Megawatt grants electrify truck charging corridors

Startup electric truck infrastructure developer WattEV won’t say how much money it has raised from investors. But its stunning accumulation of grant money is a bigger story.

“It’s one of the things that definitely sets us apart,” co-founder and CEO Salim Youssefzadeh told me about his private company’s grant hoard.

WattEV took in the largest chunk of $623 million — nearly 15% — the Federal Highway Administration awarded to 47 electric vehicle (EV) charging and alternative-fueling infrastructure projects in 22 states and Puerto Rico. The money comes from $2.5 billion allocated under the Bipartisan Infrastructure Law.

$109M from federal programs

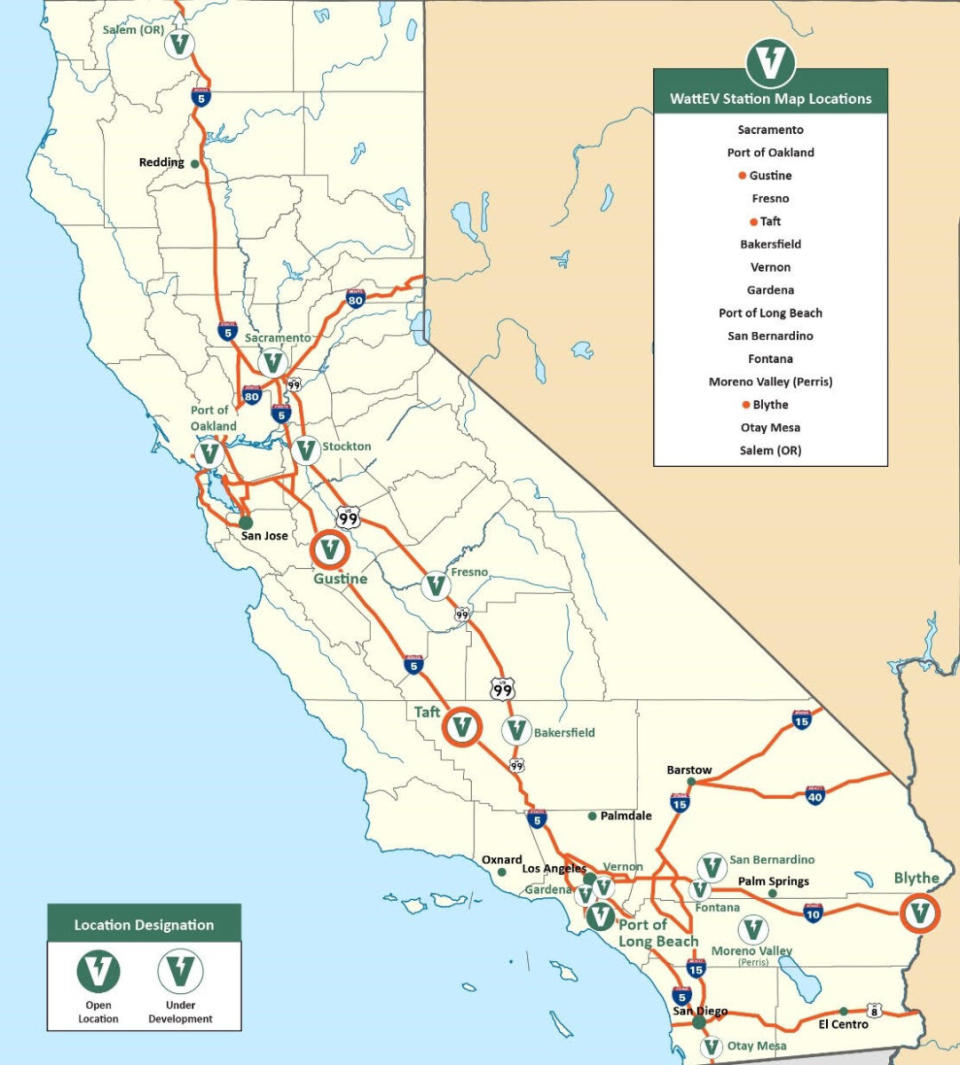

The $75.6 million haul by Long Beach, California-based WattEV’s brings to $109 million from federal programs,. That includes $34 million to build and operate what is expected to be the nation’s largest electric charging depot on more than 100 acres south of Sacramento International Airport on Interstate 5 that runs from San Diego to Seattle.

Tens of millions more has come in from state and local grants.

“WattEV isn’t just talk. It’s execution,” Youssefzadeh said. “We’ve got sites in development coming online in the next two months. “When grant organizations are [deciding] who to give funds to, do they give funds to a company that’s just talking about building corridors or do they give funds to a company that’s actually building corridors?”

TeraWatt Infrastructure, a WattEV rival, shared in a $63.9 million FHWA grant to New Mexico to build MHD corridors along I-10.

WattEV has outside investment but how much is a mystery

Practically since its public introduction at the Advanced Clean Transportation Expo in 2022, WattEV has pushed out talk of investors and when it would move to a Series A round of financing from its mostly family-and-friends-funded seed round.

“We got the Series A we closed,” Youssefzadeh said. “We announced that in November with Vitol and Apollo. These are two major infrastructure banks and infrastructure providers. They provided a good amount of capital both on the equity side as well as financing for infrastructure.”

The Nov. 9 news release stood out more for what it didn’t say than what it did. Vitol talked about owning 1.2 gigawatts (GW) operational renewable generation capacity and committing more than $2.2 billion to renewable and sustainable investments.

Apollo pointed to launching its sustainable investing platform in 2022, targeting $50 billion in clean energy and climate capital by 2027 with an eye toward doling out $100 billion by 2030.

