MediaAlpha Inc (MAX) Reports Mixed Financial Results for Q4 and Full Year 2023

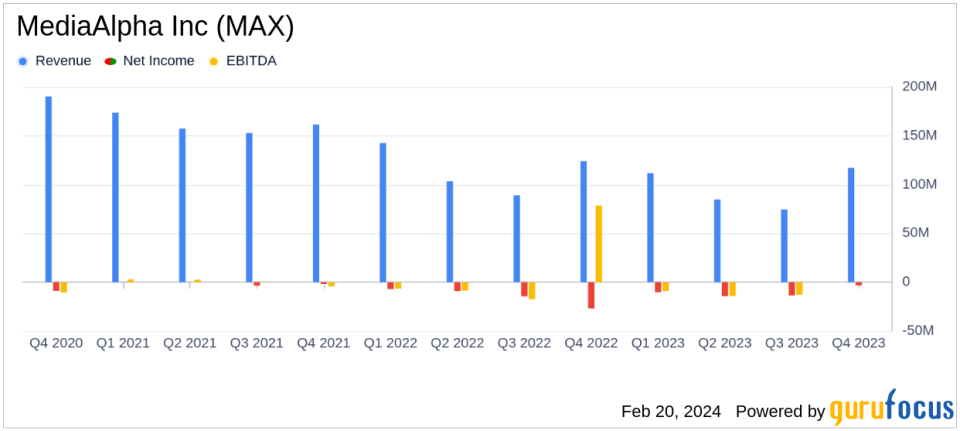

Revenue: Q4 revenue decreased by 6% year-over-year to $117.2 million; Full year revenue down 15% to $388.1 million.

Transaction Value: Q4 Transaction Value decreased by 2% year-over-year to $165.3 million; Full year down 20% to $593.4 million.

Net Loss: Q4 net loss improved to $(3.3) million from $(28.4) million year-over-year; Full year net loss narrowed to $(56.6) million from $(72.4) million.

Gross Margin: Increased to 19.0% in Q4 from 16.2% in the same period last year; Full year gross margin improved to 17.2% from 15.3%.

Adjusted EBITDA: Q4 Adjusted EBITDA rose to $12.7 million from $9.0 million year-over-year; Full year Adjusted EBITDA increased to $27.1 million from $22.9 million.

On February 20, 2024, MediaAlpha Inc (NYSE:MAX) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its technology platform that connects insurance carriers with customers, reported a decrease in revenue and Transaction Value for both the quarter and the full year, although it saw improvements in gross margin and Adjusted EBITDA.

Company Overview

MediaAlpha Inc operates a leading technology platform in the Interactive Media industry, serving as a pivotal customer acquisition channel for insurance carriers and distributors. The platform's real-time, transparent, and results-driven ecosystem specializes in property & casualty insurance, health insurance, and life insurance. The company primarily generates revenue through fees for consumer referrals sold on its platform and is focused on the United States market.

Performance and Challenges

The company's performance in the fourth quarter showed signs of recovery, particularly in the Property & Casualty (P&C) insurance vertical, which had been facing difficult market conditions. CEO Steve Yi expressed optimism about the P&C vertical, anticipating a significant increase in Transaction Value in the first quarter of 2024. Despite the challenges, the company's strategic focus and operational adjustments have led to improved gross margins and Adjusted EBITDA, indicating a potential turnaround in profitability.

Financial Achievements

MediaAlpha's financial achievements in the fourth quarter, such as the increase in gross margin to 19.0% and a rise in Adjusted EBITDA to $12.7 million, are significant as they reflect the company's ability to optimize its operations amidst challenging market conditions. These improvements are crucial for MediaAlpha as they demonstrate the company's resilience and potential for sustainable growth in the Interactive Media sector.

Financial Statement Summary

The company's Balance Sheet shows a decrease in total assets from $170.1 million in 2022 to $153.9 million in 2023, while liabilities also decreased from $256.2 million to $248.4 million over the same period. The Consolidated Statements of Operations reveal a narrowed net loss for both the quarter and the full year, with a notable reduction in costs and operating expenses contributing to this improvement. The Cash Flow Statement indicates a stable operating cash flow, which is a positive sign for the company's liquidity and financial health.

Management Commentary

"Our fourth quarter results exceeded expectations, driven primarily by improving conditions in our Property & Casualty (P&C) insurance vertical," said MediaAlpha co-founder and CEO Steve Yi. "We believe our growth will accelerate as more auto insurance carriers restore profitability and increase their marketing investments, driving strong results for MediaAlpha this year and beyond."

Analysis and Outlook

MediaAlpha's Q1 2024 guidance suggests an optimistic outlook, with expected improvements in the P&C vertical and steady growth in the Health insurance sector. However, the company remains cautious, refraining from providing full-year guidance due to uncertainties in the P&C market recovery. The expected increase in Adjusted EBITDA for Q1 2024, despite a projected decline in Transaction Value, indicates that MediaAlpha is effectively managing its operating expenses and could potentially enhance profitability in the coming quarters.

For value investors, MediaAlpha's latest earnings report presents a mixed picture. While the year-over-year declines in revenue and Transaction Value may raise concerns, the improvements in gross margin, net loss, and Adjusted EBITDA suggest that the company is on a path to recovery. The management's focus on operational efficiency and market conditions in the P&C vertical will be key factors to watch in the upcoming quarters.

For more detailed insights and analysis, visit GuruFocus.com to stay informed on MediaAlpha Inc (NYSE:MAX) and other investment opportunities.

Explore the complete 8-K earnings release (here) from MediaAlpha Inc for further details.

This article first appeared on GuruFocus.