Mercantile Bank Corp (MBWM) Reports Solid 2023 Financial Results Amidst Rising Interest Rates

Net Income: $20.0 million for Q4 2023, and $82.2 million for the full year.

Earnings Per Share (EPS): $1.25 for Q4 and $5.13 for the full year, reflecting robust growth.

Net Interest Margin: Declined to 3.92% in Q4 2023 from 4.30% in the prior-year quarter.

Loan Growth: Total loans increased by $387 million, or 9.9%, during 2023.

Asset Quality: Nonperforming assets were less than 0.1% of total assets as of December 31, 2023.

Capital Position: Shareholders equity increased to $522 million, maintaining a "well-capitalized" status.

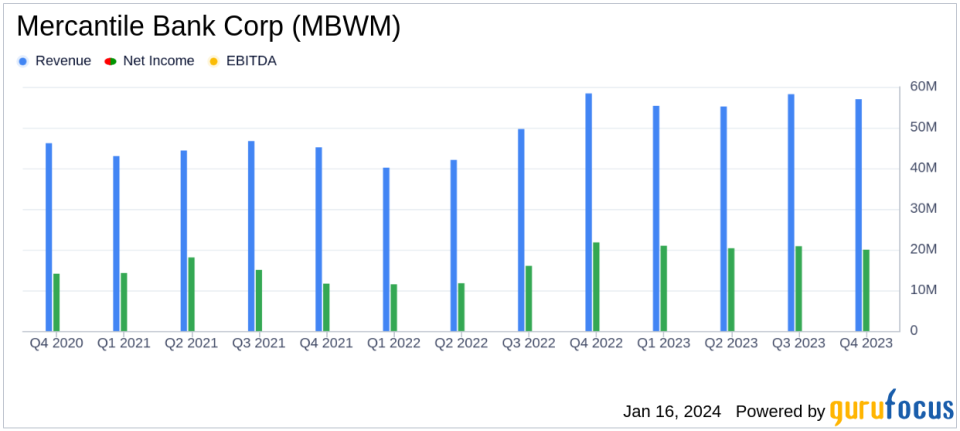

Mercantile Bank Corp (NASDAQ:MBWM) released its 8-K filing on January 16, 2024, announcing its financial results for the fourth quarter and full year of 2023. The bank, known for its commercial banking services to individuals, businesses, and institutions, reported a net income of $20.0 million, or $1.25 per diluted share, for the fourth quarter of 2023. This compares to a net income of $21.8 million, or $1.37 per diluted share, for the same period in the previous year. For the full year, net income stood at $82.2 million, or $5.13 per diluted share, up from $61.1 million, or $3.85 per diluted share, in 2022.

President and CEO Robert B. Kaminski, Jr. expressed satisfaction with the year's financial results, attributing the success to a 22 percent increase in net interest income, driven by a higher net interest margin and solid growth in commercial and residential mortgage loans. Despite a challenging operating environment, the bank's asset quality metrics remained strong, with nonperforming assets making up less than 0.1 percent of total assets as of December 31, 2023.

Financial Performance and Challenges

The bank's total revenue for the fourth quarter was $57.0 million, a slight decrease from the prior year, while net interest income for the quarter was $48.7 million. The net interest margin for the fourth quarter decreased to 3.92 percent, down from 4.30 percent in the prior-year quarter, reflecting the impact of rising interest rates. The cost of funds increased to 2.03 percent in the fourth quarter of 2023, up from 0.65 percent in the same period of 2022, due to higher costs of deposits and borrowed funds.

For the full year, total revenue was $226 million, an 18.6 percent increase from 2022, with net interest income contributing $194 million, up 22.3 percent. The net interest margin for the year improved to 4.05 percent from 3.32 percent in the prior year, while the cost of funds rose to 1.63 percent from 0.50 percent in 2022.

Balance Sheet and Asset Quality

Total assets were $5.35 billion as of December 31, 2023, an increase from the previous year. The loan portfolio expanded significantly, with total loans increasing by $387 million, or 9.9 percent, during 2023. The bank's asset quality remained robust, with nonperforming assets totaling $3.6 million, or less than 0.1 percent of total assets.

Capital Position and Shareholder Value

Shareholders equity increased to $522 million, up from the previous year, with Mercantile Bank maintaining a "well-capitalized" position. The bank's Board of Directors declared an increased first quarter 2024 regular cash dividend, reflecting confidence in the bank's financial health and commitment to shareholder value.

In conclusion, Mercantile Bank Corp (NASDAQ:MBWM) demonstrated strong financial performance in 2023, with significant growth in net interest income and a solid loan portfolio. The bank's strategic focus on maintaining asset quality and a strong capital position has positioned it well to navigate the changing economic landscape.

For more detailed information, investors and interested parties are encouraged to view the full earnings report and investor presentation materials available on Mercantile Bank's website and filed with the U.S. Securities and Exchange Commission.

For further information, please contact Robert B. Kaminski, Jr., President and CEO, or Charles Christmas, Executive Vice President and CFO, at 616-726-1502 or 616-726-1202 respectively, or via email at rkaminski@mercbank.com or cchristmas@mercbank.com.

Explore the complete 8-K earnings release (here) from Mercantile Bank Corp for further details.

This article first appeared on GuruFocus.