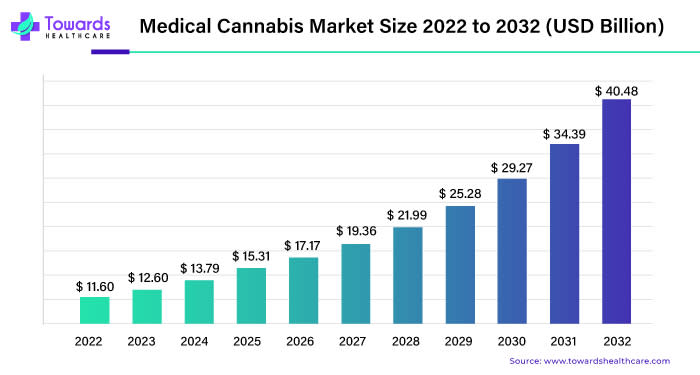

Medical Cannabis Market Size Projected to Reach $40.48 Billion by 2032

The global medical cannabis market size was valued a USD 12.60 billion in 2023 and is projected to reach around USD 40.48 billion by 2032, with a double-digit CAGR of 13.8% between 2023 and 2032.

Ottawa, Feb. 23, 2024 (GLOBE NEWSWIRE) -- The medical cannabis market size is estimated to be worth around USD 25.28 billion by 2029 from USD 13.79 billion in 2024, according to a study published by Towards Healthcare a sister firm of Precedence Research. North America reigns supreme, boasting a commanding 56% share, thanks to early legalization, established market, and booming popularity.

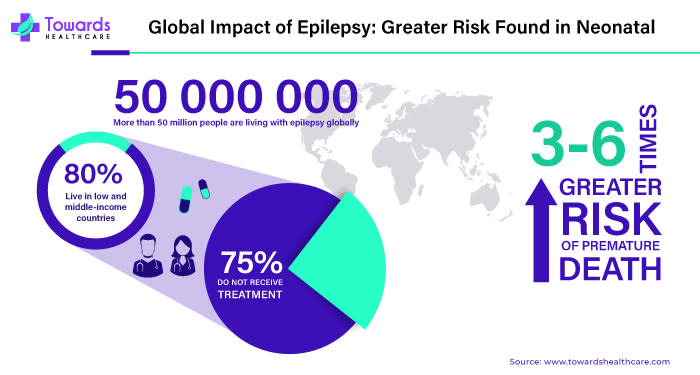

In 2023, according to the World Health Organization, it is estimated that around 50 million individuals are suffering from Epilepsy in the United States and showing a greater risk of premature death due to epilepsy. Medical cannabis hits high notes for Epilepsy, Chronic Pain Management and Rare Diseases.

Download a short version of this report @ https://www.towardshealthcare.com/personalized-scope/5099

Medical cannabis is obtained from the Cannabis Sativa plant and has been used for centuries due to its potential therapeutic benefits. Cannabis contains two main active compounds: Tetrahydrocannabinol (THC) and Cannabidiol (CBD). THC is known for its psychoactive properties, whereas CBD is non-psychoactive and has a variety of health benefits. The human body contains an endocannabinoid system (ECS), which regulates various physiological processes. Cannabinoids found in medical cannabis interact with receptors in the ECS, influencing processes such as pain perception, immunity and mood. One of the primary applications of medical cannabis is pain relief and it is used for various symptoms and diseases. THC can help alleviate chronic pain by altering how pain signals are processed in the brain. CBD, on the other hand, may have anti-inflammatory and analgesic properties without causing the "high" associated with THC. Medical cannabis is also utilized to manage nausea and vomiting, often in patients undergoing chemotherapy. THC can help reduce these symptoms and improve the quality of life for individuals undergoing cancer treatments.

In some cases, medical cannabis is prescribed for muscle spasms and spasticity associated with conditions like multiple sclerosis. The cannabinoids' muscle-relaxant properties may provide relief for these symptoms. It's crucial to highlight that the legal status of medical cannabis varies widely around the world and even within different regions of a country. Some places have legalized its use for medicinal purposes, while others still have strict regulations or complete prohibition. Before considering medical cannabis, individuals should consult with healthcare professionals to discuss potential benefits, risks and legal implications based on their specific health conditions and local regulations.

