McDonald's (MCD) Stock Up on Q3 Earnings & Revenue Beat

McDonald's Corporation MCD reported third-quarter 2023 results, with earnings and revenues beating the Zacks Consensus Estimate. Both metrics surpassed the consensus estimate for the fifth straight quarter and increased on a year-over-year basis.

Following the results, the company’s shares are up 3% in the pre-market trading session. During the quarter, MCD benefited from robust comparable sales.

Earnings & Revenue Discussion

During third-quarter 2023, McDonald's reported adjusted earnings per share (EPS) of $3.19, outpacing the Zacks Consensus Estimate of $3.00. Adjusted earnings increased 16% from the prior year.

Quarterly net revenues of $6,692.2 million outpaced the consensus mark of $6,574 million. The top line rose 14% year over year.

At company-operated restaurants, sales were $2,556.2 million, up 20% year over year. Sales at franchise-operated restaurants amounted to $4,047.1 million and improved 10% year over year. Other revenues jumped 17% year over year to $88.9 million. Our model predicted sales by company-operated and franchise-operated restaurants to gain 9.6% and 6.6% year over year, respectively.

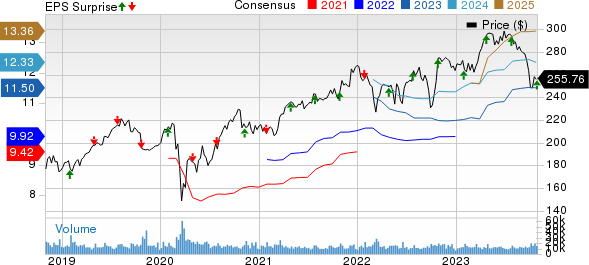

McDonald's Corporation Price, Consensus and EPS Surprise

McDonald's Corporation price-consensus-eps-surprise-chart | McDonald's Corporation Quote

Comps Details

In the quarter under discussion, global comps expanded 8.8% compared with 11.7% in the prior-year quarter. Our estimate was 9.1%.

Strong Comps Across Segments

U.S.: During the third quarter, segmental comps rose 8.1% year over year compared with 6.1% a year ago. Comps benefited from a menu price increase, positive guest counts, marketing initiatives and robust digitalization. Our model estimated U.S. comps to climb 9.8%.

International Operated Markets: Segmental comps extended 8.3% year over year compared with 8.5% in the year-ago quarter. Strong comparable sales in the Germany and the U.K. resulted in the uptick. We anticipated a 9% year-over-year rise.

International Developmental Licensed Segment: Segmental comparable sales registered a 10.5% gain year over year compared with 16.7% in the prior-year quarter. McDonald's benefited from robust comps in all geographic locations. Our model anticipated the metric to improve 7.8% year over year.

Operating Highlights & Expenses

During the third quarter, McDonald’s total operating costs and expenses were $3,483.9 million, up 12% year over year.

Operating income rose 16% year over year to $3,208.3 million. Net income totaled $2,317.1 million, up 17% year over year.

Zacks Rank

MCD currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks in the Zacks Retail – Restaurants industry are:

FAT Brands Inc. FAT sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 28.7%, on average. The stock has declined 24% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FAT’s 2024 sales and EPS suggests improvements of 36.3% and 29.6%, respectively, from the year-ago levels.

El Pollo Loco Holdings, Inc. LOCO currently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 23.7%, on average. Shares of LOCO have dipped 4.6% in the past year.

The Zacks Consensus Estimate for LOCO’s 2024 sales and EPS indicates 3.4% and 18.7% growth, respectively, from the year-earlier levels.

Arcos Dorados Holdings Inc. ARCO currently carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 35%, on average. The stock has climbed 25.7% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2024 sales and EPS suggests advancements of 8.5% and 16.2%, respectively, from the prior-year figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO) : Free Stock Analysis Report

FAT Brands Inc. (FAT) : Free Stock Analysis Report