McKesson (MCK) Hits 52-Week High: What's Driving the Stock?

Shares of McKesson Corporation MCK scaled a new 52-week high of $444.80 on Sep 20, before closing the session slightly lower at $439.86.

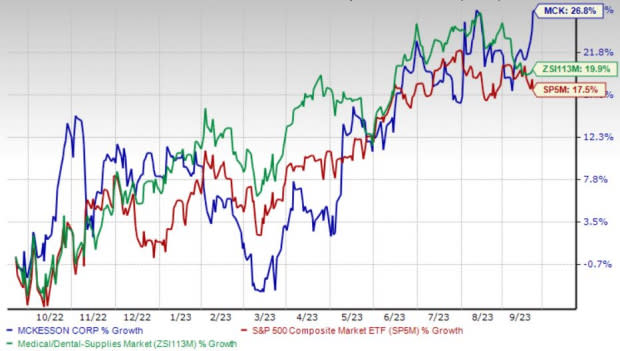

Over the past year, this Zacks Rank #2 (Buy) stock has gained 26.8% compared with 19.8% growth of the industry and a 17.5% rise of the S&P 500 composite.

Over the past five years, the company registered earnings growth of 15.4% compared with the industry’s 7.8% rise. The company’s long-term expected growth rate of 10.7% compares with the industry’s growth projection of 12.8%. McKesson’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 8.1%.

McKesson is witnessing an upward trend in its stock price, prompted by its robust Biologics business. The optimism led by a solid first-quarter fiscal 2024 performance and its strength in the distribution market are expected to contribute further. However, stiff competition and weaker generic pharmaceutical pricing trends persist.

Image Source: Zacks Investment Research

Let’s delve deeper.

Key Growth Drivers

Strength in Biologics: Investors are optimistic about McKesson’s robust Biologics business. Independent specialty pharmacy, Biologics by McKesson, has been making impressive progress lately. This month, the pharmacy was selected by GSK as a specialty pharmacy provider for OJJAARA (momelotinib).

Last month, the pharmacy was selected by Daiichi Sankyo, Inc. as a specialty pharmacy provider for VANFLYTA (quizartinib).

Strength in Distribution Market: McKesson is a major player in the pharmaceutical and medical supplies distribution market, which raises investors’ optimism. The Distribution Solutions segment caters to a wide range of customers and businesses and stands to benefit from increased generic utilization, inflation in generics driven by several patent expirations in the next few years and an aging population.

Per management, the uptick in the company’s U.S. Pharmaceutical and Medical-Surgical Solutions segments’ adjusted operating profit was driven by growth in the distribution of specialty products to providers and health systems and distribution of ancillary supplies for the U.S. government’s COVID-19 vaccine program, respectively, in the first quarter of fiscal 2024.

Strong Q1 Results: McKesson’s robust first-quarter fiscal 2024 results buoy optimism. The company recorded robust top-line and bottom-line performances and strength in its U.S. Pharmaceutical, Medical-Surgical Solutions and Prescription Technology Solutions segments.

Downsides

Weak Trends: McKesson distributes generic pharmaceuticals, which are subject to price fluctuation. The Distribution Solutions segment continues to experience weaker generic pharmaceutical pricing trends. Continued volatility, unfavorable pricing trends, reimbursement of generic drugs and significant fluctuations in the nature, frequency and magnitude of generic pharmaceutical launches could have a material adverse impact on McKesson.

Stiff Competition: Distribution Solutions faces stiff competition both in terms of price and service from various full-line, short-line and specialty wholesalers, service merchandisers, self-warehousing chains, manufacturers engaged in direct distribution, third-party logistics companies and large-payer organizations. Moreover, the company depends on fewer suppliers for its products. As a result, it is not in a position to negotiate pricing.

Other Key Picks

A few other top-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 18.1% against the industry’s 1.9% decline over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has lost 3.4% compared with the industry’s 6.7% decline over the past year.

Integer Holdings, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 29.4% compared with the industry’s 3.4% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report