Medicare Fraud Is More Common Than You May Think. Here's What You Need to Know

Medicare open enrollment time is here, and it brings with it an important warning for older Americans: Beware of fraud.

Around 37% of adult caregivers say the seniors they care for have been affected by financial abuse in some form, according to a survey by Allianz Life, and the average loss among victims is $36,000. While anyone can be targeted by fraudsters, seniors are particularly vulnerable, because they often have hundreds of thousands of dollars saved for retirement and tend to be more trusting of strangers online or over the phone.

For that reason, it's more important than ever that retirees enrolling in Medicare are careful to protect themselves (and their nest eggs).

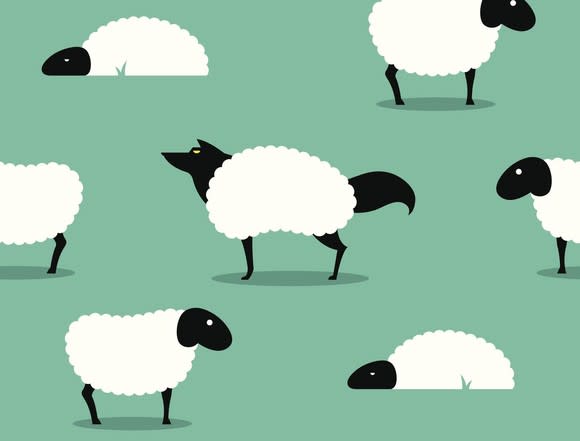

Image source: Getty Images.

What does Medicare fraud look like?

One of the most common Medicare scams involves someone calling you and saying they work for the government. They'll likely tell you they're confirming or updating your information in their system, and they need you to give them your Medicare identification number (which currently is the same as your Social Security number). Once the scammer has your Social Security number, they may try to steal your identity (and your money).

The federal government is attempting to crack down on this problem by issuing new Medicare cards between April 2018 and April 2019. Instead of using your Social Security number as an identification number, the new cards will use a randomly assigned 11-character Medicare Beneficiary Identifier.

But fraudsters are quick to come up with new scams, and according to a warning from the Federal Trade Commission, scammers are calling seniors and telling them they need to pay for the new card or provide personal information to verify their identity before they can receive it.

There are also various other types of Medicare scams seniors can fall victim to, and although these can happen year-round, the FTC notes that they're often more common during the open enrollment period.

For example, there is no such thing as an "official Medicare agent," according to the FTC, and anyone who claims to be one in order to sell you insurance is a scammer. Also, Medicare Part D is a voluntary plan, so if you receive a phone call from someone saying you have to sign up in order to keep your Medicare coverage, that's a scam as well.

How to protect yourself from Medicare scams

The key to avoiding scams is to be aware of the signs and watch out for them. Smart scammers will find as much information as possible about you in order to make their scam sound more believable. They may know your first and last name, address, or even your birth date, and they will use that information to try to trick you into thinking they're official government employees.

Keep in mind, though, that Medicare representatives will never contact you to ask for your Medicare ID number unless you've given explicit permission beforehand. When in doubt, don't give callers any personal information, and instead hang up and call 1-800-MEDICARE to report the situation as a potential scam.

You should also guard your Medicare ID and Social Security number closely. Don't give it to anyone -- even friends or family members -- unless you're absolutely sure you can trust them.

Finally, be sure you're using the official Healthcare.gov or MyMedicare.gov websites when browsing and signing up for healthcare plans. Fake sites, as official as they may look, will likely just take your private information and use it for malicious reasons. And if you notice any suspicious websites or receive any calls from people who you believe are scammers, report it online or at 1-800-MEDICARE.

Financial abuse among seniors is a $36 billion industry, according to True Link Financial, and scammers are smarter (and sneakier) than ever. To make sure you don't become a victim, be on the lookout for the red flags above and carefully guard your personal information.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

The Motley Fool has a disclosure policy.