Media Industry Trends And Its Impact On Atresmedia Corporación de Medios de Comunicación SA (BME:A3M)

Atresmedia Corporación de Medios de Comunicación SA (BME:A3M), a €1.42b small-cap, is a media company operating in an industry which has experienced the impact of the growing presence of online streaming. Media analysts are forecasting for the entire industry, a relatively muted growth of 2.6% in the upcoming year , and a robust short-term growth of 15.6% over the next couple of years. However, this rate came in below the growth rate of the ES stock market as a whole. An interesting question to explore is whether we can we benefit from entering into the media sector right now. Today, I will analyse the industry outlook, and also determine whether Atresmedia Corporación de Medios de Comunicación is a laggard or leader relative to its media sector peers.

Check out our latest analysis for Atresmedia Corporación de Medios de Comunicación

What’s the catalyst for Atresmedia Corporación de Medios de Comunicación’s sector growth?

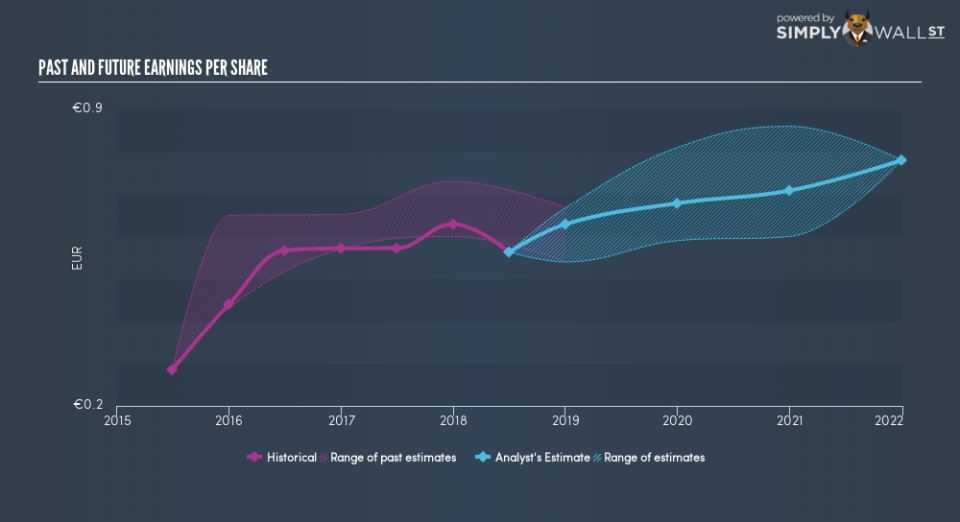

Simply capturing natural customer growth and their uptake of content with existing approaches is no longer sufficient. Over the past year, the industry saw growth in the twenties, beating the ES market growth of 15.0%. Atresmedia Corporación de Medios de Comunicación lags the pack with its negative growth rate of -1.6% over the past year, which indicates the company has been growing at a slower pace than its media peers. However, the future seems brighter, as analysts expect an industry-beating growth rate of 15.6% in the upcoming year. This future growth may make Atresmedia Corporación de Medios de Comunicación a more expensive stock relative to its peers.

Is Atresmedia Corporación de Medios de Comunicación and the sector relatively cheap?

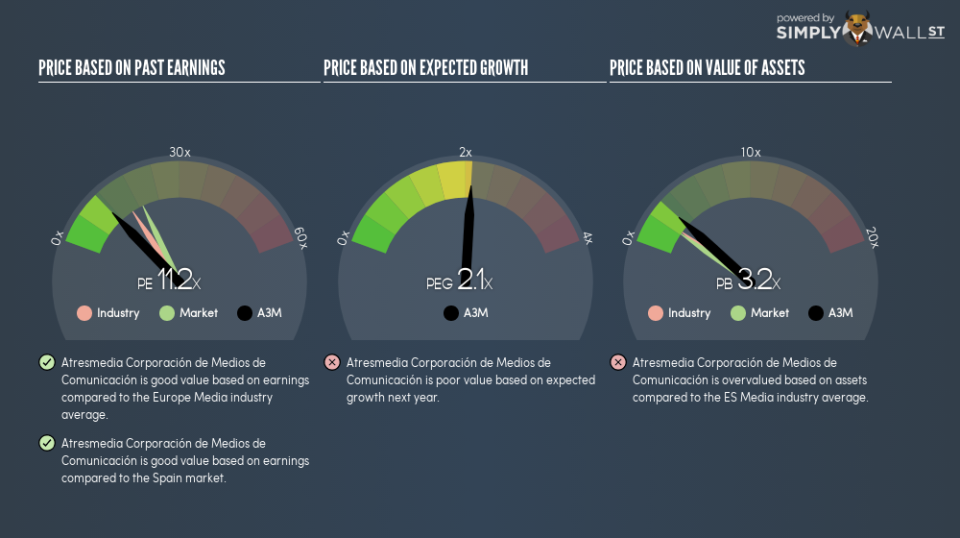

The media industry is trading at a PE ratio of 15.68x, relatively similar to the rest of the ES stock market PE of 19.05x. This means the industry, on average, is fairly valued compared to the wider market – minimal expected gains and losses from mispricing here. However, the industry returned a higher 28.4% compared to the market’s 12.7%, potentially illustrative of a turnaround. On the stock-level, Atresmedia Corporación de Medios de Comunicación is trading at a PE ratio of 11.2x, which is relatively in-line with the average media stock. In terms of returns, Atresmedia Corporación de Medios de Comunicación generated 28.4% in the past year, in-line with its industry average.

Next Steps:

Atresmedia Corporación de Medios de Comunicación’s industry-beating future is a positive for shareholders, indicating they’ve backed a fast-growing horse. However, this high growth prospect is most likely factored into the share price, given the stock is trading in-line with its peers. If Atresmedia Corporación de Medios de Comunicación has been on your watchlist for a while, now may be the time to enter into the stock. If you like its growth prospects, you’ll be paying a fair value for the company. However, if you’re hoping to gain from an undervalued mispricing, this is probably not the best time. However, before you make a decision on the stock, I suggest you look at Atresmedia Corporación de Medios de Comunicación’s fundamentals in order to build a holistic investment thesis.

Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Historical Track Record: What has A3M’s performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Atresmedia Corporación de Medios de Comunicación? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.