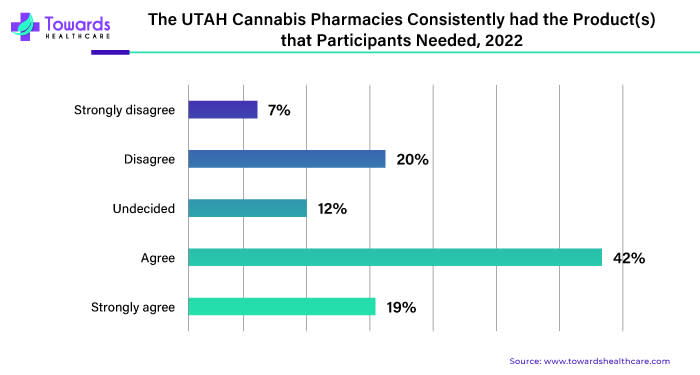

Medical Cannabis Market Analysis Survey, 2022

The DHHS center for medical cannabis surveyed participants in the state's medical cannabis program. The survey aimed to gather feedback on the state's medical cannabis sector regarding product access availability.

Additionally, medical cannabis, also known as medical marijuana, utilizes either the cannabis plant or its chemical components to address symptoms or medical conditions. While medical marijuana is available in forms similar to recreational use, there are also refined lab-made versions for specific health issues. Historically, cannabis use traces back to Central Asia or Western China, with documented instances dating back to 2800 BC in Emperor Shen Nung's pharmacopeia. The cannabis plant contains over 100 cannabinoids, with THC and CBD being the primary ones used in medicine. THC induces the characteristic "high", whether through smoking or ingesting cannabis-infused products. As of 2023, medical marijuana products were legally accessible in 38 states, three territories and the District of Columbia despite remaining prohibited under federal law.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

The Role of Medical Cannabis in Treating Various Symptoms and Conditions

In states where medical marijuana is sanctioned, its approval extends to a diverse range of medical conditions, such as

Severe and Persistent Pain

Multiple Sclerosis

Chemotherapy-Induced Nausea

Epilepsy

Alzheimer's

ALS

HIV/AIDS

Crohn's Disease

Glaucoma

Migraines

Anorexia

Wasting Syndrome

Irritable Bowel Syndrome

Post-Traumatic Stress Disorder

It's imperative to recognize that some endorsed applications lack robust scientific validation. This discrepancy arises, in part, from the challenge researchers face in conducting comprehensive studies on a substance that, despite state-level approval, remains federally prohibited. The intricacies of this legal landscape contribute to limitations in establishing conclusive evidence for certain medicinal uses of Cannabis. More and more folks are realizing the amazing health benefits of medical cannabis, and it's causing a big demand boost in the market. People are getting hip to the therapeutic perks of cannabis-based products and as we all get more comfortable with using cannabis for medical reasons, the demand is shooting up. Ongoing research backing up its effectiveness also plays a role, making these products even more popular. It's like everyone's realizing that cannabis is a legitimate and valuable part of taking care of our health.

A cannabis patient cardholder is someone whose state's regulatory body has issued a medical marijuana card or license. This card verifies that the holder has a qualifying medical condition that makes them eligible to use cannabis for therapeutic purposes.

Prescription Drugs Based on Cannabis Compounds

The FDA hasn't endorsed marijuana for health issues, but it has given the thumbs up to two prescription medications featuring synthetic cannabinoids.

FDA-Approved Medical Cannabis Drugs:

Dronabinol, also known as Marinol, comes into play for managing chemotherapy-induced nausea and vomiting and addressing appetite and weight loss in individuals with HIV/AIDS.

Nabilone, marketed as Cesamet, steps in to alleviate nausea and vomiting from chemotherapy when other remedies fall short.

What sets these drugs apart from medical marijuana is the ability to regulate the active ingredient precisely, ensuring a consistent and known dosage each time. This level of control contributes to a more reliable and predictable therapeutic experience.