Neither Vitol nor Apollo said how much they invested in or loaned to WattEV.

Infrastructure incentives aren’t forever

The availability of incentives for large fleets to purchase electric trucks becomes more scarce — at least in California — in 2025. That comes as the state refocuses on helping smaller fleets and owner-operators afford equipment that costs two to three times as much as a diesel tractor.

“Eventually, it will dry up, and how soon that happens will probably depend a lot on what happens in [the presidential election] November,” Sam Abuelsamid, principal analyst at Guidehouse Insights, told me. “At some point, they will stop subsidizing the installation of infrastructure and it will have to become self-sustaining.”

But for now, WattEV is able to attract money for its ambitious buildout plans. So far, that consists of a medium- and heavy-duty charging depot operating at the Port of Long Beach. Depots in San Bernardino in the Inland Empire, Gardenia and Bakersfield come online soon,

The FHWA money included $56 million awarded to WattEV and the San Joaquin Valley Air Pollution Control District. It was the largest of 10 awards to California. The City of Blythe in Riverside County shared a second grant of $19.6 million for a charging depot on I-10, which covers 2,640 miles and eight states from California to Florida.

Is Megawatt charging premature?

WattEV’s site in Bakersfield will be its first to offer a megawatt charging system. That’s a power level only the purpose-built Tesla Semi comes close to being able to use.

Youssefzadeh defends the decision to go big now. The 1.2 MW power cabinets being installed can split the wattage among five trucks at one time. Charging rates range between 60 kilowatt hours (kWh) to 240 kWh at five dispensers. One dispenser is reserved for MW charging.

“We’re putting in technology that is future proof,” he said. “You can charge current technology trucks with CCS [combined charging system] and have the ability to charge with MW charging when those trucks are on the road.”

Unlike current chargers that, for example, split a 350kWh load between two vehicles, WattEV is pushing dynamic charging.

“We’ve had an opportunity to charge almost all of the [electric] truck manufacturers out there,” Youssefzadeh said. “There’s pros and cons to all of them. Some charge faster than others. Some have a little more range but at the expense of [battery] weight. It’s really about finding the use case that works best for them.”

Judge to TuSimple: Not so fast

Autonomous trucking developer TuSimple wants to get out of Dodge. That includes selling its trucks and office furniture and taking its $777 million cash pile to its China-based operations in Shanghai. A federal judge in San Diego this week told the company to hold its horses.

U.S. District Court Judge Roger Benitez granted a temporary restraining order sought by shareholders. They alleged TuSimple co-founders Xiaodi Hou and Mo Chen, along with CEO Cheng Lu and Sina Corp. Chairman Guowei “Charles” Chao, are trying to get around national security laws by taking TuSimple private.

The plaintiffs claim the move is intended to allow collaboration between TuSimple and Hydron, a hydrogen fuel cell truck business started by Chen, who is also the executive chairman of TuSimple and holder of 59% of its voting stock.

Lack of transparency

Allegations about a lack of transparency about TuSimple providing services to Hydron kicked off a nasty boardroom battle in 2022. Results included Hou’s ouster as CEO followed by the firing of independent directors by Chen 10 days later.

TuSimple’s winddown of its U.S. business effectively began with the layoff of 350 U.S. employees in December 2022. Another 300 were furloughed in May followed by 150 more in December. TuSimple said Jan. 17 it would delist its stock from the Nasdaq.

The shareholders argued in a hearing Monday that Hydron’s announcement that its trucks were “autonomous ready” just 20 months after its March 2021 founding suggested Hydron used TuSimple’s trade secrets. TuSimple took seven years to perfect its robot driving system it piloted on an 80-mile run in December 2021.

The judge barred TuSimple from violating a National Security Agreement with the Committee on Foreign Investment in the United States and from selling, transferring or disclosing TuSimple trade secrets to anyone outside the U.S., including Hydron. That included moving any proceeds from truck and furniture sales, too.

Benitez set a preliminary injunction hearing for March 8.

Separately, TuSimple filed a flurry of documents with the Securities and Exchange Commission this week disclosing share sales by its executives ahead of Monday’s delisting and ceasing of its stock trading expected on Feb. 7.

Briefly noted:

A report in TechCrunch says Aurora Innovation laid off dozens of workers amounting to 3% of its 1,800-person workforce at the beginning of the year.

The $9 trillion asset management company BlackRock Inc. now holds 8.1% of the stock in engine maker and power distribution provider Cummins Inc.

Holcim will deploy a total of 1,000 units of Mercedes-Benz Trucks’ new eActros 600 battery-powered electric truck, introduced in October, to its European fleet.

Prime Mover magazine reports that Bill Hall, featured here as one of Nikola’s early purchasers of its fuel cell truck, completed a 400-mile run on a single tank of hydrogen.

Hyliion has begun printing parts for its Karno generator that it wants to sell as a stationary power source for electric charging and other uses.

Starting with two truck deliveries, Snickers and M&Ms candy maker Mars Inc. is buying 300 electric trucks from Einride for its European operations.

The Ford E-Transit got the bulk of early orders for battery-powered Postal Service delivery trucks, but startup Canoo got a small taste.

That’s it for this week. Thanks for reading. Click here to get Truck Tech via email on Fridays. And catch the latest in major events and hear from the top players on “Truck Tech” at 3 p.m. Wednesdays on the FreightWaves YouTube channel. Your feedback and suggestions are always welcome. Write to aadler@freightwaves.com.

The post Megawatt grants electrify truck charging corridors appeared first on FreightWaves.