MDU Resources (MDU) Q4 Earnings and Revenues Decrease Y/Y

MDU Resources Group Inc. MDU reported fourth-quarter 2023 operating earnings per share of 48 cents, which declined 9.4% from the year-ago quarter’s 53 cents.

GAAP earnings in the reported quarter were 84 cents per share compared with 57 cents in the prior-year period.

Adjusted earnings in 2023 were $1.50 per share, up 20% from $1.25 registered in 2022.

Total Revenues

MDU’s fourth-quarter net sales decreased 14.1% to $1.13 billion from $1.32 billion in the comparable period of 2022.

Operating revenues in the electric, natural gas distribution and regulated pipeline totaled $495.7 million, down 16.7% from the prior-year quarter’s figure. Revenues in the non-regulated pipeline, construction services and other segments dropped 12% to $639.6 million from the prior-year quarter.

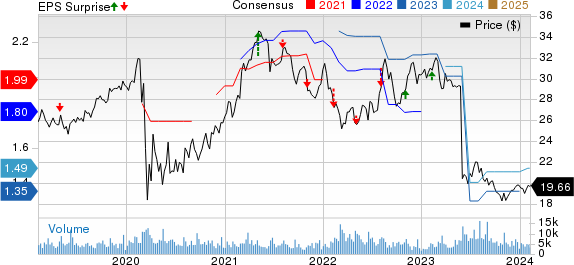

MDU Resources Group, Inc. Price, Consensus and EPS Surprise

MDU Resources Group, Inc. price-consensus-eps-surprise-chart | MDU Resources Group, Inc. Quote

Highlights of the Release

Total operating expenses in the fourth quarter amounted to nearly $1 billion, down approximately 15.9% from the year-ago quarter’s $1.18 billion. This was due to an 11% decline in operation and maintenance expenses.

Operating income totaled $140.8 million, up 1.3% from the year-ago quarter’s $139 million.

Interest expenses were $31.7 million, up 41.5% year over year.

Financial Highlights

As of Dec 31, 2023, Cash and cash equivalents were $77 million compared with $80.5 million as of Dec 31, 2022.

In 2023, Net cash provided by operating activities was $332.6 million compared with $510 million in the year-ago period.

Guidance

MDU Resources expects, in 2024, regulated energy delivery earnings in the range of $170-$180 million and construction services revenues in the band of $2.9-$3.1 billion.

The company expects its electric and natural gas customer growth to continue at a rate of 1-2% annually.

For 2024, the company expects to invest $609 million to strengthen its existing operations. For the 2024-2028 period, it plans to invest $2.76 billion.

Zacks Rank

MDU Resources currently has a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Releases

Spire Inc. SR reported fiscal first-quarter 2024 operating earnings per share of $1.47, which surpassed the Zacks Consensus Estimate of $1.37 by 7.3%.

The Zacks Consensus Estimate for SR’s fiscal 2024 earnings is pinned at $4.34 per share, implying a year-over-year improvement of 7.2%.

Atmos Energy ATO posted first-quarter fiscal 2024 earnings of $2.08 per share, which missed the Zacks Consensus Estimate of $2.09 by 0.47%.

The Zacks Consensus Estimate for ATO’s fiscal 2024 earnings is pegged at $6.57 per share, indicating a year-over-year improvement of 7.7%.

National Fuel Gas Company NFG reported fiscal first-quarter 2024 adjusted operating earnings of $1.46 per share, which surpassed the Zacks Consensus Estimate of $1.32 by 10.6%.

The Zacks Consensus Estimate for NFG’s fiscal 2024 earnings is pinned at $4.74 per share, implying a year-over-year decrease of 8.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

MDU Resources Group, Inc. (MDU) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

Spire Inc. (SR) : Free Stock Analysis Report