MDU Resources Group Inc. Reports Record Results and Sets 2024 Guidance

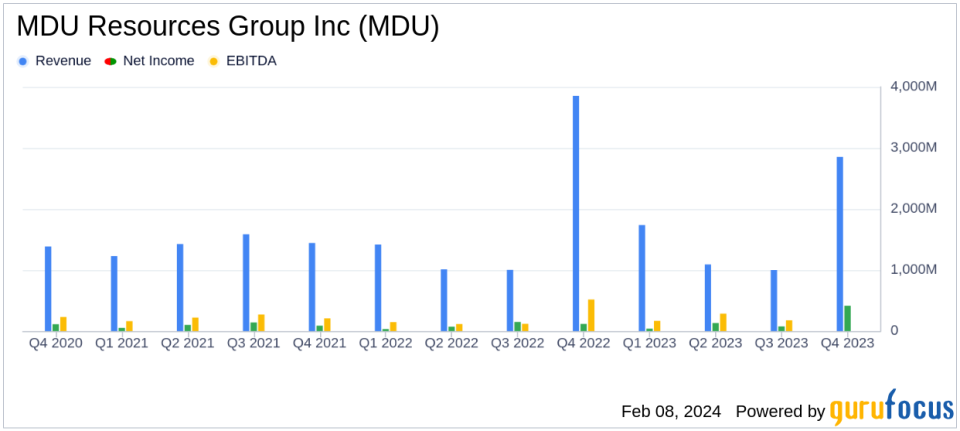

Net Income: $414.7 million in 2023, up from $367.5 million in 2022.

Earnings Per Share (EPS): Diluted EPS from continuing operations rose to $2.36 in 2023 from $1.23 in 2022.

Revenue: Construction services revenue reached a record $2.85 billion in 2023, compared to $2.7 billion in 2022.

Regulated Energy Delivery Earnings: Increased to $167.0 million in 2023 from $137.6 million in 2022.

EBITDA: Construction services EBITDA hit a record $222.7 million in 2023.

2024 Guidance: Regulated energy delivery earnings projected between $170 million to $180 million; construction services revenues forecasted at $2.9 billion to $3.1 billion.

Investor Day: Scheduled for March 13 at the New York Stock Exchange.

On February 8, 2024, MDU Resources Group Inc (NYSE:MDU) announced a year of robust growth in its 8-K filing, with record achievements across its utility, pipeline, and construction services businesses. The company, which operates across various segments including electric, natural gas distribution, pipeline, construction materials and contracting, and construction services, also completed a tax-free exchange of its retained shares in Knife River Corporation, the construction materials business it spun off in May 2023.

MDU Resources' President and CEO Nicole A. Kivisto highlighted the company's transformation and record results, attributing the success to the hard work of employees and strategic initiatives. The company's net income for 2023 was reported at $414.7 million, a significant increase from $367.5 million in the previous year. Diluted earnings per share (EPS) from continuing operations also saw a substantial rise to $2.36, up from $1.23 in 2022.

The company's regulated energy delivery earnings grew to $167.0 million, up from $137.6 million in 2022, benefiting from rate relief and customer growth. The construction services segment reported record revenues of $2.85 billion, up from $2.7 billion in 2022, with earnings of $137.2 million and EBITDA of $222.7 million.

MDU Resources expects the strong momentum to continue into 2024, with investments in transmission and distribution upgrades and expansion projects at its natural gas pipeline business. The company has provided guidance for 2024, expecting earnings from regulated energy delivery businesses to be in the range of $170 million to $180 million, and construction services revenues to be between $2.9 billion and $3.1 billion, with EBITDA of $220 million to $240 million.

Financial Highlights and Analysis

The electric and natural gas utility segment earned $120.1 million in 2023, up from $102.3 million in 2022, driven by approved rate relief and a 25.5% increase in electric retail sales volumes. The pipeline business also saw record earnings of $46.9 million, a 33% increase from the previous year, due to record annual transportation volumes and higher revenue from new transportation and storage rates.

The construction services business not only achieved record revenues but also saw its earnings increase to $137.2 million from $124.8 million in 2022, with strong demand across various service areas and improved project margins.

MDU Resources' strategic initiatives, including the spinoff of Knife River Corporation and the planned spinoff of the construction services business in late 2024, are expected to further streamline the company's focus on regulated energy delivery.

The company's financial tables reveal a solid performance with an increase in net income, earnings per share, and EBITDA. The balance sheet remains healthy, with capital expenditures aligned with the company's growth strategy. The cash flow statement shows a robust operating cash flow of $332.6 million, although there was a net decrease in cash and cash equivalents due to investing and financing activities.

MDU Resources' continued investment in infrastructure and strategic initiatives positions the company for sustained growth and operational efficiency. The upcoming investor day will provide an opportunity for the company to share more details about its future expectations and operational strategy.

For value investors, MDU Resources Group Inc presents a compelling investment opportunity with its consistent performance, strategic growth initiatives, and commitment to delivering shareholder value. The company's focus on regulated energy delivery and construction services is expected to drive future growth and profitability.

For more detailed information and analysis, investors are encouraged to visit GuruFocus.com and explore the comprehensive financial data and market insights available.

Explore the complete 8-K earnings release (here) from MDU Resources Group Inc for further details.

This article first appeared on GuruFocus.