Medifast (MED) Gains on OPTAVIA Lifestyle Solution Strength

Medifast, Inc. MED is steadily fortifying its OPTAVIA lifestyle solution and coaching support system, capitalizing on the growing consumer interest in health and wellness.

This Baltimore, MD-based company’s Fuel for the Future program, aimed at streamlining expenses across its operations, bodes well. This strategic move not only unlocks capital for investment in growth initiatives but also contributes to margin improvement.

However, the company has been facing challenges from macroeconomic factors, such as inflation, changes in social media algorithms and intensifying competition.

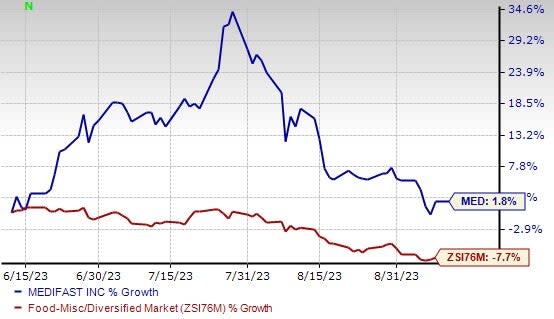

Image Source: Zacks Investment Research

Let’s Introspect

Medifast, which is the manufacturer and distributor of clinically proven healthy living products and programs, is focused on the OPTAVIA lifestyle solution and coaching support system, which has emerged as a beacon of promise.

OPTAVIA is not only a weight loss program; it is a holistic approach that addresses the well-being of individuals across six crucial dimensions — weight management, dietary choices, hydration, physical activity, sleep patterns and mental health.

The company also announced on Jul 27 the launch of its product line, OPTAVIA ACTIVE, which is part of its coach-supported healthy motion program and is one of the six habits of health within the proprietary system.

Continual investments in digital tools and fully integrated mobile apps further facilitate stronger connections between clients and coaches. This digital transformation not only enhances efficiency but also enables OPTAVIA Coaches to serve a larger client base effectively.

Furthermore, the Fuel for the Future program exemplifies Medifast's dedication to efficiency and cost reduction. By reallocating capital from non-essential areas to growth initiatives, the company not only increases profitability but also ensures the sustainability of its long-term vision.

The plan is on track to deliver a substantial 200-300-basis-point sustainable reduction in annualized cost savings by the end of 2025. Remarkably, the company is surpassing its expectations in these cost-reduction efforts. It anticipates realizing a third of the savings in 2023. By the end of 2025, the company is targeting a sustainable 15% revenue growth rate, and a 15% operating margin.

Markedly, shares of this Zacks Rank #3 (Hold) company have advanced 1.8% in the past three months against the industry’s decline of 7.7%.

3 Hot Stocks to Consider

We have highlighted three better-ranked stocks, namely MGP Ingredients, Inc. MGPI, McCormick & Company MKC and Celsius Holdings CELH.

MGP Ingredients produces and markets ingredients and distillery products to the packaged goods industry. The company currently sports a Zacks Rank #1 (Strong Buy). It has an expected EPS growth rate of 11% for three-five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and EPS suggests growth of 5.8% and 10.4%, respectively, from the year-ago reported figures. MGPI has a trailing four-quarter earnings surprise of around 18%, on average.

McCormick, a manufacturer, marketer and distributor of spices, seasoning mixes and condiments, currently carries a Zacks Rank #2 (Buy). The company has an expected EPS growth rate of 7.5% for three-five years.

The Zacks Consensus Estimate for McCormick’s current financial-year sales and EPS suggests growth of 6.4% and 5.1%, respectively, from the year-ago reported figures. MKC has a trailing four-quarter earnings surprise of 4.2%, on average.

Celsius Holdings, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 100% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 88.9% and 168.8%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report