Medical Device Stocks' Q2 Earnings on Jul 27: BSX, LH & IART

The second-quarter 2023 reporting cycle for the Medical Device space has started with Abbott ABT reporting better-than-expected earnings and sales. The gradual improvement in the economic scenario compared to the first quarter implies that trading volumes have risen. This is expected to be reflected in the results of the industry players.

Some major industry players like Boston Scientific BSX, Laboratory Corporation of America Holdings or LabCorp LH and Integra LifeSciences Holdings Corporation IART are set to report their results tomorrow.

Q2 Preview and Scorecard

Per the latest Earnings Preview, quarterly results so far have improved year over year despite the ongoing macroeconomic headwinds in the form of worldwide inflationary pressure and unfavorable foreign exchange headwind. Going by the broader Medical sector’s scorecard, 3.4% of the companies in the Medical sector, constituting 12.3% of the sector’s market capitalization, reported earnings till Jul 19. Of these, 100% beat earnings and revenue estimates. Earnings improved 9.3% year over year on 14% higher revenues.

However, overall, second-quarter earnings of the Medical sector are expected to plunge 18.6% despite 3.4% revenue growth. This compares with the first-quarter earnings decline of 17.9% on revenue growth of 4%.

Factors That Influenced Medical Device Stocks

Replicating the broader market trend, Medical Device or the Zacks-defined Medical Products companies’ collective business growth in the second quarter is likely to have been significantly dampened by the ongoing macroeconomic threat in the United States and outside. Through the second-quarter months, the companies, which are into international trade, are expected to have faced severe currency headwinds. During this period, the U.S. dollar remained strong compared to several foreign currencies, which is expected to have had an unfavorable impact on sales.

Further, in Medical Devices, going by the industry-wide trend, logistical challenges and increasing unit costs are likely to have weighed heavily on the corporate profitability of stocks across the board. This might have, in a way, shrunk the companies’ revenues in the second quarter compared to the prior quarter.

On a positive note, companies’ successful addressing of a couple of years’ pent-up demand is likely to have led to higher year-over-year growth within the legacy base businesses. During the post-pandemic phase, the key focus of medical device R&D has again shifted from COVID-related PPE, testing and distant care options to point-of-care testing, heavy as well as minimally invasive implants, elective procedures and so forth. Accordingly, legacy base business recovery and testing demand through the months of the second quarter are expected to have been impressive. Meanwhile, AI and robotics for the medical Internet of Things (IoT), which rose to the limelight during the pandemic phase, remained popular.

Medical Device Stocks to Watch

Let's take a look at four defense companies that are scheduled to report second-quarter 2023 earnings on Jul 27 and find out how things might have shaped up prior to the announcements.

Boston Scientific: An improved scenario in terms of hospital visits and elective medical procedures, along with an innovative pipeline, expansion into faster growth markets, globalization efforts and enhanced digital capabilities, poise BSX well to register decent second-quarter 2023 results. Boston Scientific is particularly expected to have registered strong growth in EMEA within structural heart, including Transcatheter aortic valve replacement, WATCHMAN and other interventional cardiology therapies. It is also expected to have recorded growth in electrophysiology divisions, fueled by ongoing investments in emerging markets, new and ongoing product launches across the portfolio, pricing discipline and strong commercial execution.

(Read more: Will Boston Scientific Beat Q2 Earnings Estimates?)

The Zacks Consensus Estimate for total revenues of $3.50 billion for the second quarter suggests a 7.8% improvement from the prior-year quarter’s reported figure. The consensus mark for BSX’s earnings of 49 cents per share indicates an 11.4% rise from the year-ago quarter’s reported figure.

Per our proven model, a stock with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates. This is exactly the case as you can see below.

BSX has an Earnings ESP of +0.47% and carries a Zacks Rank #2. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

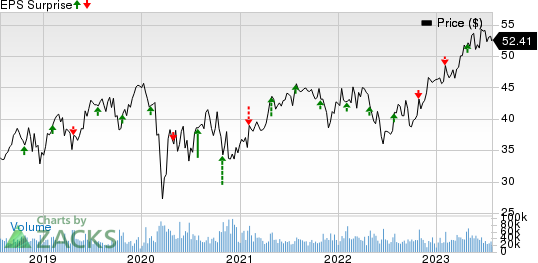

Boston Scientific Corporation Price and EPS Surprise

Boston Scientific Corporation price-eps-surprise | Boston Scientific Corporation Quote

LabCorp: Similar to the past few quarters, LabCorp is expected to have benefited from an ongoing sales rebound in its legacy Diagnostics business, driven by routine and esoteric testing and a benefit from hospital deals. However, a slowdown in COVID-19 testing is likely to have hampered the sales performance of LabCorp Diagnostics. This is expected to be reflected in its second-quarter results.

(Read more: LabCorp to Report Q2 Earnings: What's in the Cards?)

The Zacks Consensus Estimate for LabCorp’s second-quarter revenues is pegged at $2.99 billion, which implies a plunge of 19.3% from the year-ago figure. The consensus estimate for earnings per share is pegged at $3.47, suggesting a fall of 30% from the prior-year reported figure.

LH has an Earnings ESP of 0.00% and a Zacks Rank #5 (Strong Sell).

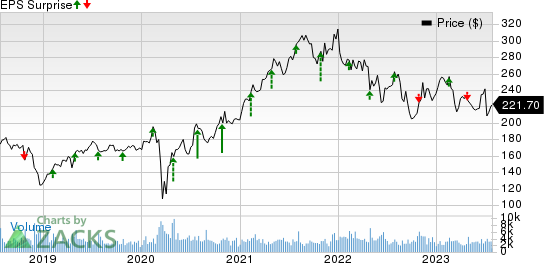

Laboratory Corporation of America Holdings Price and EPS Surprise

Laboratory Corporation of America Holdings price-eps-surprise | Laboratory Corporation of America Holdings Quote

Integra: It is expected to have gained in the second quarter from healthy demand for its industry-leading products within Codman Specialty Surgical (CSS). The segment has been benefiting from the growing market acceptance of the company’s global neurosurgery line-ups, including CSS management and neuromonitoring. Further, Integra’s Tissue Technologies business is expected to report strong second-quarter sales on efficient growth strategies and a better price management policy.

The Zacks Consensus Estimate for Integra’s second-quarter revenues is pegged at $373.9 million, which implies a 6% decline from the year-ago figure. The consensus estimate for earnings per share is pegged at 57 cents, suggesting a fall of 30.5% from the prior-year reported figure.

IART has an Earnings ESP of -1.75% and a Zacks Rank #4 (Sell).

Integra LifeSciences Holdings Corporation Price and EPS Surprise

Integra LifeSciences Holdings Corporation price-eps-surprise | Integra LifeSciences Holdings Corporation Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

Integra LifeSciences Holdings Corporation (IART) : Free Stock Analysis Report