McKesson (MCK) Announces Availability of FDA-Cleared mCRC Drug

McKesson Corporation MCK recently announced that its independent specialty pharmacy specializing in oncology and rare disease areas, Biologics by McKesson, was selected by Takeda as a specialty pharmacy provider for FRUZAQLA (fruquintinib). FRUZAQLA is an oral targeted therapy for adults with metastatic colorectal cancer (mCRC) who have been previously treated with fluoropyrimidine-, oxaliplatin-, and irinotecan-based chemotherapy, an anti-VEGF therapy, and, if RAS wild-type and medically appropriate, an anti-EGFR therapy.

FRUZAQLA was approved by the FDA on Nov 8, 2023.

The availability of the FDA-approved drug is expected to significantly solidify McKesson’s foothold in the global cancer treatment space and boost its U.S. Pharmaceutical business.

Significance of the Availability

Per McKesson, it is the first targeted-therapy for mCRC in adults irrespective of biomarker status or prior types of therapies in more than 10 years. McKesson’s management believes that the approval of FRUZAQLA will likely address the significant unmet medical needs of mCRC patients.

Industry Prospects

Per a report by Straits Research, the global oncology cancer drugs market was valued at $148,050.6 million in 2021 and is anticipated to reach $288,636.6 million by 2030 at a CAGR of 7.7%. Factors like the rise in the incidence of various cancer conditions and the growing popularity of advanced therapies (such as biological and targeted drug therapies) are expected to drive the market.

Given the market potential, the recent drug availability is expected to strengthen McKesson’s position in the global oncology care space.

Recent Developments

This month, McKesson reported its second-quarter fiscal 2024 results, wherein it recorded a solid uptick in its overall top line. The revenue uptick was primarily driven by growth in the U.S. Pharmaceutical segment, resulting from increased prescription volumes, including higher volumes from retail national account customers, specialty products, and GLP-1 medications.

In September, McKesson announced that Biologics by McKesson was selected by GSK as a specialty pharmacy provider for OJJAARA (momelotinib).

In August, McKesson announced that Biologics by McKesson was selected by Daiichi Sankyo, Inc. as a specialty pharmacy provider for VANFLYTA (quizartinib).

Price Performance

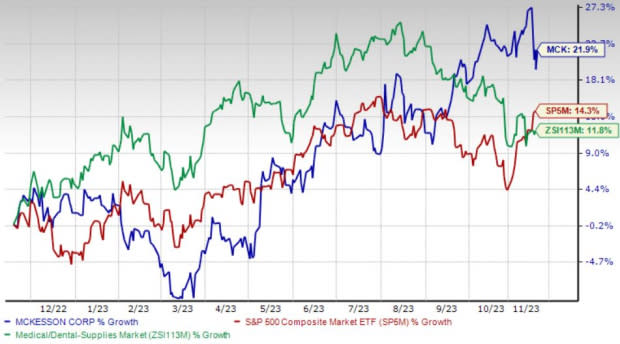

Shares of the company have gained 21.9% in the past year compared with the industry’s 11.8% rise and the S&P 500's 14.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, McKesson carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 34.1% compared with the industry’s 3.9% rise over the past year.

HealthEquity, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 26.7%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has gained 10.4% against the industry’s 12.4% decline over the past year.

Integer Holdings, sporting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Integer Holdings has gained 24% against the industry’s 6.2% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report