Medical Properties Trust: Multi-Bagger or Bust?

It is the fifth round of a cage match between Medical Properties Trust Inc. (NYSE:MPW) and the bears, which has now lasted for over two years. The real estate investment trust is bloodied and staggering. Will it survive? Or will it have to be taken on a stretcher to bankruptcy? Thus is the situation for one of the largest private owners of hospital real estate in the U.S.

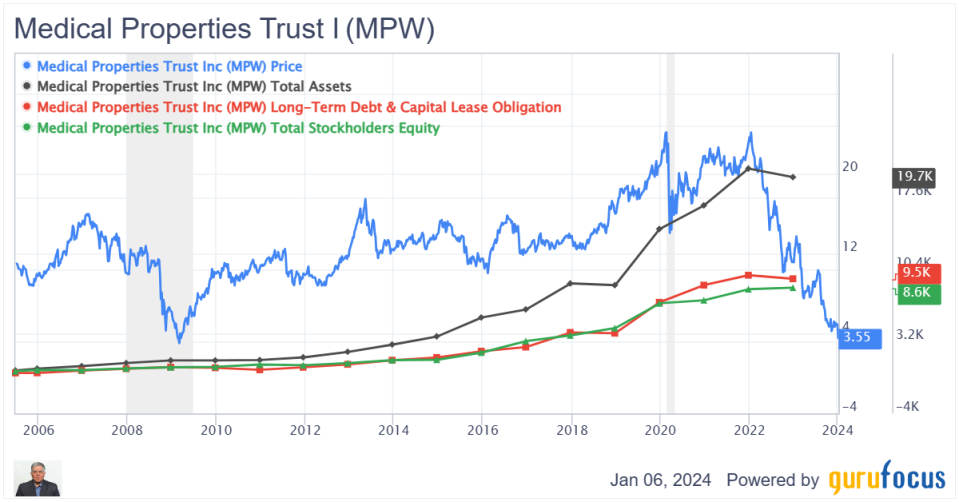

Medical Properties Trust is a self-managed real estate investment trust with a market capitalization of $2.1 billion (down from $6.65 billion last year and $14.1 billion in 2021) and an enterprise value of $12.9 billion. Founded in 2003 to purchase and develop hospitals that are leased to operators on a net basis, this Birmingham, Alabama-based company has grown to become one of the largest owners of hospitals in the world, with 431 facilities and approximately 43,000 licensed beds in nine countries.

The company's business model enabled it to facilitate acquisitions and recapitalizations and allows hospitals to monetize the value of their real estate assets (Its total portfolio is valued at $19 billion as of September). This in turn allowed Medical Properties to raise debt and equity from the market. This happy situation continued until the bear attack began in 2022.

Medical Properties' business model involves leveraging of hospitals by buying the underlying real estate and then leasing it back to the hospital operators. Private equity firms started to acquire hospitals through leveraged buyouts. In this process, a private equity firm raises seed capital from investors and borrows the rest to acquire the hospital, putting the acquired hospital's physical assets such as buildings as collateral for the loan or selling them to an outfit like Medical Properties and then leasing them back. The borrowed money is then returned. The net result is sucking out the equity to benefit the private equity firm and its investors.

The hospital then generates revenue to pay down the debt (or pay rent to Medical Properties), while the private equity firm charges management fees to its investors and focuses on high-profit procedures, cost-cutting, reorganization and financial engineering to generate more profits. Private equity is not there for long and is alway looking to unload the asset at opportunistic prices. This approach has raised concerns about potential negative impacts on patient care, such as staff layoffs, reduced services and financial pressures that may prioritize profit over patients. Hospital operators have also become vulnerable to the vicissitudes of the economy and, in the aftermath of the Covid-19 pandemic, the bears saw an opportunity to pounce.

MPW Data by GuruFocus

Short attack

Medical Properties Trust has been under attack by short sellers since 2022, with allegations of a circular financial relationship with the operators of the hospitals whose real estate the company owns. The bears alleged that Medical Properties Trust is propping up some of these hospital operators (particularly Steward Health, its biggest tenant) who are basically insolvent by loaning them money, so they can keep up with the rent payments. According to the bears, this is a house of cards that is crashing down. The bears have been spectacularly right so far. Short interest continues to rise while the stock falls. The company is caught in a vicious feedback loop as investors lose confidence.

