McCormick (MKC) Q1 Earnings & Sales Top Estimates, Grow Y/Y

McCormick & Company, Incorporated MKC reported robust first-quarter fiscal 2024 results, wherein the top and bottom lines grew year over year and came ahead of the Zacks Consensus Estimate.

MKC’s commitment to achieving long-term objectives is evident from its proven track record, wide-reaching and competitive global portfolio, focus on high-growth, profitable areas, alignment with evolving consumer preferences and a distinctive heat platform. Management continues to prioritize investments in key areas and growth drivers, like brand promotion, product and packaging innovation, category management and proprietary technology. Moving on, the company’s cost-saving programs position it well to support investments and drive operating margin growth.

Management is encouraged by its positive business momentum and anticipates continued improvement in volume performance, which is expected to strengthen throughout the year. Quarterly results, together with growth strategies, keep the company confident about achieving the mid to upper end of its projected constant currency sales growth for 2024.

Quarter in Detail

Adjusted earnings of 63 cents per share increased from the 59 cents reported in the year-ago quarter. The metric came above the Zacks Consensus Estimate of 58 cents per share. The year-over-year upside can be attributed to increased adjusted operating income and greater income from unconsolidated operations stemming from solid performance in the largest joint venture, McCormick de Mexico. This was partly negated by the increased adjusted tax rate.

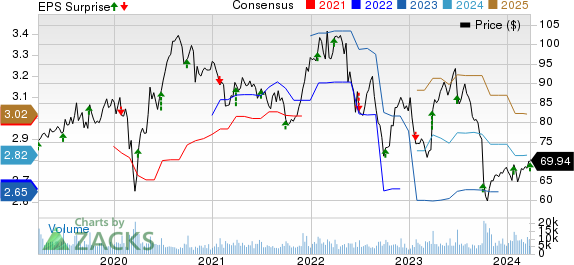

McCormick & Company, Incorporated Price, Consensus and EPS Surprise

McCormick & Company, Incorporated price-consensus-eps-surprise-chart | McCormick & Company, Incorporated Quote

This global leader in flavor generated sales of $1,602.7 million, up 2.4% year over year, including a 1% benefit from currency movements. On a constant-currency (cc) basis, sales grew nearly 1.5%, backed by a 3% increase in pricing actions, somewhat offset by a 1% volume and mix decline. The decline in volume and mix was a result of management’s strategic decisions to discontinue a low-margin business and offload a small canning business. The top line exceeded the Zacks Consensus Estimate of $1,553 million.

McCormick’s gross profit margin expanded 140 basis points. The upside can be attributed to positive pricing actions, product mix and cost savings from Comprehensive Continuous Improvement (“CCI”) and Global Operating Effectiveness (“GOE”) programs. This was partly countered by escalated cost inflation.

Selling, general and administrative (SG&A) expenses escalated year over year due to elevated brand marketing and investments in research and development, partly offset by cost savings from the abovementioned programs.

At cc, the adjusted operating income rose 4%, mainly backed by sales growth and gross profit margin expansion, somewhat offset by increased SG&A expenses.

Segment Details

Consumer: Sales went up 1% to $921.5 million, with a negligible impact of currency movements. Sales were aided by a 3% rise in pricing actions, offset by declines in volume to the tune of 2%. Sales remained flat year over year in the Americas while increasing 13% in the EMEA region. Segment sales tumbled 7% in the Asia/Pacific (APAC).

Flavor Solutions: Sales in the segment advanced 4% to $681.2 million. On a cc basis, sales rose 2%, including a 1% decrease from the divestiture of the canning business. A pricing increase of 2% and volume growth of 1% led to the upside. Flavor Solutions’ sales in the Americas grew 5%. Flavor Solutions’ sales in the EMEA rose by 2%. Sales in the APAC market also ascended 2% year over year.

Financial Update

McCormick exited the quarter with cash and cash equivalents of $178 million, long-term debt of $3,329.1 million and total shareholders’ equity of $5,257.4 million. Through the first quarter, net cash provided by operating activities was $138 million. For fiscal 2024, MKC expects robust cash flow generation and envisions returning a considerable part of its cash flow via dividends.

Fiscal 2024 Guidance

For fiscal 2024, McCormick is focused on strengthening its volume trends and prioritizing investments to fuel profits. The company’s CCI and GOE programs are driving growth investments and operating margin expansion. Management anticipates currency movements to negatively impact sales, adjusted operating income and adjusted earnings per share (EPS) by nearly 1%.

For 2024, management expects sales to range between a 2% decline to flat year over year. At cc, sales are likely to be between a 1% decline and 1% growth. Management anticipates witnessing a favorable impact of pricing actions undertaken in the prior year. Volume trends are likely to improve and revert to growth due to solid brands and targeted investments. However, its decision to discontinue the low-margin business and sell the canning business is likely to put some pressure on volume during 2024.

Management expects 2024 operating income to grow by 8-10%. Adjusted operating income is likely to grow 3-5% (up 4-6% at cc) due to the gross margin expansion, somewhat offset by a major rise in brand marketing investments.

Management envisions 2024 adjusted EPS in the band of $2.80-$2.85, which suggests a 4-6% increase from the year-ago period and a 5-7% increase at cc. On a GAAP basis, McCormick projects 2024 earnings in the range of $2.76- $2.81 per share compared with the year-ago period figure of $2.52.

This Zacks Rank #3 (Hold) stock has declined 5.6% in the past six months against the industry’s growth of 8.2%.

Solid Staple Picks

The Chef’s Warehouse CHEF, which engages in the distribution of specialty food products, currently carries a Zacks Rank #2 (Buy). CHEF has a trailing four-quarter earnings surprise of 3.2%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for The Chef’s Warehouse’s current fiscal-year sales and earnings suggests growth of 8.7% and 4.7%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank #2. VITL has a trailing four-quarter average earnings surprise of 155.4%.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 18.6% and 35.6%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks, currently carrying a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 2.6%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 15.8% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report