zacks Consensus Estimate is pegged at $6.36 per share.

Adjusted operating income is expected to range between $488 million and $513 million. Free cash flow is expected to range between $290 million and $340 million for fiscal year 2024. The company forecasts interest expense of approximately $70 million, an effective income tax rate between 24.5% and 25.5%, and weighted average shares outstanding between 62.2 million and 62.3 million for fiscal year 2024.

Recent Earnings Snapshots of Some Service Providers

The Interpublic Group of Companies, Inc. IPG posted third-quarter 2023 results, wherein both earnings and revenues missed the Zacks Consensus Estimate.

IPG’s adjusted earnings of 70 cents per share lagged the consensus estimate by 6.7%. The bottom line, however, climbed 11.1% on a year-over-year basis.

Net revenues of $2.31 billion fell short of the consensus estimate by 3.3%. In the year-ago quarter, IPG’s net revenues were $2.3 billion. Total revenues of $2.68 billion increased 1.5% year over year.

Equifax Inc. EFX reported lower-than-expected third-quarter 2023 results. Adjusted earnings (excluding 45 cents from non-recurring items) were $1.76 per share, missing the Zacks Consensus Estimate by 1.1%. Yet, the metric rose 1.7% from a year ago.

EFX’s total revenues of $1.32 billion fell short of the consensus estimate by 0.7%. Nonetheless, the figure gained 6% from a year ago on a reported basis and 6.5% on a local-currency basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report