Medifast (MED) Poised on OPTAVIA ACTIVE Line Amid Cost Woes

Medifast, Inc. MED is actively expanding its presence in the health and wellness market, acknowledging evolving customer patterns. A prime example is its entry into the sports nutrition market through the innovative OPTAVIA ACTIVE line. Recognizing the growing popularity of weight loss medications, the company is strategically positioning itself to incorporate medical weight loss products into its offerings.

Technological innovation plays a pivotal role in Medifast's growth strategy, with OPTAVIA Coaches leveraging proprietary app-based platforms, social media channels and field-led training platforms. Ongoing investments in digital tools and fully integrated mobile apps aim to enhance the connection between clients and coaches, increase efficiencies and enable OPTAVIA Coaches to cater to a broader clientele.

Medifast places paramount importance on developing a culture that not only attracts but engages and fosters loyalty. Simultaneously, the company is diligently working toward a paradigm shift in decision-making by embracing a data-driven approach. The overarching goal is to achieve long-term growth, characterized by an average annual revenue growth of 15% and an operating margin of 15%.

Medifast's Fuel for the Future program focuses on streamlining the supply chain, optimizing manufacturing processes, and reducing overhead costs through facility consolidation and IT improvements, investing in technology and data analytics.

The program not only boosts profitability but also lays a solid foundation for sustained growth, aligning with the company's long-term vision and ensuring its continued viability in the evolving market landscape. The gross profit margin was 75.2% in the third quarter of 2023, up from the 72.5% reported in the prior-year quarter, driven by this program.

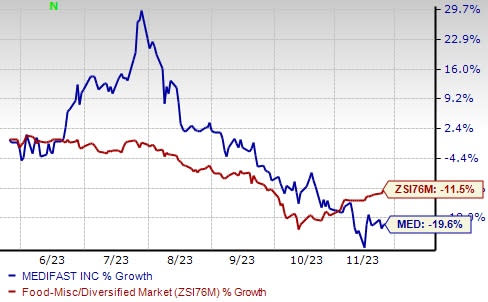

Image Source: Zacks Investment Research

Cost Hurdle & Customer Acquisition Headwinds

The company struggles with customer acquisition, attributed to macroeconomic factors like economic shifts, inflation, altered social media algorithms and heightened competition. In the third quarter of 2023, net revenues plummeted 39.6% year over year to $235.9 million due to a decline in active earning OPTAVIA Coaches and reduced productivity per coach.

Also, as a percentage of revenues, SG&A expenses increased 430 basis points (bps) to 64.4% in the third quarter of 2023, primarily driven by the lack of leverage on fixed costs resulting from lower sales volumes in comparison to 2022.

The company expects earnings per share (EPS) of $8.65-$9.55 for 2023. In 2022, Medifast delivered earnings of $12.73 per share, whereas its adjusted EPS was $14.50.

Shares of this Zacks Rank #3 (Hold) company have lost 19.6% in the past six months compared with the industry’s decline of 11.5%.

3 Hot Stocks to Consider

We have highlighted three better-ranked stocks, namely Lamb Weston Holdings, Inc. LW, Celsius Holdings, Inc. CELH and The Kraft Heinz Company KHC.

Lamb Weston is a leading global manufacturer, marketer and distributor of value-added frozen potato products, particularly French fries. It also provides a range of appetizers. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston Holdings’ current fiscal-year sales and EPS suggests growth of 28.3% and 24.8%, respectively, from the year-ago reported figures. LW has a trailing four-quarter earnings surprise of 46.2%, on average.

Celsius Holdings specializes in commercializing healthier, nutritional, and functional foods, beverages and dietary supplements. The company currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and EPS suggests growth of 98.5% and 184%, respectively, from the year-ago reported figures.

Kraft Heinz is one of the largest consumer packaged food and beverage companies. The company currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Kraft Heinz’s current financial-year sales and EPS suggests growth of 1.1% and 6.5%, respectively, from the year-ago reported figures. KHC has a trailing four-quarter earnings surprise of 9.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MEDIFAST INC (MED) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report