Mercer International Inc. (MERC) Faces Net Loss in 2023 Despite Revenue Stability

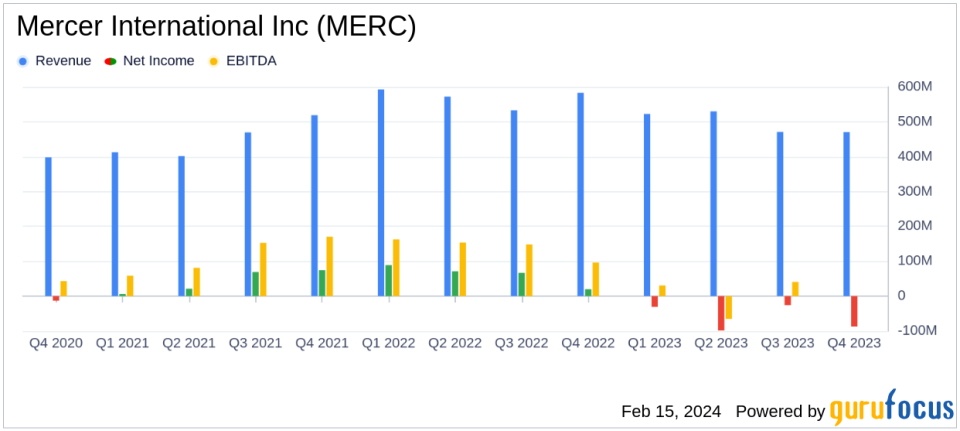

Operating EBITDA: $21.1 million in Q4 2023, down from $96.1 million in Q4 2022.

Net Loss: Reported a net loss of $87.2 million in Q4 2023, and $242.1 million for the full year.

Revenue: Q4 2023 revenues were $470.5 million, a decrease from $583.1 million in Q4 2022.

Dividend: Announced a quarterly cash dividend of $0.075 per share.

Liquidity: Ended the year with approximately $610 million in aggregate liquidity.

Mass Timber Business: Achieved strong growth with a nearly $100 million order book entering 2024.

Mercer International Inc. (NASDAQ:MERC) released its 8-K filing on February 15, 2024, disclosing its financial results for the fourth quarter and full year of 2023. The company, which operates in the forest products industry with a focus on pulp and solid wood, faced a challenging year with a significant net loss despite maintaining stable revenues. Mercer International Inc. is known for its manufacture, sale, and distribution of pulp, lumber, and other related products, primarily generating revenue from its Pulp segment.

The fourth quarter saw an Operating EBITDA of $21.1 million, a stark decrease from the $96.1 million reported in the same quarter of the previous year. The net loss for the quarter was substantial at $87.2 million, which included a non-cash impairment charge of $33.7 million related to the sandalwood business being classified as held for sale. For the full year, the company reported an Operating EBITDA of $17.5 million and a net loss of $242.1 million, compared to a net income of $247.0 million in 2022.

CEO Juan Carlos Bueno commented on the improved pulp pricing environment and the company's efficient mill operations. Despite these positive aspects, the lumber market's overall weakness and strategic decisions, such as the impairment of the sandalwood business, impacted the financial outcomes. The mass timber business, however, showed strong growth, contributing positively to the Operating EBITDA in the fourth quarter.

Mercer International Inc. expects pulp pricing to continue improving into 2024, with modest price increases anticipated in the first quarter. The company remains disciplined in controlling costs and managing working capital to maintain healthy cash and liquidity levels, which stood at approximately $610 million at the end of 2023.

The company's balance sheet reflects the challenges faced, with total assets of $2.66 billion and long-term liabilities of $1.74 billion as of December 31, 2023. Shareholders' equity was reported at $635.4 million.

Mercer International Inc. will pay a quarterly dividend of $0.075 per share on April 4, 2024, to shareholders of record on March 27, 2024. The company's management will host a conference call to discuss the earnings report and provide further insights into its performance and outlook.

In conclusion, Mercer International Inc. (NASDAQ:MERC) faced a challenging 2023 with a significant net loss, impacted by a non-cash impairment charge and a weak lumber market. However, the company's mass timber business showed promising growth, and management remains focused on maintaining financial stability through cost control and liquidity management. Investors will be watching closely to see if the expected improvements in pulp pricing and the company's strategic focus on its core operations will lead to a better performance in 2024.

Explore the complete 8-K earnings release (here) from Mercer International Inc for further details.

This article first appeared on GuruFocus.