MaxLinear Inc (MXL) Reports Decline in Annual Revenue and Shift to Operating Loss in FY2023

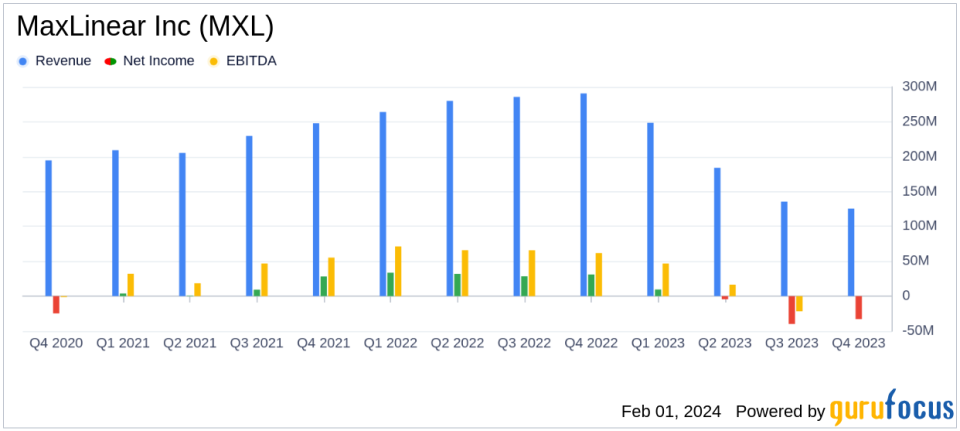

Annual Revenue: FY2023 revenue fell 38% to $693.3 million from FY2022.

Quarterly Performance: Q4 revenue decreased to $125.4 million, an 8% sequential drop and a 57% decline year-over-year.

Gross Margin: GAAP gross margin for FY2023 was 55.6%, with non-GAAP gross margin at 60.8%.

Operating Expenses: GAAP operating expenses represented 61% of net revenue for FY2023, with non-GAAP operating expenses at 45%.

Net Income/Loss: GAAP net loss per share for FY2023 was $(0.91), while non-GAAP diluted earnings per share were $1.10.

Cash Flow: Operating activities generated $43.4 million in cash for FY2023, a significant decrease from $388.7 million in FY2022.

On January 31, 2024, MaxLinear Inc (NASDAQ:MXL), a leader in radio frequency and mixed-signal integrated circuits, released its financial results for the fourth quarter and fiscal year 2023 through an 8-K filing. The company, known for its products that enable the distribution and display of broadband video and data content, faced significant challenges in the fiscal year, including a substantial decrease in annual revenue and a shift from operating income to loss.

Fiscal Year 2023 Overview

MaxLinear reported a 38% decrease in net revenue for FY2023, totaling $693.3 million, compared to the previous fiscal year. The GAAP gross margin also saw a decline to 55.6%, down from 58.0% in FY2022. Non-GAAP gross margin slightly decreased to 60.8% from 61.6% the prior year. The company's operating expenses as a percentage of net revenue increased to 61% on a GAAP basis and 45% on a non-GAAP basis, leading to a GAAP loss from operations of 6% of net revenue, a stark contrast to the 16% income from operations in FY2022. The non-GAAP income from operations stood at 15.5% of net revenue, down from 33.0% in the prior year.

Fourth Quarter Performance

For the fourth quarter, MaxLinear's net revenue was $125.4 million, an 8% sequential decrease and a 57% drop year-over-year. The GAAP gross margin remained relatively stable at 54.7%, while non-GAAP gross margin improved to 61.4%. However, GAAP operating expenses surged to 88% of net revenue, resulting in a GAAP loss from operations of 33% of net revenue. The non-GAAP income from operations was modest at 1% of net revenue. The GAAP diluted loss per share improved slightly to $0.47 from $0.49 in the previous quarter, but it was down from earnings of $0.38 per share in the same quarter last year.

Management Commentary and Outlook

CEO Kishore Seendripu commented on the results, stating,

In the fourth quarter, we delivered $125.4 million in revenues, with solid gross margin performance and positive cash flow. For 2023, revenues were $693.3 million, with wireless infrastructure continuing to be a highlight, growing 30% over the previous year."

He also expressed optimism for 2024, citing potential market tailwinds and new revenue opportunities from product innovations.

For the first quarter of 2024, MaxLinear anticipates net revenue to be between $85 million and $105 million, with GAAP gross margin estimated at 50.0% to 54.0% and non-GAAP gross margin at 59.5% to 62.5%. GAAP operating expenses are expected to range from $115 million to $125 million, with non-GAAP operating expenses projected between $72 million and $78 million.

Financial Tables and Additional Details

The detailed financial tables provided in the earnings release offer a comprehensive view of MaxLinear's financial position, including the balance sheet, income statement, and cash flow statement. These tables highlight the company's financial trajectory and the impact of the challenging fiscal year on its overall performance.

MaxLinear's performance in FY2023 reflects the broader challenges faced by the semiconductor industry, including market headwinds and economic conditions. However, the company's non-GAAP gross margin resilience and management's forward-looking statements suggest a strategic focus on growth and innovation, aiming to capitalize on emerging opportunities in the coming fiscal year.

For a more detailed analysis and additional information, investors and interested parties are encouraged to review the full 8-K filing and listen to the webcast and conference call hosted by MaxLinear.

MaxLinear's financial results highlight the importance of agility and innovation in navigating market fluctuations. Value investors may find the company's strategic initiatives and potential for recovery in the upcoming year to be of particular interest. For continued coverage and expert analysis, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from MaxLinear Inc for further details.

This article first appeared on GuruFocus.