Medifast (MED) Q3 Earnings Top Estimates, Revenues Decline Y/Y

Medifast, Inc. MED delivered third-quarter 2023 results, with the top and bottom lines declining year over year. However, earnings and net revenues beat the Zacks Consensus Estimate.

Medifast is encountering difficulties in attracting customers, primarily because of a range of macroeconomic elements, such as a rapidly changing economy, inflation, shifts in social media algorithms and fierce competition. Nonetheless, the company's leadership is actively implementing the "Fuel for the Future" strategy, which comprises essential efforts designed to improve efficiency and reduce costs.

MEDIFAST INC Price, Consensus and EPS Surprise

MEDIFAST INC price-consensus-eps-surprise-chart | MEDIFAST INC Quote

Q3 in Details

Medifast’s adjusted earnings were $2.12 per share in the third quarter of 2023, down from the $3.27 reported in the year-ago quarter. The metric surpassed the Zacks Consensus Estimate of $1.02 per share.

Net revenues of $235.9 million declined 39.6% year over year mainly due to lesser active earning OPTAVIA Coaches and lesser productivity per active earning OPTAVIA Coach. The average revenue per active earning OPTAVIA Coach stood at $5,008, down 15.1% from $5,897 million, thanks to persistent pressure on customer acquisition. This was somewhat offset by the price increase undertaken in November 2022. The total number of active earning OPTAVIA Coaches fell 28.9% to 47,100 compared with the 66,200 reported in the year-ago quarter. The top line surpassed the Zacks Consensus estimate of $225 million.

The gross profit came in at $177.4 million, down 37.3% year over year on reduced revenues. The gross profit margin was 75.2%, up from the 72.5% reported in the prior-year quarter. Efficiencies in inventory management and reduced supply-chain costs, along with the optimization of the company's distribution center footprint, had a positive effect on the rise in gross margin. We had expected the gross profit margin to come in at 68.3% in the third quarter of 2023.

Selling, general and administrative expenses (SG&A) fell 35.3% year over year to $151.9 million. The decrease in SG&A expenses was primarily attributed to several factors, including reduced Coach compensation due to lower sales volumes and fewer active earning Coaches, as well as the progress made in various cost reduction and optimization initiatives. Additionally, charitable donations made in 2022 contributed to the decrease.

As a percentage of revenues, SG&A expenses increased 430 basis points (bps) to 64.4% primarily due to the lack of leverage on fixed costs resulting from lower sales volumes in comparison to 2022. It also included expenses related to market research and investments in medically-supported weight loss activities in the third quarter of 2023. We had expected SG&A expenses, as a percentage of revenues, to be 60.4% in the third quarter.

The income from operations declined 47% to $25.5 million mainly due to a decrease in gross profit. However, this was partially mitigated by reduced SG&A expenses and supported by the cost reduction efforts associated with the "Fuel for the Future" program. The operating margin decreased to 10.8% from the 12.3% reported in the year-ago quarter. We had expected the metric to come in at 8% in the third quarter.

Image Source: Zacks Investment Research

Other Financial Updates

Medifast concluded the quarter with cash and cash equivalents of $112.8 million, no interest-bearing debt (as of Sep 30, 2023), and total shareholders’ equity of approximately $193 million.

MED declared a quarterly cash dividend of $1.65 per share, payable on Nov 7, 2023, to shareholders of record as of Sep 19.

Guidance

Management expects revenues of $1,050-$1,070 million for 2023. The company expects earnings per share (EPS) of $8.65-$9.55 for 2023. MED assumes the effective tax rate between 20.5% and 21.5% for 2023.

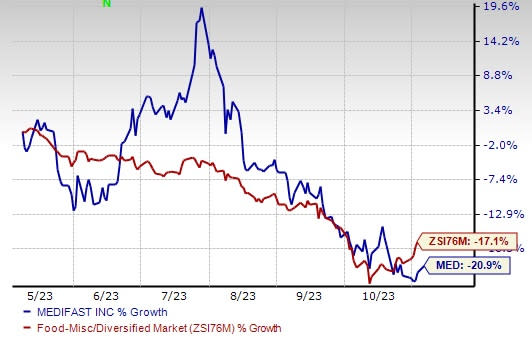

The Zacks Rank #3 (Hold) company’s shares have lost 20.9% in the past six months compared with the industry’s 17.1% decline.

Some Better-Ranked Staple Bets

Here, we have highlighted three better-ranked stocks, namely Lamb Weston Holdings, Inc. LW, Vital Farms Inc. VITL and MGP Ingredients, Inc. MGPI.

Lamb Weston is a leading global manufacturer, marketer and distributor of value-added frozen potato products. It currently sports a Zacks Rank #1 (Strong Buy). LW has a trailing four-quarter earnings surprise of 46.2% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston’s current fiscal-year sales and earnings suggests growth of 28.3% and 24.8%, respectively, from the year-ago reported figures.

Vital Farms offers a range of produced pasture-raised foods. It currently flaunts a Zacks Rank #1. VITL has a trailing four-quarter earnings surprise of 132.5%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales suggests growth of 29.4% from the year-ago reported figure.

MGP Ingredients produces and markets ingredients and distillery products to the packaged goods industry. It currently sports a Zacks Rank #1. MGPI has a trailing four-quarter earnings surprise of 18% on average.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and earnings suggests growth of 5.8% and 12.6%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MEDIFAST INC (MED) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report