McGrath RentCorp (MGRC) Announces Solid Revenue Growth and Dividend Increase for Q4 2023

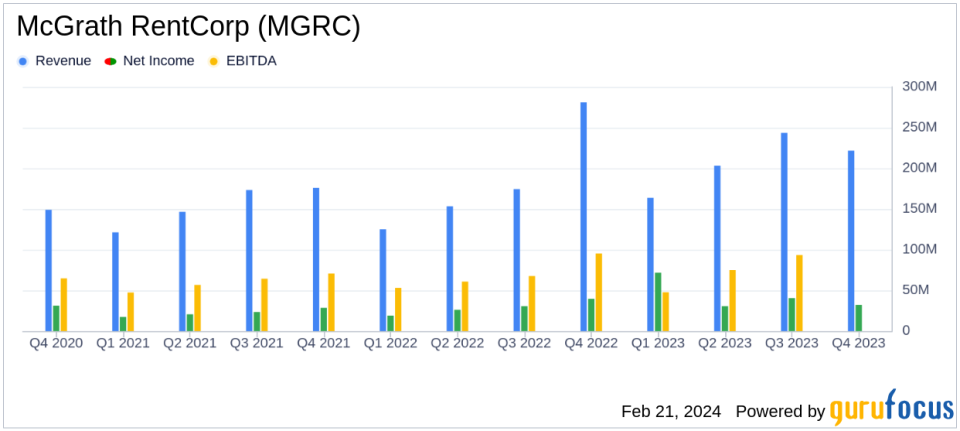

Revenue Growth: Q4 revenues surged by 21% year-over-year to $221.6 million.

Net Income: Q4 net income from continuing operations was $32.0 million, a slight decrease from $35.0 million in the previous year.

Earnings Per Share: Diluted EPS for Q4 stood at $1.30, down from $1.43 year-over-year.

Annual Dividend Increase: The board declared a quarterly cash dividend of $0.475 per share, marking the 33rd annual increase.

Adjusted EBITDA: Full-year Adjusted EBITDA climbed 28% to $322.0 million.

Rental Revenue: Rental revenues grew by 19% in Q4, driven by strong modular and portable storage performance.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 21, 2024, McGrath RentCorp (NASDAQ:MGRC) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, a diversified business-to-business rental company in North America, operates through four segments: Mobile Modular, TRS-RenTelco, Adler Tanks, and Enviroplex. McGrath RentCorp's business model primarily revolves around the rental of equipment, with equipment sales occurring as part of its regular operations.

Performance and Challenges

McGrath RentCorp's performance in the fourth quarter showed a robust increase in rental revenues, particularly in its modular and portable storage segments. The company's Mobile Modular division saw a 37% increase in rental revenues, largely attributed to the Vesta Modular acquisition. However, the TRS-RenTelco division experienced a downturn with an 11% decline in rental revenues, mainly due to softness in semiconductor-related demand. This mixed performance highlights the importance of diversification within McGrath's portfolio, as strength in one area can help offset weaknesses in another.

Financial Achievements

The company's financial achievements, including a significant increase in total revenues and Adjusted EBITDA, are critical for sustaining growth and shareholder returns in the competitive Business Services industry. The consistent dividend growth underscores McGrath's commitment to shareholder value and financial stability.

Key Financial Metrics

McGrath RentCorp's balance sheet remains strong, with net rental equipment valued at $1.33 billion after accounting for depreciation. The company's cash flows from operations were solid, providing $95.3 million for the full year, which supports ongoing investments and dividend payments. The increase in net income and diluted EPS for the full year demonstrates McGrath's ability to translate revenue growth into profitability.

"We were pleased with our fourth quarter results. Our 19% increase in companywide rental revenues was driven by strong modular and portable storage performance," said Joe Hanna, President and CEO of McGrath.

McGrath RentCorp's financial tables reveal a detailed view of the company's income, balance sheet, and cash flows. The income statement shows a healthy gross profit margin, while the balance sheet indicates a solid position with total assets of $2.22 billion. The cash flow statement reflects the company's operational efficiency and ability to generate cash from its business activities.

Analysis of Company's Performance

Despite facing challenges in the electronic test equipment segment, McGrath RentCorp has shown resilience through its diversified business model. The company's strategic focus on modular and portable storage has paid off, with significant revenue growth in these segments. The increase in dividend payout is a testament to the company's financial health and its confidence in future performance.

Overall, McGrath RentCorp's latest earnings report reflects a company that is successfully navigating market fluctuations and capitalizing on growth opportunities. The company's strong financial position and strategic investments in its modular and portable storage businesses are likely to continue driving value for shareholders.

For a more detailed analysis and to stay updated on McGrath RentCorp's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from McGrath RentCorp for further details.

This article first appeared on GuruFocus.