Is Meitu Inc (HKG:1357) As Financially Strong As Its Balance Sheet Indicates?

Mid-caps stocks, like Meitu Inc (SEHK:1357) with a market capitalization of HK$44.69B, aren’t the focus of most investors who prefer to direct their investments towards either large-cap or small-cap stocks. Surprisingly though, when accounted for risk, mid-caps have delivered better returns compared to the two other categories of stocks. Mid-caps are found to be more volatile than the large-caps but safer than small-caps, largely due to their weaker balance sheet. I’ve put together a small checklist, which I believe provides a ballpark estimate of their financial health status. See our latest analysis for Meitu

Can 1357 service its debt comfortably?

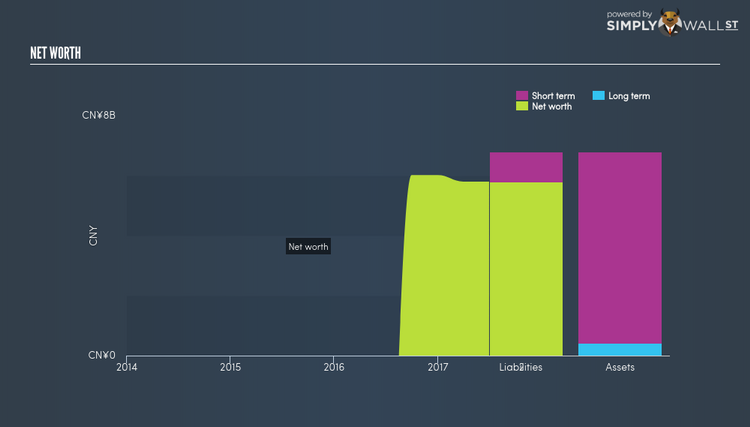

While ideally the debt-to equity ratio of a financially healthy company should be less than 40%, several factors such as industry life-cycle and economic conditions can result in a company raising a significant amount of debt. The good news for investors is that Meitu has no debt. This means it has been running its business utilising funding from only its equity capital, which is rather impressive. Whether it’s an issue of access to debt or management choosing not to borrow, investors risk associated with debt issues is virtually non-existent with 1357.

Can 1357 meet its short-term obligations with the cash in hand?

Given zero long-term debt on its balance sheet, Meitu has no solvency issues. Solvency is the company’s ability to meet its long-term obligations. But another important aspect of financial health is liquidity: the company’s ability to meet short-term obligations, including payments to suppliers and employees. If an adverse event occurs, the company may be forced to pay these immediate expenses with its liquid assets. Our analysis shows that 1357 does have enough liquid assets on hand to meet its upcoming liabilities, which lowers our concerns should adverse events arise.

Next Steps:

Are you a shareholder? 1357 has no debt as well as ample cash to cover its near-term liabilities such as salary and supplier payments. While it’s safe operations might reduce risk for the company and investors, some degree of debt could also boost earnings growth and operational efficiency. Given that 1357’s capital structure could change, I suggest assessing market expectations for 1357’s future growth on our free analysis platform.

Are you a potential investor? Although investors should analyse the serviceability of debt, it shouldn’t be viewed in isolation of other factors. After all, debt is often used to fund or accelerate new projects that are expected to improve a company’s growth trajectory in the longer term. 1357’s Return on Capital Employed (ROCE) in order to see management’s track record at deploying funds in high-returning projects.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.