MercadoLibre Inc (MELI) Delivers Record Revenue and Net Income in 2023

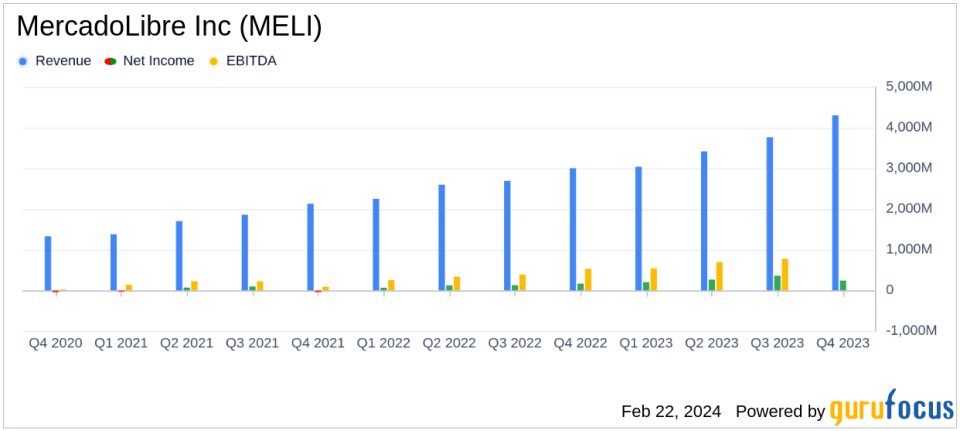

Revenue Growth: MercadoLibre Inc (NASDAQ:MELI) reported a significant increase in revenue, reaching $14.5 billion for the full year, a 37% year-over-year growth.

Net Income Surge: Net income soared to nearly $1 billion, marking a substantial improvement from the previous year.

Operational Efficiency: Income from operations, excluding one-off expenses, expanded by 270 basis points year-over-year, demonstrating enhanced operational efficiency.

GMV and TPV Acceleration: Gross Merchandise Volume (GMV) and Total Payment Volume (TPV) saw robust increases of 39.9% and 57.2% year-over-year, respectively.

Active User Growth: Unique active users grew significantly, reaching 218 million by the end of 2023.

On February 22nd, 2024, MercadoLibre Inc (NASDAQ:MELI), the leading e-commerce and financial services company in Latin America, released its 8-K filing, showcasing a year of remarkable financial performance. The company, known for its vast e-commerce marketplace and complementary services such as Mercado Pago and Mercado Envios, has reported record figures for revenue, income from operations, and net income in 2023.

Financial Highlights and Strategic Achievements

MercadoLibre's revenue for the fourth quarter of 2023 was $4.3 billion, a 41.9% increase year-over-year, and an 83.2% increase on an FX neutral basis. The company's strategic focus on technology and innovation has propelled its growth, with unique buyers accelerating to the fastest year-on-year pace since 2020, resulting in almost 85 million for the full year. This growth trajectory is supported by the company's continuous improvement of its value proposition, driven by technology and category-specific enhancements.

The company's logistics network, a competitive advantage, shipped a total of 650 million items in 2023, which is 45% more than the previous year. The relaunch of the loyalty program as Meli+ and the introduction of MELI Delivery Day (MDD) have contributed to increased shipping efficiency and reduced unit costs.

Challenges and Financial Resilience

Despite facing challenges such as increased free shipping levels and cost increases, MercadoLibre has demonstrated financial resilience. The company's income from operations for Q423 was $240 million, negatively impacted by one-off expenses of $351 million related to contingent tax liabilities. Excluding these one-off expenses, the income from operations margin would have been 13.4%, a 270 basis point gain year-over-year.

Net income for Q423 was reported at $165 million, with $383 million (+166% YoY) excluding one-off expenses. The company incurred FX losses primarily due to the repatriation of funds in Argentina and the devaluation of the Argentine Peso.

Looking Ahead

MercadoLibre looks forward to 2024 with optimism, focusing on providing the best user experience and value proposition. The company is confident in its ability to continue delivering growth, scale, cost efficiency, and operating leverage, which will strengthen its position to pursue its mission of democratizing commerce and financial services in Latin America.

For detailed financial tables and further insights into MercadoLibre's performance, investors and interested readers are encouraged to view the full 8-K filing.

Value investors and potential GuruFocus.com members seeking to explore the investment potential of MercadoLibre Inc (NASDAQ:MELI) can find comprehensive analysis and up-to-date information on GuruFocus.com.

Explore the complete 8-K earnings release (here) from MercadoLibre Inc for further details.

This article first appeared on GuruFocus.