Meet a $496 Billion Artificial Intelligence (AI) Stock That's Not in the "Magnificent Seven"

What's the fuel driving the current bull market? One answer stands out as arguably the best: artificial intelligence (AI). Without the ongoing surge in AI adoption, the stock market almost certainly wouldn't be up nearly as much as it is.

The so-called "Magnificent Seven" stocks have set the pace. All of them have close connections with AI. But not every mega-cap stock benefiting tremendously from the AI boom is in the group. Meet a $496 billion AI stock that's not in the Magnificent Seven.

More of an AI stock than meets the eye

You might be surprised which stock I have in mind. It's Walmart (NYSE: WMT). Some could immediately object that the giant retailer isn't an AI stock. However, it's more of one than meets the eye.

Walmart has invested in AI development for years. The company had integrated AI into its operations well before the explosion of large language models ignited by OpenAI's introduction of ChatGPT. In particular, Walmart deployed AI to help manage its supply chain by predicting sales demand to powering high-tech fulfillment centers.

More recently, Walmart has harnessed the power of generative AI. The company's new online search functionality uses generative AI as a shopping assistant. For example, you can ask it, "Help me get the supplies I need for a new baby." It will then list relevant products and efficiently guide you through the process of purchasing all you need for a newborn.

The huge discount retailer incorporated natural language understanding AI into its customer service chatbots. Since 2020, these chatbots have eliminated millions of customer contacts with Walmart staff by answering customers' questions. Walmart's Ask Sam voice assistant is making associates more efficient by helping locate products, look up prices, and more.

You might still think that all of this doesn't make Walmart an AI stock. But consider that the company is also selling its AI route optimization technology to other businesses. Walmart says that this AI software helps "optimize driving routes, pack trailers efficiently, and minimize miles traveled." What do you call the stock of a company that markets AI technology it's developed? My answer: an AI stock.

Magnificent in multiple ways

Although Walmart isn't a member of the Magnificent Seven, it's magnificent in multiple ways. Just look at the company's financials. Walmart generated revenue of $648 billion last year, more than any of the Magnificent Seven stocks.

Granted, Walmart's profit margins aren't as impressive as those mega-cap growth stocks. However, the company still delivered a greater profit than Tesla in 2023.

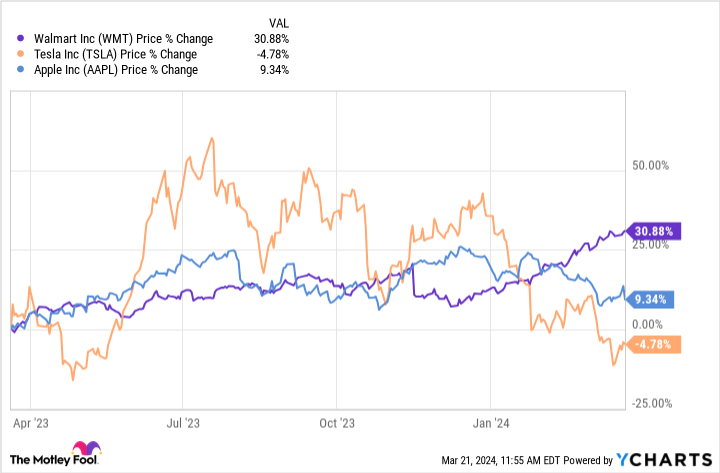

Has Walmart's stock performance been magnificent? Yep. The retailer's shares have soared more than 30% over the past 12 months. That's a much bigger gain than Tesla or Apple generated during the same period.

Walmart's valuation also looks more attractive than five of the Magnificent Seven stocks based on one widely used metric. Its shares trade at 26 times forward earnings, which is lower than the forward earnings multiples of Amazon, Apple, Microsoft, Nvidia, and Tesla.

Is this AI stock a buy?

Walmart's valuation could limit the stock's near-term growth prospects even with a lower forward earnings multiple than most of the Magnificent Seven. Investors hoping for big gains over the next 12 months or so can find better stocks to buy.

However, Walmart's business is built to last. Its financial position is strong. The company's integration of AI throughout its processes should boost profits over time. I think the stock remains a solid pick for long-term investors.

Should you invest $1,000 in Walmart right now?

Before you buy stock in Walmart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walmart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Keith Speights has positions in Amazon, Apple, and Microsoft. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, Nvidia, Tesla, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet a $496 Billion Artificial Intelligence (AI) Stock That's Not in the "Magnificent Seven" was originally published by The Motley Fool