Cannabis has Potential Benefits in Managing Epilepsy

Epilepsy is a persistent neurological condition affecting individuals across all age groups. Globally, approximately 50 million people grapple with epilepsy, marking it as one of the most prevalent neurological disorders. Alarmingly, around 80% of those affected reside in low and middle income nations. With proper diagnosis and treatment, up to 70% of individuals living with epilepsy could potentially lead seizure-free lives. Unfortunately, the risk of premature death is three times higher in people with epilepsy compared to the general population. Regrettably, a significant number of individuals in low-income countries, around three-quarters, lack access to the necessary treatment. Beyond the medical challenges, many regions worldwide witness people with epilepsy and their families enduring the burden of societal stigma and discrimination. Addressing these issues requires a concerted effort to enhance accessibility to proper care and eliminate misconceptions surrounding epilepsy. Research suggests that certain compounds in cannabis, such as Cannabidiol (CBD), may have anticonvulsant properties and could potentially help manage epilepsy. CBD interacts with the endocannabinoid system in the body, influencing neural activity. However, it’s crucial to consult with a healthcare professional before considering any cannabis-related treatment for epilepsy, as the effectiveness and safety can vary and individual responses may differ.

While some studies suggest that certain compounds in cannabis, particularly cannabidiol (CBD), may have anticonvulsant properties, the overall evidence supporting cannabis as a primary treatment for epilepsy is not yet conclusive.

For Instance,

Epidiolex, a CBD-based medication, has been approved by the U.S. Food and Drug Administration (FDA) for specific types of seizures associated with epilepsy. Cannabis is gaining recognition for its role in epilepsy treatment, with an increasing demand for its medicinal use.

In 2023, according to the World Health Organization, around 50 million individuals in the United States are affected by epilepsy, comprising 3 million adults and 470,000 children. Notably, epilepsy stands out as one of the leading causes of hospital inpatient stays among children aged 0 to 17 in the U.S.

Many individuals are finding relief through cannabis-based therapies, and as awareness grows, so does the demand for these medicinal products. This positive shift reflects a changing perspective on the potential benefits of cannabis in managing epilepsy, providing hope for those seeking alternative, effective treatments and increasing demand for medical cannabis in the market.

Medical Cannabis Faces a Tangled Web of Legal and Regulatory Hurdles

The challenge of legal and regulatory issues in the medical cannabis market is like facing a tricky obstacle course. Imagine each country having its own set of rules – some straightforward, others complex. The first hurdle is the patchwork of regulations globally; what's legal in one place might be strictly prohibited in another. The clash of rules between regions adds complexity, creating a regulatory puzzle. It's like trying to follow a map with conflicting instructions, making the journey more challenging. Concerns about misuse and safety act as barriers. Some fear that opening the doors to medical cannabis could lead to problems. This concern adds an extra layer of difficulty, making the regulatory landscape akin to a tricky obstacle course that needs careful navigation.

Additionally, varying legal statuses across jurisdictions create complexities for companies operating in multiple markets. Despite its growing acceptance, navigating the evolving regulatory landscape remains a key factor influencing the expansion of the medical cannabis industry.

Customize this study as per your requirement @ https://www.towardshealthcare.com/customization/5099

Geographical Landscape

In North America, the geographical landscape for the medical cannabis market has seen significant changes in recent years. Canada has a well-established legal framework for both medical and recreational cannabis, allowing for cultivation, distribution and use. Several U.S. states, including California, Colorado and Florida, have developed robust medical cannabis markets. Mexico has also undergone legislative changes, decriminalizing cannabis for personal use and exploring avenues for medical cannabis legalization. The North American medical cannabis market exhibits a patchwork of regulations, with ongoing developments and shifting attitudes contributing to a dynamic landscape. As more regions and states embrace medical cannabis, the market is likely to continue evolving across the continent.

In the Asia Pacific, the geographical landscape for the medical cannabis market is marked by a mix of regulatory approaches. While many countries maintain strict regulations or even criminalize cannabis, some are exploring or implementing changes. Australia has made strides in medical cannabis legalization, establishing a framework for cultivation and distribution. In contrast, countries like Thailand and South Korea have taken steps toward cannabis decriminalization for medical purposes. However, the overall landscape in Asia Pacific remains diverse, with varying levels of acceptance and regulatory frameworks.

Browse More Insights of Towards Healthcare:

The global smart bandages market size was valued at USD 648.10 million in 2022 to reach around USD 1,834.45 million by 2032, expanding at a CAGR of 11.5% between 2023 and 2032.

The global AI in cardiology market size to grow from USD 1.06 billion in 2022 to surpass an estimated USD 20.35 billion by 2032, registered at a double digit CAGR of 34.38% between 2023 and 2032.

The global over-the-counter analgesics market size is estimated to grow from USD 28.6 billion in 2022 to project around USD 40.93 billion by 2032, expanding at a CAGR of 3.7% between 2023 and 2032.

