MaxLinear (MXL): A Significantly Undervalued Gem in the Semiconductor Industry

MaxLinear Inc (NASDAQ:MXL) experienced a daily loss of 5.69%, and a 3-month loss of 29.25%. Despite this, the company's Earnings Per Share (EPS) stands at 0.8. This raises the question: Is MaxLinear significantly undervalued? This article seeks to address this question through a comprehensive valuation analysis. Read on to understand the intrinsic value of MaxLinear and make informed investment decisions.

Introduction to MaxLinear Inc

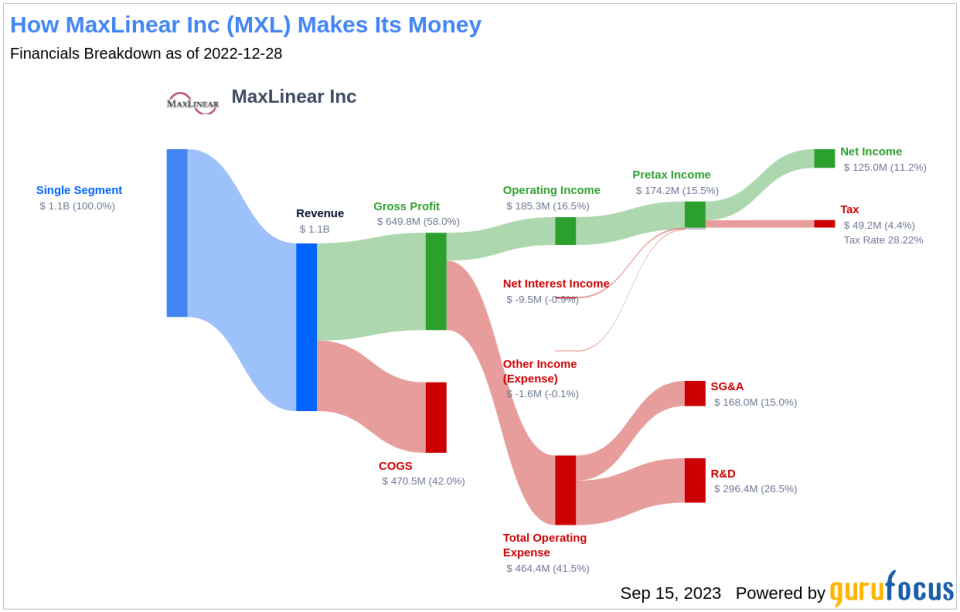

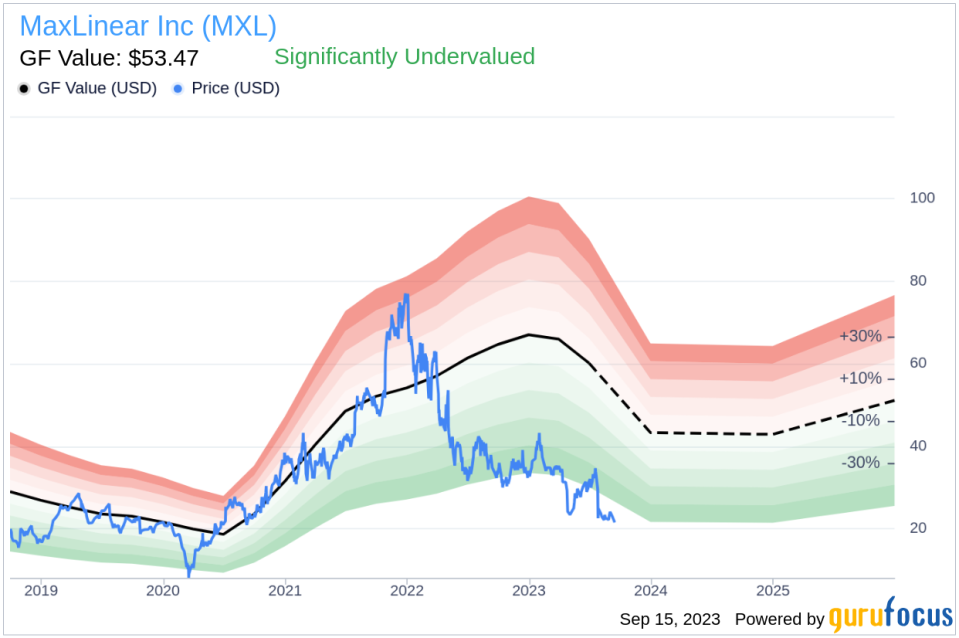

MaxLinear Inc (NASDAQ:MXL) is a leading provider of radio frequency and mixed-signal integrated circuits. The company caters to cable and satellite broadband communications, connected homes, and data center, metro, and long-haul fiber networks. MaxLinear's radio frequency receiver products capture and process digital and analog broadband signals for various applications. With a stock price of $21.53 and a market cap of $1.70 billion, MaxLinear appears to be significantly undervalued when compared to its GF Value of $53.47.

