Medpace Holdings Inc (MEDP) Reports Robust Revenue Growth and Solid Earnings in Q4 and Full ...

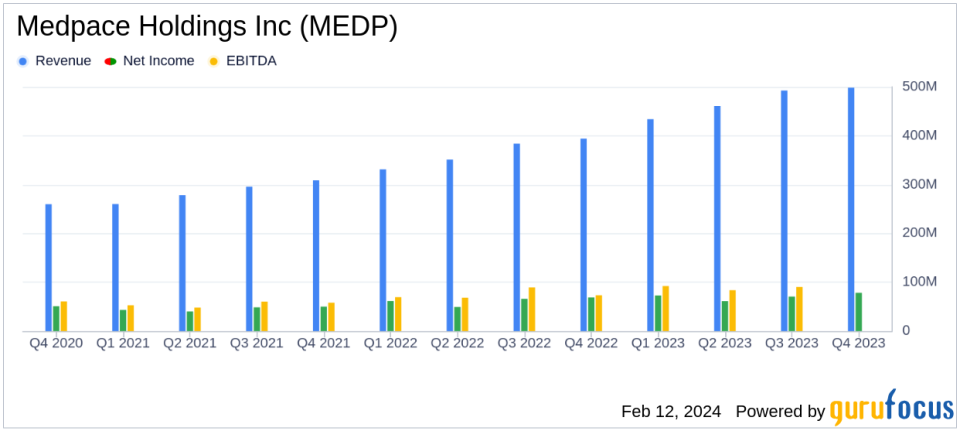

Revenue Growth: Q4 revenue increased by 26.5% to $498.4 million, and full-year revenue jumped by 29.2% to $1.885.8 million.

Net Income: Q4 GAAP net income rose to $78.3 million, with a net income margin of 15.7%. Full-year net income reached $282.8 million.

Earnings Per Share: Diluted EPS for Q4 was $2.46, up from $2.12 in the prior-year period. Full-year diluted EPS increased to $8.88.

EBITDA: Q4 EBITDA grew by 19.2% to $95.8 million, representing an EBITDA margin of 19.2%. Full-year EBITDA was $362.5 million.

Backlog and Book-to-Bill Ratio: Backlog as of December 31, 2023, increased by 20.2% to $2.813.0 million, with a net book-to-bill ratio of 1.23x for Q4.

2024 Financial Guidance: Medpace forecasts 2024 revenue in the range of $2.150 billion to $2.200 billion, with GAAP net income expected between $326.0 million and $348.0 million.

Liquidity and Share Repurchase: Cash and cash equivalents stood at $245.4 million, and the company repurchased 781,068 shares for $144.0 million in 2023.

On February 12, 2024, Medpace Holdings Inc (NASDAQ:MEDP) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The late-stage contract research organization, known for its full-service drug development and clinical trial services, reported significant revenue growth and an increase in net income, reflecting a strong performance in a competitive industry.

Financial Performance Highlights

Medpace's revenue for Q4 2023 reached $498.4 million, a 26.5% increase from the $394.1 million reported in the same period last year. This growth was attributed to a backlog conversion rate of 18.5%. The full-year revenue also saw a substantial rise, with a 29.2% increase to $1.885.8 million compared to the previous year. The company's net new business awards for Q4 were $614.7 million, marking a 26.7% increase from the prior-year period and resulting in a net book-to-bill ratio of 1.23x.

GAAP net income for Q4 was $78.3 million, or $2.46 per diluted share, compared to $68.7 million, or $2.12 per diluted share, for the same quarter in the previous year. The net income margin slightly decreased to 15.7% from 17.4% in Q4 2022. For the full year, GAAP net income was $282.8 million, or $8.88 per diluted share, up from $245.4 million, or $7.28 per diluted share, in 2022.

EBITDA for Q4 2023 increased by 19.2% to $95.8 million, representing an EBITDA margin of 19.2%. The full-year EBITDA also grew by 17.7% to $362.5 million. These financial achievements underscore Medpace's ability to efficiently manage its operations and maintain profitability in the Medical Diagnostics & Research industry.

Operational and Strategic Developments

Medpace's operational efficiency is reflected in its direct costs and SG&A expenses. For Q4 2023, total direct costs were $361.6 million, and SG&A expenses were $42.5 million. The company's balance sheet remains strong, with cash and cash equivalents of $245.4 million as of December 31, 2023. Medpace generated $156.4 million in cash flow from operating activities during Q4 2023 and repurchased 781,068 shares for $144.0 million throughout the year.

Looking ahead, Medpace provided its 2024 financial guidance, forecasting revenue in the range of $2.150 billion to $2.200 billion, which would represent a growth of 14.0% to 16.7% over 2023 revenue. The company also anticipates GAAP net income for the full year 2024 to be between $326.0 million and $348.0 million, with EBITDA expected in the range of $400.0 million to $430.0 million.

Medpace's continued investment in its global infrastructure and its disciplined approach to clinical development have positioned the company for sustained growth. With a strong financial foundation and a clear strategic direction, Medpace is well-equipped to navigate the dynamic landscape of the biotechnology, pharmaceutical, and medical device industries.

For more detailed information on Medpace Holdings Inc's financial results, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Medpace Holdings Inc for further details.

This article first appeared on GuruFocus.