Steward Health was controlled by private equity firm Cerberus Capital Management. However, in June 2020, a group of Steward Health Care physicians, led by the company's CEO, acquired the controlling interest. As a result, Steward Health Care became the largest physician-owned and operated health care system in the United States, with the physician group controlling 90% of the company and Medical Properties Trust maintaining the remaining 10% it already owned.

Source: morningstar.com

Recent development

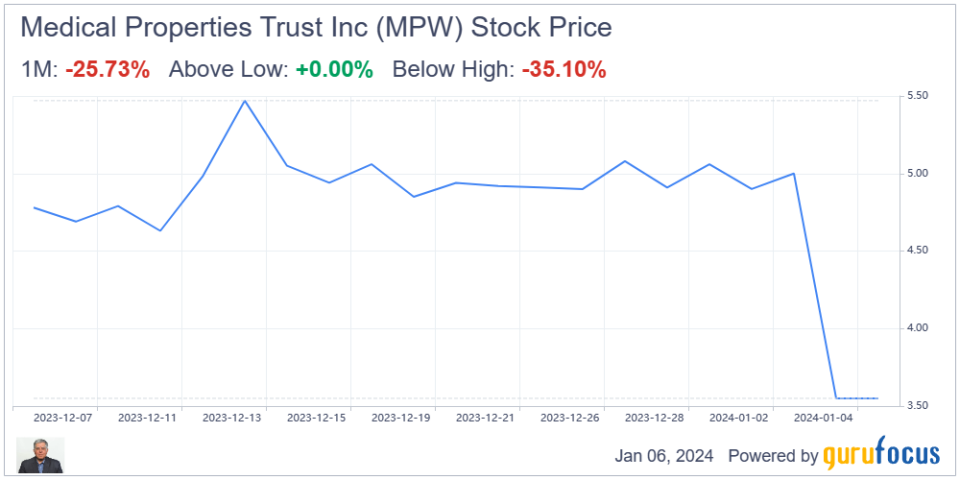

On Jan. 4, management announced via a press release that it has forwarded a further $60 million in a "bridge loan" to its ailing tenant Steward Health in addition to its previous $215 million loan and has agreed to defer future rents further. The company further revealed it will be taking a non-cash charge of approximately $225 million in the fourth quarter of 2023 to write off rent receivables and other items. Medical Properties also expressed uncertainty about potential further impairments to its real estate and non-real estate assets in its upcoming fourth-quarter 2023 report.

All this reeks of a last-ditch attempt by Medical Properties to stave off Stewards' bankruptcy. This led to a panicked reaction by shareholders who dumped the shares. The shareholder base seems to have concluded that the company's equity has no value and it will follow its largest tenant into bankruptcy as well.

Analysis

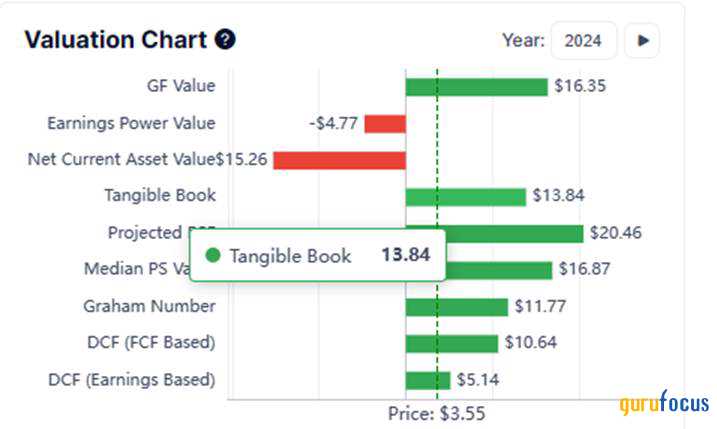

Looking at the Gurufocus Valuation chart below, we see the company's tangible book value is around $13.84 per share, which is much higher than the stock price of $3.55. So there is a large margin of safety. However, it should be understood that the write-offs already anticipated and further write-offs associated with a possible Steward Health bankruptcy will erode a chunk of this tangible book value.

