McKesson (MCK) Announces Availability of PNH's FDA-Approved Drug

McKesson Corporation’s MCK Biologics by McKesson, its independent specialty pharmacy specializing in oncology and rare disease areas, has been selected by Novartis as a specialty pharmacy provider for FABHALTA (iptacopan). FABHALTA is the first oral monotherapy for the treatment of adults with paroxysmal nocturnal hemoglobinuria (PNH), a chronic and rare blood disorder that involves the destruction of red blood cells.

FABHALTA was approved by the FDA on Dec 5, 2023.

The availability of the FDA-approved drug is expected to significantly solidify McKesson’s foothold in the global PNH treatment space and boost its Specialty Pharmacy Solutions business.

Significance of the Availability

Per McKesson, PNH can result in significant burdens for patients affected by this complex condition. McKesson’s management believes that FABHALTA, being the first oral monotherapy treatment option for adults with PNH, will likely be able to address a significant unmet need.

Industry Prospects

Per a report by Zion Market Research, the global PNH drug market was worth around $3500 million in 2022 and is anticipated to reach about $8900 million by 2030 at a CAGR of approximately 12.5%. Factors like the increasing regulatory approvals and research and development efforts are expected to drive the market.

Given the market potential, the recent drug availability is expected to strengthen McKesson’s position in the global desmoid tumors care space.

Recent Developments in Specialty Pharmacy Solutions

This month, McKesson announced that Biologics by McKesson was selected by SpringWorks Therapeutics as a limited distribution specialty pharmacy for OGSIVEO (nirogacestat).

The same month, McKesson announced that Biologics by McKesson was selected by AstraZeneca as a specialty pharmacy provider for TRUQAP (capivasertib).

Last month, McKesson announced that Biologics by McKesson was selected by Takeda as a specialty pharmacy provider for FRUZAQLA (fruquintinib).

The same month, McKesson reported its second-quarter fiscal 2024 results, wherein it recorded a solid uptick in its overall top line. The revenue uptick was primarily driven by growth in the U.S. Pharmaceutical segment, resulting from increased prescription volumes, including higher volumes from retail national account customers, specialty products, and GLP-1 medications.

Price Performance

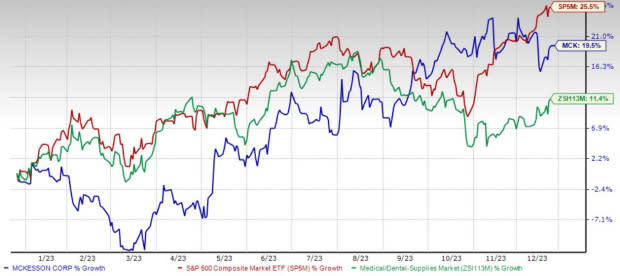

Shares of the company have gained 19.5% in the past year compared with the industry’s 11.4% rise and the S&P 500's 25.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, McKesson carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 17.3%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 41.2% compared with the industry’s 10.2% rise in the past year.

HealthEquity, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 27.5%. HQY’s earnings surpassed estimates in each of the trailing four quarters, with the average being 16.5%.

HealthEquity has gained 6.8% against the industry’s 6.9% decline over the past year.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 11.9%.

Integer Holdings’ shares have rallied 46.4% compared with the industry’s 4.9% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report