Medtronic (MDT) Obtains U.S. Distribution Rights for BioButton

Medtronic plc MDT recently formed a strategic partnership with BioIntelliSense for the exclusive U.S. hospital and 30-day post-acute hospital to home distribution rights of the BioButton multi-parameter wearable for continuous, connected monitoring. BioIntelliSense offers continuous health monitoring and clinical intelligence for Remote Patient Monitoring (RPM). Its medical-grade Data-as-a-Service (DaaS) platform effortlessly captures multi-parameter vital signs and physiological biometrics. The terms of the deal have been kept under wraps.

Through the partnership, the Medtronic Patient Monitoring business will be able to provide general care patients with access to a medical-grade device that facilitates continuous vital sign measurements in-hospital and post-discharge. This will simplify care delivery through workflow automation, allowing proactive clinical intervention while addressing the implications of staffing shortages.

The latest collaboration aligns with the Patient Monitoring business goals of empowering clinicians and patients with actionable insights to personalize care. Per management at Medtronic, this collaboration will help the company support continuous, connected care from in-hospital to home and extend its reach to assist more patients in more places.

Few Words on BioButton Device

The BioButton medical-grade device measures up to 1,440 vital sign measurements per day, including skin temperature, respiratory rate at rest and heart rate at rest. It is the exclusive multi-parameter wearable for the Patient Monitoring business. When combined with advanced analytics, this device holds the potential to help clinicians better identify early signs of patient deterioration or even stable patients who might be allowed for earlier hospital discharge.

The configurable acute and post-acute modes within the rechargeable BioButton device also enable continuous monitoring of patients as they move from higher to lower acuity settings.

More on the News

To address the healthcare staffing shortages, the Patient Monitoring business intends to keep growing its HealthCast portfolio to enhance workflow automation, enabling clinicians to direct greater focus on patients. Adding BioButton multi-parameter wearable to the HealthCast portfolio will again allow Medtronic to help more general care patients inside and outside the hospital, advancing its commitment to patient safety.

Image Source: Zacks Investment Research

The management at BioIntelliSense expects the latest partnership to accelerate continuous connected care models that provide hospitals struggling with workforce shortages and cost of care management with a new level of clinical surveillance and workflow efficiencies.

Industry Prospects

Per a report by MarketsandMarkets, the patient monitoring devices market is expected to see a CAGR of 8.6% during 2020-2025. The integration of monitoring technologies in smartphones and wireless devices leading to the introduction of remote monitoring systems, mobile cardiac telemetry devices, etc. can be attributable to market growth.

Given the substantial market prospects, Medtronic’s latest agreement seems well-timed.

Other Notable Developments

Last month, Medtronic completed the acquisition of Affera, Inc. This buyout expands the company's cardiac ablation portfolio with the addition of the Affera Prism-1 cardiac mapping and navigation platform. The investigational Affera technology is intended to deliver solutions for patients with cardiac arrhythmias. It will be compatible with Medtronic and several competitive therapeutic catheters and technologies.

In Jul 2022, the company gained FDA’s 510(k) clearance for its UNiD Spine Analyzer v4.0 planning platform, which features a novel Degen Algorithm for degenerative spine procedures. This next-generation UNiD Spine Analyzer will help surgeons plan procedures, personalize care for patients and predict postoperative spinal compensation. The latest update also involves improvements to the pediatric and adult deformity algorithms that predict compensatory changes to the spine.

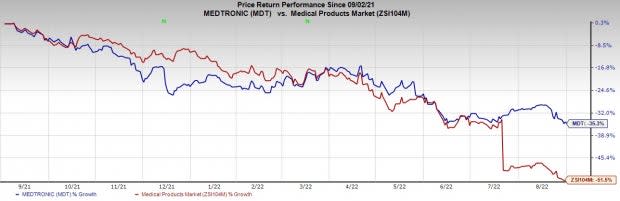

Share Price Performance

The stock has outperformed its industry over the year. It has declined 35.3% compared with the industry’s 51.5% fall.

Zacks Rank and Key Picks

Currently, Medtronic carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space that investors can consider are AMN Healthcare Services, Inc. AMN, Patterson Companies, Inc. PDCO and McKesson Corporation MCK.

AMN Healthcare has a long-term earnings growth rate of 3.2%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 15.7%, on average. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry in the past year. AMN has lost 11.2% against the industry’s 38.2% fall.

Patterson Companies has an estimated long-term growth rate of 7.9%. The company’s earnings surpassed estimates in all the trailing four quarters, the average beat being 16.5%. It currently flaunts a Zacks Rank #2 (Buy).

Patterson Companies has underperformed its industry in the past year. PDCO lost 17.4% compared with the industry’s 14.8% fall in the past year.

McKesson has an estimated long-term growth rate of 9.9%. The company surpassed earnings estimates in the trailing three quarters and missed in one, delivering a surprise of 13%, on average. It currently carries a Zacks Rank #2.

McKesson has outperformed its industry in the past year. MCK has gained 77.5% against the industry’s 14.8% fall.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Medtronic PLC (MDT) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research