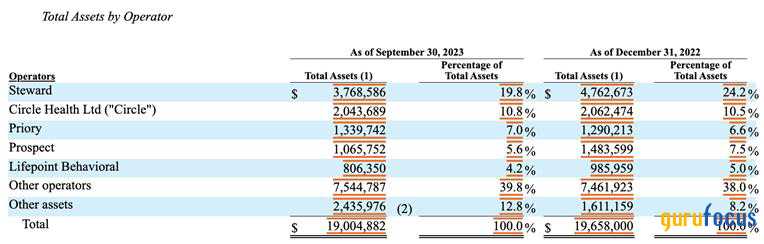

How much of this tangible book value will be eroded is thebillion-dollar question. We see from the September 2023 10-Q that Steward leased about 19.9% of Medical Properties' total assets. Further let us assume that after Steward's bankruptcy, about 50% of the value of that asset has to be written off. That is about a write off of $1.84 billion out of an asset base of around $19 billion.

Source: 10-Q

This implies erosion of about a 10% of the assets and 22% of equity (given 44% equity to asset ratio), if Steward was to go belly-up. While this is a serious situation, it does not necessarily imply that Medical Properties will follow, as the stock price reaction seems to imply. Though, of course, it is possible.

Tangible book value in this scenario would still be in about the $10 a share ball park. assuming a 22% impairment (10.79=13.84 X (1-0.22)). The issue then becomes whether Medical Properties will be able to retain enough confidence with the lenders to refinance its loan book or not. And if not, can it sell assets fast enough to stave off bankruptcy in 2025?

Of course this is a high-risk situation and there is a possibility that Medical Properties' debt holders may drive the company into Chapter 11 depending on any covenants they may have on their debt instruments. But then there is also the possibility that Steward Health will continue to operate under Chapter 11 under the supervision of a trustee and continue to pay rent, though in that case loans to Steward would be forfeit. Courts are generally sympathetic to a hospital operator to continue functioning because the effect the alternative can have on the community. This will allow the company to kick the can further out and give it time to improve the situation by bringing in a new operator or selling the Steward leased asset and get whatever value they can out of it. Unlike office or retail, hospital real estate assets do not have structural or secular issues working against them and there is still a market for them.

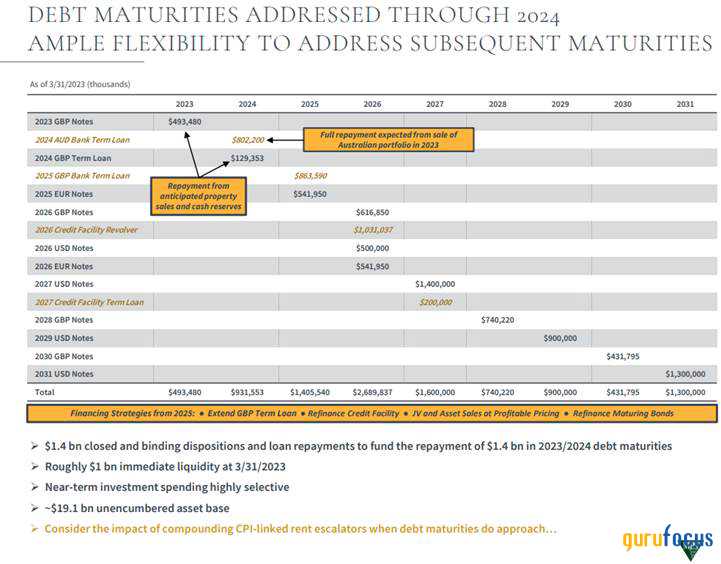

In its June 2023 investor update, Medical Properties disclosed that it had addressed debt maturities until 2024. We will have to wait till the next earnings release to see if the situation has changed.

Source: Company presentation.

Conclusion

Therefore, my back of the envelope analysis indicates the steep fall in share price may represent a high-risk, high-return speculative opportunity to buy shares much below tangible book value. The short attack has resulted in a crisis of confidence among Medical Properties' investors. Short attackers frequently target companies dependent on the debt market to fund their operations, hoping to stampede equity holders into a panic and to freeze the debt market by spreading fear, uncertainty and doubt. They profit when the stock falls. I think there is a decent possibility that if the situation resolves and Medical Properties can avoid insolvency, the shares are worth several times more than the market price.

On the other hand, when the stock is down so much and is selling deeply below intrinsic value, as this one is, it can become a value trap because of leverage. This is because the lollapalooza effect of unexpected negative synergistic consequences kick in. In the jungle when a wounded beast is fighting for survival,there are all kinds of predators, waiting for an opportunity to feed, who tend to show up.

This article first appeared on GuruFocus.