The global pediatric drugs market size was valued at USD 115.6 billion in 2022 to reach around USD 363.86 billion by 2032, expanding at a CAGR of 12.2% between 2023 and 2032.

The global AI in healthcare market size was at USD 15.1 billion in 2022 to skyrocket an estimated USD 355.78 billion by 2032, registered at a double digit CAGR of 37.66% between 2023 and 2032.

The global 3D Printed medical devices market size was estimated at USD 3.41 billion in 2022 to surpass around USD 17.76 billion by 2032, growing at a 17.94% CAGR between 2023 and 2032.

The global respiratory devices market size was valued at USD 20.66 billion in 2022 at an expanding 8.74% CAGR between 2023 and 2032, to reach around USD 47.76 billion by 2032.

The 503A U.S. compounding pharmacies market size is estimated to grow from USD 3.99 billion in 2022 to surpass around USD 7.18 billion by 2032, growing at a 6.11% CAGR between 2023 and 2032.

The global generative AI in healthcare market was valued at USD 1.07 billion in 2022 to reach an estimated USD 21.74 billion by 2032, growing at a CAGR of 35.1% from 2023 to 2032.

The global chatbots for mental health and therapy market size to grow from USD 0.99 billion in 2022 to reach around USD 6.51 billion by 2032, registered at a CAGR of 21.3% between 2023 to 2032.

Competitive Landscape

The competitive landscape in the medical cannabis market is dynamic and evolving. Numerous companies worldwide are actively engaged in the cultivation, processing and distribution of medical cannabis products. The entrance of established pharmaceutical and biotech companies into the medical cannabis space is noteworthy. These companies are often involved in the research and development of cannabis-based pharmaceuticals, aiming to meet regulatory standards for broader acceptance. Regulatory environments, research advancements and strategic partnerships influence the competitive landscape. As the industry continues to expand globally, the competitive dynamics within the medical cannabis market are expected to undergo further transformation.

The Fast-Evolving Landscape of Medical Cannabis

In January 2023, Celadon Pharmaceuticals Pic shared the exciting news that the UK Medicines and Healthcare Products Regulatory Agency (MRHA) has officially registered its cannabis active pharmaceutical ingredient at its Midlands facility, UK, ensuring compliance with Good Manufacturing Practices (GMP).

In February 2023, Aurora Cannabis Inc. joined forces with MedReleaf Australia, introducing an innovative medical cannabis brand called CraftPlant to the Australian market. CraftPlant brings three new products – Greendale, Navana and HiVolt – all derived from carefully cultivated strains, boasting THC dominance and enriched with high terpene content. This collaboration aims to provide doctors in Australia with various prescription options for their patients.

In June 2023, Avicanna Inc., a pioneer in cannabinoid-based pharmaceuticals, partnered with the Canadian Consortium for the Investigation of Cannabinoids. Together, they developed an educational course customized for the medical community in Canada, fostering a deeper understanding of cannabinoids.

In August 2023, Avicanna Inc. expanded its footprint by acquiring Medical Cannabis by Shopper's Business from Shoppers Drug Mart. To add to the celebration, they proudly launched MyMedi.ca, an innovative medical cannabis care platform, offering a comprehensive and user-friendly experience for individuals seeking medical cannabis solutions.

Market Players

Ilray Inc.

Canopy Growth Corporation

Aurora Cannabis Inc.

Endoca

Curaleaf Holding Inc.

Medical Marijuana Inc.

Green Thumb Industry

Acreage Holdings

GW Pharmaceutical Plc.

Folium Europe B.V.

Market Segments

By Type

Tetrahydrocannabinol (THC)

Cannabidiol (CBD)

Other Cannabinoids

By Application

Chronic Pain Management

Mental Health and Neurodegenerative Disorder

Oncology

Others

By Distribution Channel

Hospital Pharmacies

Retail Pharmacies

Online Stores

By Geography

North America

Europe

Asia-Pacific

Latin America

The Middle East and Africa

Acquire our comprehensive analysis today @ https://www.towardshealthcare.com/price/5099

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Explore the comprehensive statistics and insights on healthcare industry data and its associated segmentation: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Web: https://www.towardshealthcare.com

Browse our Brand-New Journal@ https://www.towardspackaging.com

Browse our Consulting Website@ https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare