MDC's Q2 Earnings & Revenues Beat, Net New Orders Increase

M.D.C. Holdings, Inc. MDC reported impressive second-quarter 2023 results, wherein earnings and revenues topped the Zacks Consensus Estimate. However, the metrics declined year over year.

Following the results, shares of this leading homebuilder gained 0.8% on Jul 27.

MDC is benefiting from improved the supply-chain scenario and an increase material availability, compared with the pandemic level. In the quarter, it witnessed sequential improvement in the average construction build time for the homes closed this and is now projecting construction build time of under 180 days for the new home starts. The company expects its inventory turns and capital efficiency to improve in the upcoming period, courtesy of enhanced building conditions and its keen focus on spec inventory.

Earnings & Revenues Discussion

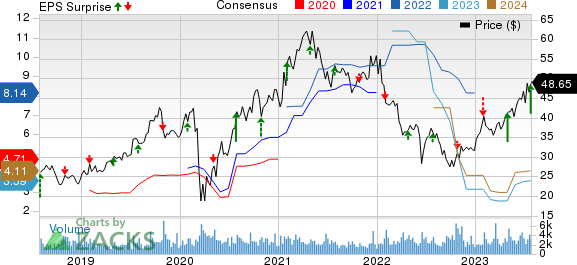

The company reported quarterly earnings of $1.24 per share, which significantly beat the Zacks Consensus Estimate of earnings of 69 cents per share by 79.7%. Yet, the bottom line decreased 52.1% from the year-ago quarter’s figure of $2.59 per share. The downside was due to softer housing revenues and higher costs.

M.D.C. Holdings, Inc. Price, Consensus and EPS Surprise

M.D.C. Holdings, Inc. price-consensus-eps-surprise-chart | M.D.C. Holdings, Inc. Quote

Total revenues (including Home sale revenues and Financial Services revenues) of $1.14 billion topped the consensus mark of $938 million by 21.1% but declined 23.6% on a year-over-year basis from $1.49 billion reported a year ago.

Segment Details

Homebuilding: Home sale revenues of $1.1 billion fell 24.1% from the prior-year period’s levels, due to a 4% lower average selling price or ASP. Homebuilding revenues topped our model’s prediction of $915.8 million by 19.6%.

Units delivered were also down 20.8% from the year-ago level to 2,009 homes. Our model predicted 1,665 units delivered for the reported quarter.

Net new orders grew 54.3% year over year to 2,167 units year driven by an increase in the monthly sales absorption pace, which was backed by the high pace of gross orders as well as a decrease in cancellations as a percentage of gross sales. The value of net orders increased 36.8% from the year-ago quarter’s levels to $1.21 billion, backed by the increase in net new orders. The uptrend of the new home market is driven by reduced existing home supply. The company’s net new orders’ units and value topped our model’s expectation of 1,851 units and $1.1 billion, respectively.

Cancellations, as a percentage of gross sales, decreased year over year to 20.2% from 37.2%. The monthly absorption rate also increased 34% year over year.

At the end of the quarter, the backlog totaled 3,048 homes, down 59% from a year ago. Potential housing revenues from backlog plunged 60% from the prior-year period’s levels to $1.76 billion due to a 3% lower ASP of $578,500.

Housing gross margin contracted 1,040 basis points (bps) year over year to 16.4%. This contraction was due to an increase in both incentives and construction costs year over year. The metric, however, topped our model’s prediction of 14.7% by 170 bps.

Selling, general and administrative expenses — as a percentage of housing revenues — increased 50 bps from the year-ago quarter’s figure to 9.7%.

Financial Services’ revenues declined 10% year over year to $32.6 million.

Balance Sheet & Cash Flow

MDC had cash and cash equivalents of $1.01 billion in the Homebuilding segment and $140.6 million in the Financial Services unit as of Jun 30, 2023. This compares with 2022-end numbers of $696.1 million and $17.9 million, respectively.

Total inventories declined to $3.15 billion from $3.52 billion at the 2022-end. Lots owned and optioned of 22,309 on June 2023-end was down 33% from 33,130 at June 2022-end.

Net cash provided by operating activities was $225.8 million in the quarter, compared with $53 million a year ago.

Q3 & 2023 Outlook

For third-quarter 2023, the company expects home deliveries to be between 1,850 units and 2,000 units. This indicates a fall from 2,387 units reported in third-quarter 2022. The ASP is anticipated to be approximately $555,000, compared with $590,000 reported a year ago.

Housing gross margin (assuming no impairments or warranty adjustments) is anticipated to be between 18% and 19%, compared with 22.7% reported in the prior-year period.

For 2023, the company expects home deliveries to be at least 8,000 units, compared with 9,710 units delivered in 2022.

Zacks Rank & Recent Construction Releases

MDC currently sports a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PulteGroup Inc. PHM reported impressive results in second-quarter 2023. Its earnings and revenues surpassed their respective Zacks Consensus Estimate and increased year over year. The upside was mainly driven by its solid operating model, which strategically aligns the production of build-to-order and quick-move-in homes with applicable demand across consumer groups.

Backed by its disciplined and balanced business model, the company witnessed solid gross closings, orders and margins in the reported quarter and posted a 12-month return on equity of 32%.

Otis Worldwide Corporation’s OTIS second-quarter 2023 earnings and sales surpassed the Zacks Consensus Estimate. Its quarterly results reflected 11th consecutive quarters of organic sales growth and solid operating margin expansion, contributing to mid-single digit adjusted earnings per share growth.

The company remains focused on strong portfolio growth and aims to generate a solid New Equipment backlog. It also intends to expand operating margins, return cash to shareholders through a capital-allocation strategy and pursue additional progress toward ESG goals.

Armstrong World Industries, Inc. AWI reported mixed results for second-quarter 2023, wherein earnings surpassed the Zacks Consensus Estimate but net sales missed the same. Both metrics increased on a year-over-year basis.

AWI’s results were backed by robust growth in operating income and adjusted EBITDA, as well as expanded margins, fueled by positive performances from both the Mineral Fiber and Architectural Specialties segments. The company remains focused on advancing digital and healthy spaces initiatives and pursuing attractive, bolt-on acquisitions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report