Medifast (NYSE:MED) Exceeds Q4 Expectations But Stock Drops 10.1%

Wellness company Medifast (NYSE:MED) beat analysts' expectations in Q4 FY2023, with revenue down 43.4% year on year to $191 million. On the other hand, next quarter's revenue guidance of $165 million was less impressive, coming in 19.8% below analysts' estimates. It made a GAAP profit of $0.55 per share, down from its profit of $2.41 per share in the same quarter last year.

Is now the time to buy Medifast? Find out by accessing our full research report, it's free.

Medifast (MED) Q4 FY2023 Highlights:

Revenue: $191 million vs analyst estimates of $184.2 million (3.7% beat)

EPS: $0.55 vs analyst expectations of $0.96 (42.7% miss)

Revenue Guidance for Q1 2024 is $165 million at the midpoint, below analyst estimates of $205.8 million

Gross Margin (GAAP): 74%, up from 69.3% in the same quarter last year

Market Capitalization: $538.7 million

“We are realigning our business to respond to the evolving dynamics of the weight loss industry and to aggressively execute on bold initiatives to transform our business model,” said Dan Chard, Chairman & CEO of Medifast.

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE:MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

Personal Care

Personal care products include lotions, fragrances, shampoos, cosmetics, and nutritional supplements, among others. While these products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. As with other consumer staples categories, personal care brands must exude quality and be priced optimally given the crowded competitive landscape. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Medifast is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

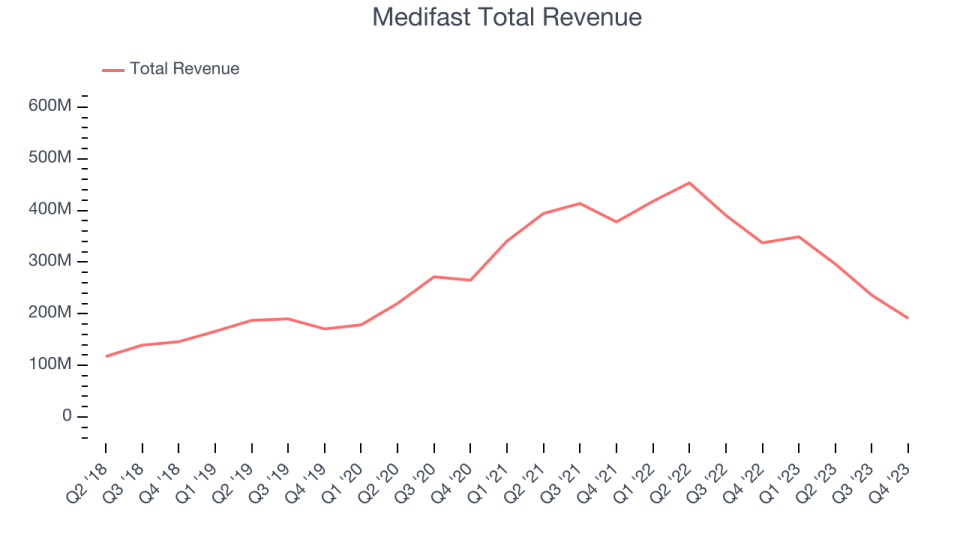

As you can see below, the company's annualized revenue growth rate of 4.7% over the last three years was weak for a consumer staples business.

This quarter, Medifast's revenue fell 43.4% year on year to $191 million but beat Wall Street's estimates by 3.7%. The company is guiding for a 52.7% year-on-year revenue decline next quarter to $165 million, a further deceleration from the 16.4% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to decline 23.5% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

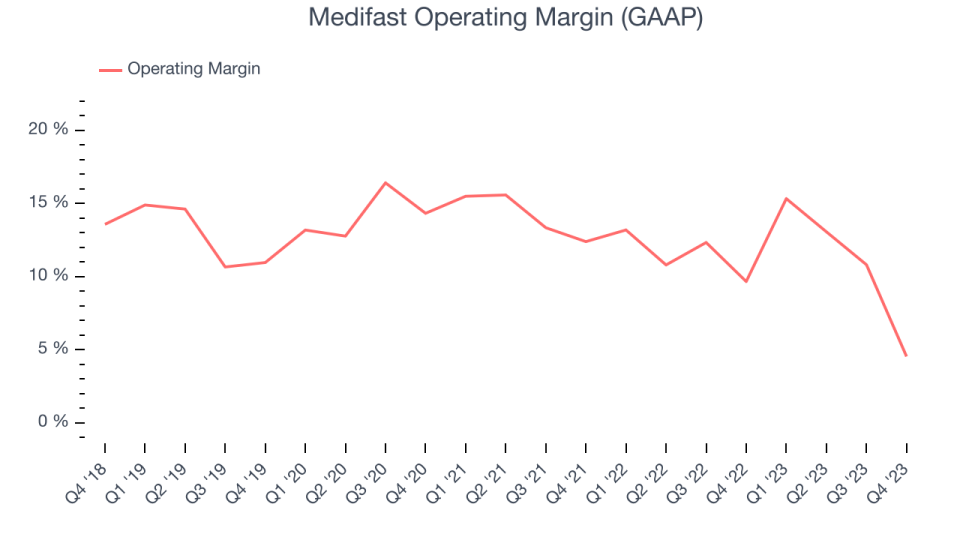

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

In Q4, Medifast generated an operating profit margin of 4.5%, down 5.1 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by operational inefficiencies and a step up in discretionary spending in areas like corporate overhead and advertising.

Zooming out, Medifast has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 11.7%, higher than the broader consumer staples sector. On top of that, its margin has remained more or less the same, highlighting the consistency of its business.

Key Takeaways from Medifast's Q4 Results

We enjoyed seeing Medifast exceed analysts' revenue expectations this quarter, but that's where the good news ends. Its operating margin and EPS fell short of estimates while its revenue and EPS guidance for the next quarter was significantly underwhelming. In the face of the demand headwinds the company is facing, it expects to spend more marketing dollars over the next year to acquire new customers. Overall, the combination of a mediocre quarter, weak sales outlook, and calls for higher marketing spending is spooking investors. The company is down 10.1% on the results and currently trades at $44 per share.

Medifast may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.