McKesson Corp (MCK) Posts Strong Revenue Growth and Raises Full-Year Guidance Despite Earnings Dip

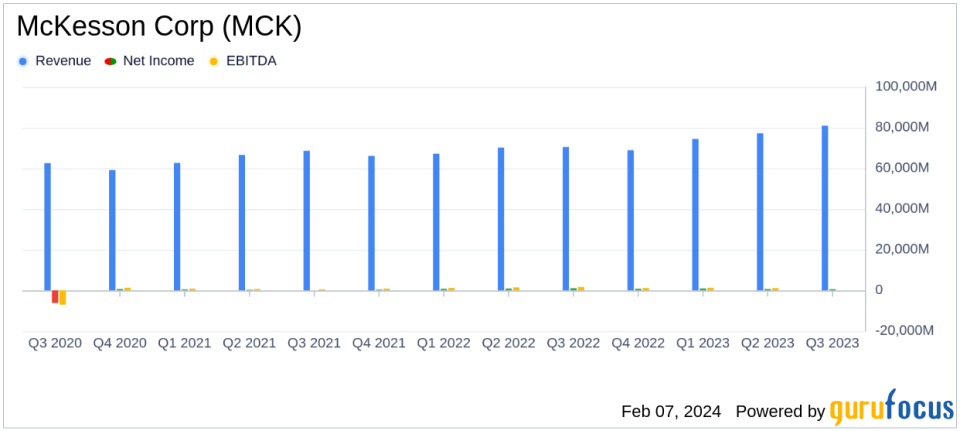

Revenue Growth: Consolidated revenues increased by 15% to $80.9 billion.

Earnings Per Share: Earnings per diluted share from continuing operations decreased by $3.23 to $4.42.

Adjusted Earnings Per Share: Adjusted earnings per diluted share rose by 12% to $7.74.

Expansion: The US Oncology Network grew with the addition of Nashville Oncology Associates and SCRI Oncology Partners.

Full-Year Guidance: Adjusted earnings per diluted share guidance range increased to $27.25 to $27.65.

Shareholder Returns: $2.6 billion returned to shareholders in the first nine months through stock repurchases and dividends.

On February 7, 2024, McKesson Corp (NYSE:MCK) released its 8-K filing, detailing the financial results for the third quarter ended December 31, 2023. The company, a leading pharmaceutical wholesaler in the U.S., reported a significant increase in consolidated revenues, which rose by 15% to $80.9 billion. However, earnings per diluted share from continuing operations saw a decrease to $4.42, down $3.23 from the previous year, primarily due to a pre-tax increase to the provision for bad debts related to the Rite Aid bankruptcy.

Despite the dip in earnings per share, adjusted earnings per diluted share increased by 12% to $7.74, driven by a lower tax rate, reduced share count, and growth in the U.S. Pharmaceutical and Prescription Technology Solutions segments. McKesson's performance reflects its strategic focus on delivering differentiated solutions and value in oncology and biopharma services.

McKesson's CEO, Brian Tyler, expressed pride in the company's ability to create value for all stakeholders and attributed the solid results to the dedication of team members executing against the company's strategy. As a result of the strong third-quarter performance and solid operating momentum, McKesson raised its full-year adjusted earnings per diluted share guidance to $27.25 to $27.65.

Financial Performance Analysis

McKesson's revenue growth was primarily driven by the U.S. Pharmaceutical segment, which saw an 18% increase due to higher prescription volumes, including specialty products and retail national account customers. The Prescription Technology Solutions segment also contributed positively with a 7% revenue increase and a 25% jump in adjusted segment operating profit.

However, the company faced challenges in the International segment, where revenues decreased by 18% on an FX-Adjusted basis, largely due to divestitures within McKesson's European business. The Medical-Surgical Solutions segment experienced a modest 2% revenue increase, but adjusted segment operating profit decreased by 16%, impacted by lower contributions from the U.S. government's COVID-19 vaccine program.

McKesson's financial achievements, including the expansion of the US Oncology Network and multiple awards recognizing its commitment to sustainability, underscore the company's strategic growth and operational efficiency. These accomplishments are particularly important in the competitive medical distribution industry, where maintaining a strong market position and adapting to changing healthcare landscapes are crucial for success.

For the first nine months of the fiscal year, McKesson returned $2.6 billion to shareholders and generated cash from operations of $167 million. However, the company invested $418 million in capital expenditures, resulting in negative free cash flow of $251 million.

McKesson's financial tables reveal a complex picture of growth, challenges, and strategic maneuvers. The company's ability to navigate the dynamic healthcare sector and deliver value to shareholders remains a focal point for investors and industry observers alike.

For a more detailed analysis and insights into McKesson Corp's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from McKesson Corp for further details.

This article first appeared on GuruFocus.