Unraveling the GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

For MaxLinear (NASDAQ:MXL), the stock appears to be significantly undervalued according to the GuruFocus Value calculation. This suggests that the long-term return of its stock is likely to be much higher than its business growth.

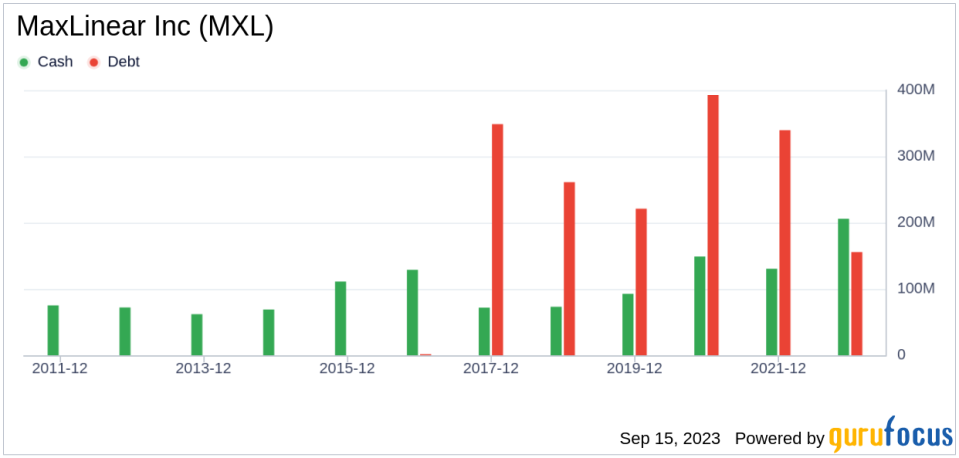

Assessing Financial Strength

Investing in companies with poor financial strength carries a higher risk of permanent loss. Therefore, it's important to understand the financial strength of a company before buying its stock. MaxLinear's cash-to-debt ratio of 1.52 is worse than 56.33% of 900 companies in the Semiconductors industry. However, the overall financial strength of MaxLinear is 8 out of 10, indicating strong financial health.

Profitability and Growth

Companies that have been consistently profitable over the long term offer less risk for investors. MaxLinear has been profitable for 3 out of the past 10 years, with an operating margin of 12.95%, which ranks better than 68.01% of 944 companies in the Semiconductors industry. The profitability of MaxLinear is ranked 5 out of 10, indicating fair profitability.

Growth is a crucial factor in the valuation of a company. The 3-year average annual revenue growth rate of MaxLinear is 45.8%, which ranks better than 93.44% of 869 companies in the Semiconductors industry. The 3-year average EBITDA growth rate is 72.8%, which ranks better than 90.03% of 772 companies in the Semiconductors industry. This implies that MaxLinear's growth is robust.

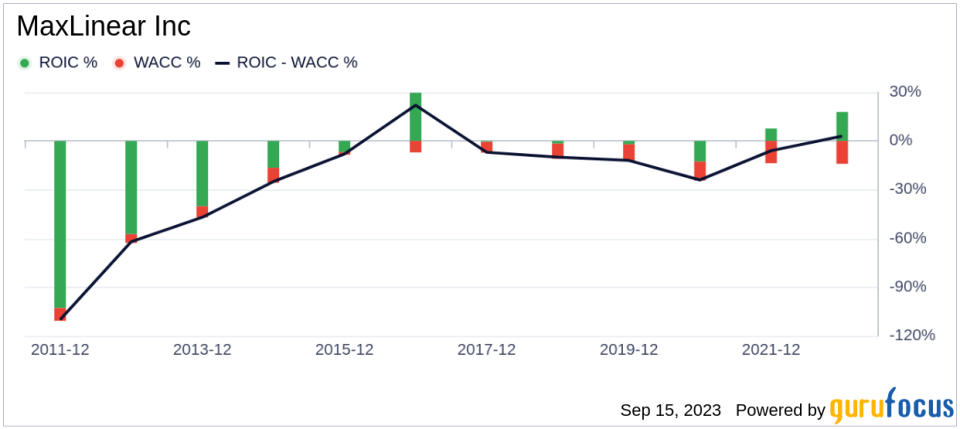

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) and the weighted average cost of capital (WACC) is another way to assess its profitability. For the past 12 months, MaxLinear's ROIC is 11.35, and its cost of capital is 12.98.

Conclusion

In conclusion, MaxLinear's stock appears to be significantly undervalued. The company's financial condition is strong, and its profitability is fair. Its growth ranks better than 90.03% of 772 companies in the Semiconductors industry. To learn more about MaxLinear stock, you can check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.