Merck (MRK), Eisai to End Keytruda-Lenvima Combo Cancer Study

Merck MRK and partner Eisai announced that they are closing a study evaluating a combination of Merck’s blockbuster PD-1 inhibitor, Keytruda and Eisai’s TKI inhibitor, Lenvima for first-line treatment of recurrent or metastatic head and neck squamous cell carcinoma (HNSCC)

Over an 11-month period, an independent Data Monitoring Committee (DMC) conducted two planned interim analyses of the phase III LEAP-010 study whose primary endpoints were overall survival (OS), progression-free survival (PFS) and objective response rate (ORR). Though a statistically significant improvement in two primary endpoints, PFS and ORR was observed in the Keytruda plus Lenvima arm in the first analysis, in the second analysis, the Keytruda/Lenvima combination failed to demonstrate an improvement in OS compared with Keytruda plus placebo. Meanwhile, the chances of reaching the protocol-specified threshold for statistical significance for OS was low. With the study failing to show an overall survival benefit for patients., Merck and Eisai have decided to close the study.

In HNSCC, another study called LEAP-009 is ongoing, which is evaluating Keytruda plus Lenvima versus chemotherapy for treating recurrent or metastatic HNSCC who progressed after platinum therapy and immunotherapy.

Merck’s stock has declined 0.7% so far this year against an increase of 7.6% for the industry.

Image Source: Zacks Investment Research

At present, Keytruda plus Lenvima is approved in the United States, the EU, Japan and other countries for the treatment of advanced renal cell carcinoma and certain types of advanced endometrial carcinoma. Lenvima is being studied in combination with Keytruda for several different tumor types.

We remind investors that in April, Merck and Eisai discontinued another phase III study called LEAP-003 evaluating a combination of Keytruda and Lenvima for the first-line treatment of adults with unresectable or metastatic melanoma. Per DMC’s recommendation, Keytruda plus Lenvima did not demonstrate an improvement in OS, one of the study’s dual primary endpoints, versus Keytruda alone.

Back then, Merck and Eisai also announced that the phase III LEAP-017 study, evaluating Keytruda plus Lenvima for the treatment of patients with unresectable and metastatic colorectal cancer, did not meet its primary endpoint of OS.

In another press release, Merck announced that a comprehensive phase III program called CORALreef has been initiated on MK-0616, its oral PCSK9 inhibitor being developed for treating hypercholesterolemia. Enrollment has begun in two registrational phase III studies (CORALreef Lipids and CORALreef HeFH) evaluating reduction in low-density lipoprotein (LDL) or “bad” cholesterol.

It plans to begin another phase III cardiovascular outcomes study, CORALreef Outcomes, by the end of 2023. The CORALreef program is expected to enroll approximately 17,000 participants across three global studies. We remind investors that MK-0616 has shown statistically significant LDL cholesterol-lowering activity in a phase II study across a broad spectrum of patients with atherosclerotic cardiovascular disease. It has the potential to be developed as a once-daily oral pill, which targets PCSK9 for LDL cholesterol lowering. At present there are no oral PCSK9 inhibitors available in the market.

Zacks Rank and Stocks to Consider

Merck has a Zacks Rank #3 (Hold).

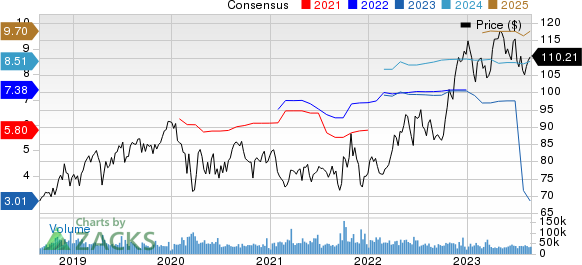

Merck & Co., Inc. Price and Consensus

Merck & Co., Inc. price-consensus-chart | Merck & Co., Inc. Quote

Some drug/biotech stocks worth considering are J&J JNJ, Alaunos Therapeutics TCRT and Corcept Therapeutics CORT, all with a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks (Strong Buy) here.

Estimates for J&J’s 2023 earnings per share have increased from $10.66 to $10.75 over the past 60 days. Estimates for 2024 have jumped from $11.01 per share to $11.30 in the same timeframe. J&J’s stock has declined 5.9% year to date.

J&J beat earnings expectations in all the trailing four quarters. The company delivered a four-quarter earnings surprise of 5.58%, on average.

Estimates Alaunos Therapeutics’ 2023 and 2024 bottom lines have narrowed from a loss of 16 cents to 15 cents and from a loss of 15 cents to 14 cents, respectively over the past 60 days.

TCRT’s earnings beat estimates in two of the trailing four quarters while being in line in the other two, delivering an average surprise of 30.56%.

In the past 60 days, the Zacks Consensus Estimate for Corcept’s 2023 earnings per share has gone up from 62 cents to 78 cents. The consensus estimate for Corcept’s 2024 earnings per share has also improved from 61 cents to 83 cents. Shares of CORT have climbed 56.2% so far this year.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Alaunos Therapeutics, Inc. (TCRT) : Free Stock Analysis Report