Meituan Revenue Beats Estimates After Staving Off ByteDance

(Bloomberg) -- Meituan’s quarterly revenue climbed a better-than-expected 23%, a sign that it’s making headway in efforts to fend off a challenge from ByteDance Ltd.’s Douyin in China’s meal delivery arena.

Most Read from Bloomberg

Trump’s Net Worth Hits $6.5 Billion, Making Him One of World’s 500 Richest People

Biden Gains Ground Against Trump in Six Key States, Poll Shows

Japan Amps Up Intervention Threat as Yen Hits Lowest Since 1990

Trump Vows to Pay Fraud Trial Bond Cut by 68% to $175 Million

Using Your Premium Credit Card May Cost More After Visa-Mastercard Deal

The company reported sales of 73.7 billion yuan ($10.2 billion) in the December quarter, versus the 72.7 billion yuan average projection. Net income was 2.22 billion yuan, also better than projected.

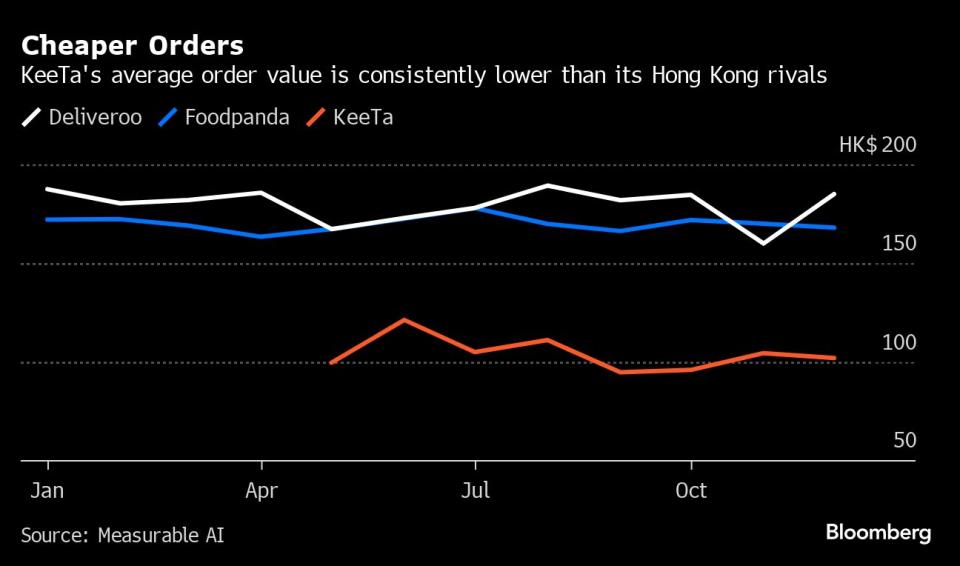

Meituan, for years the dominant player in a mammoth Chinese food delivery market, is exploring international expansion because of a slowdown back home. Its shares are up this year, after losing more than half their value in 2023. In February, billionaire founder Wang Xing took over the company’s overseas businesses, which for now are centered on the fledgling KeeTa app — already the No. 2 service in Hong Kong by some measures.

Meituan joins a growing wave of Chinese consumer brands now venturing abroad because of a weak rebound in domestic consumption after years of strict Covid controls. On Friday, Wang told analysts the company is evaluating a number of overseas markets but hasn’t made a final decision on where next to expand. He emphasized however that Meituan is in no rush, adding that it took 10 years to build its Chinese business.

What Bloomberg Intelligence Says

The slide in Meituan’s 4Q core local-commerce margin, which fell below 15% for the first time in seven quarters, could persist through December if the firm aims to lift revenue by more than 20% year over year. Rivalry could intensify, not just from Douyin but also Alibaba’s Ele.me, where leadership change on March 31 may prompt new measures to gain delivery market share.

- Catherine Lim and Trini Tan, analysts

Click here for the research.

The company, which grew into a meal delivery leader with backing from Tencent Holdings Ltd., has to contend with video platform Douyin and a potentially renewed challenge at home from Alibaba Group Holding Ltd.’s Ele.me.

It’s spending heavily to protect its user base from new entrants, sapping margins. The Beijing-based company has been relying on its familiar subsidy-heavy strategy to draw in merchants and users despite the economic malaise.

Meituan is also getting involved in the artificial intelligence contest, first by acquiring generative AI firm Light Year and then by backing high-flying startup Moonshot via its investment arm Long-Z.

Read More: Meituan Joins AI Race by Buying Co-Founder’s Months-Old Firm

The company has ramped up investments in past years in newer initiatives such as grocery retailing, group-buying and live-streaming. It held talks with Delivery Hero SE about potentially acquiring the Foodpanda business in Southeast Asia, though those discussions ultimately went nowhere.

Read More: Alibaba Replaces Head of Delivery Arm Ele.me in Latest Reshuffle

(Updates with analyst’s and CEO’s comments from the fourth paragraph)

Most Read from Bloomberg Businessweek

Hong Kong’s Elderly Are Increasingly Retiring in Mainland China

In This Coworking Space, Only the Cappuccino Isn’t Classified

©2024 Bloomberg L.P.