Medifast's (MED) Q2 Earnings Top Estimates, Sales Decline Y/Y

Medifast, Inc. MED delivered second-quarter 2023 results, with the top and the bottom line declining year over year. Nevertheless, earnings and net revenues missed the Zacks Consensus Estimate.

Macroeconomic headwinds like the dynamic economy, inflation, shift in social media algorithms and a competitive environment have been hurting Medifast’s ability to push customer acquisition. Management is on track with the Fuel for the Future plan with key initiatives to fuel efficiency and reduce costs.

Quarterly Highlights

Medifast’s adjusted earnings came in at $2.77 per share, down from $3.42 million reported in the year-ago quarter. The metric surpassed the Zacks Consensus Estimate of $1.44.

Net revenues of $296.2 million declined 34.7% year over year, mainly due to lesser active earning OPTAVIA Coaches and lesser productivity per active earning OPTAVIA Coach. The average revenue per active earning OPTAVIA Coach stood at $5,578, down 16.3% from $6,667 million, thanks to persistent pressure on customer acquisition. This was somewhat offset by the price increase undertaken in November 2022. The total number of active earning OPTAVIA Coaches fell 21.9% to 53,100 compared with 68,000 reported in the year-ago quarter. The top line surpassed the Zacks Consensus estimate of $253.5 million.

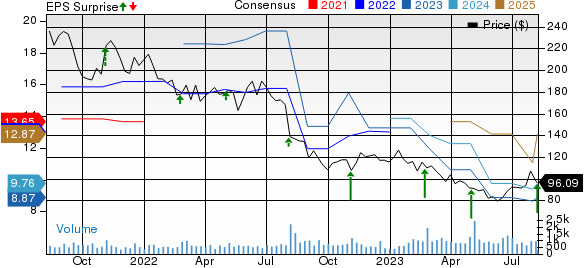

MEDIFAST INC Price, Consensus and EPS Surprise

MEDIFAST INC price-consensus-eps-surprise-chart | MEDIFAST INC Quote

The gross profit came in at $210.7 million, down 34.5% year over year on reduced revenues. The gross profit margin was 71.1%, up from 71% reported in the prior-year quarter. We had expected the gross profit margin to come in at 67.3% in the second quarter.

Selling, general and administrative expenses (SG&A) fell 36.9% year over year to $172 million. As a percentage of revenues, SG&A expenses contracted 208 basis points (bps) to 58.1%. The reduction in SG&A expenses is a result of progress on various cost reduction and optimization efforts and lower coach compensation, stemming from reduced sales volumes and lesser active earning coaches. We had expected SG&A expenses, as a percentage of revenues, to be 60%.

The income from operations declined 21% to $38.7 million. As a percentage of revenues, the metric increased to 13.1% from 10.8% reported in the year-ago quarter. We had expected the metric to come in at 7.3% in the second quarter.

Other Financial Updates

Medifast concluded the quarter with cash and cash equivalents of $147.4 million, no interest-bearing debt (as of Jun 30, 2023) and total shareholders’ equity of approximately $185.6 million.

The company declared a quarterly cash dividend of $1.65 per share, payable on Aug 8, 2023, to shareholders of record as of Jun 27.

Image Source: Zacks Investment Research

Guidance

Management expects third-quarter 2023 revenues in the range of $220-$240 million. The company expects earnings per share (EPS) in the range of 71 cents to $1.32 for the third quarter. The company assumes that the effective tax rate will be between 23% and 25% in the third quarter of 2023.

The Zacks Rank #3 (Hold) company’s shares have increased 7.2% in the past three months against the industry’s 6.3% decline.

Some Better-Ranked Staple Bets

Here, we have highlighted three better-ranked stocks, namely TreeHouse Foods, Inc. THS, Post Holdings POST and Utz Brands Inc. UTZ.

TreeHouse Foods, a packaged food and beverage manufacturer, currently carries a Zacks Rank #2 (Buy). THS has a trailing four-quarter earnings surprise of 49.3% on average. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for TreeHouse Foods’ current financial year’s sales suggests a decline of 12.4% from the year-ago reported numbers.

Post Holdings, a consumer-packaged goods holding company, currently has a Zacks Rank #2. POST has a trailing four-quarter earnings surprise of 59.6% on average.

The Zacks Consensus Estimate for Post Holdings’ current fiscal year sales and earnings suggests growth of 13% and 141.1%, respectively, from the corresponding year-ago reported figures.

Utz Brands, which manufactures a diverse portfolio of salty snacks, currently has a Zacks Rank #2. UTZ’s expected EPS growth rate for three to five years is 10.4%.

The Zacks Consensus Estimate for Utz Brands’ current fiscal-year sales suggests growth of 3.5% from the year-ago reported numbers. UTZ has a trailing four-quarter earnings surprise of 16.9% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report