Medifast (MED) Poised on Expansion Initiatives Amid Cost Woes

Medifast, Inc. MED has been focused on investing in digital tools and fully integrated mobile apps to support stronger connections between clients and coaches. This digital transformation not only enhances operational efficiency but also empowers OPTAVIA Coaches to effectively serve a broader client base, further solidifying the company’s position in the health and wellness market.

MED has been strategically strengthening its OPTAVIA lifestyle solution and coaching support system in response to the growing consumer interest in health and wellness. As a manufacturer and distributor of clinically proven health products and programs, Medifast places significant emphasis on a comprehensive solution addressing six crucial dimensions of well-being — weight management, dietary choices, hydration, physical activity, sleep patterns and mental health.

The company also recently announced the launch of its product line, OPTAVIA ACTIVE, which is part of its coach-supported healthy motion program and is one of the six habits of health within the proprietary system.

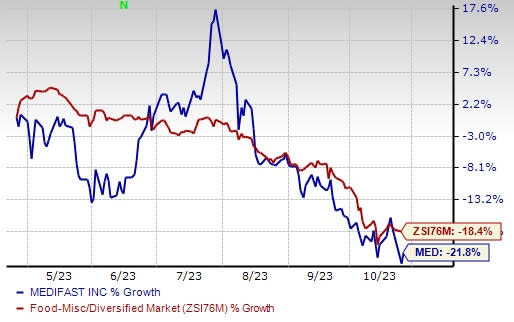

Image Source: Zacks Investment Research

Fuel for the Future Program Bodes Well

The Fuel for the Future initiative showcases Medifast's commitment to enhancing efficiency and cutting costs. By shifting funds from non-essential areas to support growth-focused endeavors, the company not only boosts profitability but also secures the long-term viability of its vision.

The program is progressing well and is poised to achieve a significant sustainable reduction in annualized costs, ranging from 200 to 300 basis points, by the close of 2025. Impressively, the company is outperforming its initial expectations in its cost-saving endeavors, with one-third of the savings expected to be realized in 2023. Medifast has set ambitious targets, aiming for a sustainable 15% increase in revenues and a 15% operating margin by the end of 2025.

Cost Inflation & Other Headwinds

While its strategies hold promise, the company faces challenges from macroeconomic factors like inflation, evolving social media algorithms and increased competition. In the second quarter of 2023, Medifast’s gross profit was $210.7 million, down 34.5% year over year on reduced revenues, and higher cost inflation in raw ingredients, shipping and labor. The persistence of these trends is concerning.

At MED’s second-quarter 2023 earnings release, management highlighted challenges related to customer acquisition in the current environment, wherein coaches are dedicating more time to engaging new customers. These difficulties stem from changes in consumer spending, alterations in social media scenarios and a competitive landscape.

For the third quarter of 2023, the company anticipates revenues of $220-$240 million, indicating a decline from the $390.4 million reported in 2022. Earnings per share (EPS) for the third quarter are expected between 71 cents and $1.32, whereas it reported $3.32 in 2022.

Shares of this Zacks Rank #3 (Hold) company have lost 21.8% in the past year compared with the industry’s decline of 18.4%.

Nonetheless, Medifast’s growth-oriented investments and expansion efforts bode well for the long run.

3 Hot Stocks to Consider

We have highlighted three better-ranked stocks, namely Lamb Weston Holdings, Inc. LW, Celsius Holdings, Inc. CELH and Post Holdings, Inc. POST.

Lamb Weston is a leading global manufacturer, marketer and distributor of value-added frozen potato products, particularly French fries. It also provides a range of appetizers. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston Holdings’ current fiscal-year sales and EPS suggests growth of 28.3% and 24.8%, respectively, from the year-ago reported figures. LW has a trailing four-quarter earnings surprise of 46.2%, on average.

Celsius Holdings specializes in commercializing healthier, nutritional functional foods, beverages and dietary supplements. The company currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and EPS suggests growth of 88.9% and 170.3%, respectively, from the year-ago reported figures.

Post Holdings is a consumer-packaged goods holding company involved in the production of center-of-the-store, refrigerated, foodservice, food ingredient and convenient nutrition product categories. The company currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Post Holdings’ current fiscal-year sales and EPS suggests growth of 13.2% and 189.9%, respectively, from the year-ago reported figures. POST has a trailing four-quarter earnings surprise of 59.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report