Merck (MRK) Q2 Earnings & Revenues Top, COVID Drug Helps Sales

Merck & Co., Inc. MRK reported second-quarter 2022 adjusted earnings of $1.87 per share, beating the Zacks Consensus Estimate of $1.67. Earnings rose significantly year over year (excluding the impact of currency) on higher revenues.

Including acquisition and divestiture-related costs, restructuring costs, income and losses from investments in equity securities, and certain other items, earnings per share were $1.55 compared with earnings of 48 cents per share in the year-ago quarter.

Revenues rose 28% year over year (31% on a constant currency basis) to $14.6 billion, driven by additional sales from its oral COVID drug, Lagevrio (molnupiravir), increased demand for its cancer drugs and human papillomavirus (“HPV”) vaccines. Sales comfortably beat the Zacks Consensus Estimate of $13.8 billion.

Shares of Merck were up more than 1% in pre-market trading owing to the better-than-expected earnings results. The stock has rallied 19% so far this year compared with the industry’s increase of 9.1%.

Image Source: Zacks Investment Research

Quarter in Detail

The Pharmaceutical segment generated revenues of $12.7 billion, up 28% year over year, especially due to additional sales from Merck’s COVID-19 drug, Lagevrio. Higher sales of oncology drugs and HPV vaccines also drove the top line. Excluding Lagevrio sales, the Pharmaceutical segment sales were up 18%, reflecting recovery from the unfavorable impact of the COVID-19 pandemic.

Keytruda, the largest product in Merck’s portfolio, generated sales of $5.25 billion in the quarter, up 26% (30% excluding Fx impact) year over year. Keytruda sales have been gaining particularly from continued strong momentum in lung cancer indications and continued uptake in other indications.

The company’s COVID-19 drug, Lagevrio, generated sales of $1.77 billion during the second quarter, primarily from supply to the United Kingdom and Japan. In the first quarter, Lagevrio generated sales of $3.24 billion.

Alliance revenues from Lynparza and Lenvima also boosted oncology sales in the quarter. Merck has a deal with British pharma giant AstraZeneca AZN to co-develop and commercialize PARP inhibitor, Lynparza, and a similar one with Japan’s Eisai for its tyrosine kinase inhibitor, Lenvima.

Alliance revenues from AstraZeneca-partnered Lynparza increased 11% year over year to $275 million in the quarter. Lenvima alliance revenues were $231 million, surging 28% from the year-ago period, fueled by higher demand in the United States and China.

In the hospital specialty portfolio, neuromuscular blockade medicine — Bridion injection generated sales of $426 million in the quarter, up 10% year over year, reflecting a recovery in surgical procedures.

Merck’s vaccine portfolio witnessed continued recovery for the majority of its vaccines.

Sales of HPV vaccines — Gardasil and Gardasil 9 — surged 36% year over year to $1.67 billion, primarily driven by strong demand, particularly in China. Proquad, M-M-R II and Varivax vaccines recorded combined sales of $578 million, up 12% year over year. Sales of the rotavirus vaccine, Rotateq declined 17% to $173 million. Sales of Pneumovax 23 gained 1% to $153 million. Januvia/Janumet (diabetes) franchise sales were down 2% year over year to $1.23 billion. The drug sales were hurt by the unfavorable impact of foreign exchange and lower pricing in certain international markets. The drugs lost market exclusivity in China in July and are set to lose market exclusivity in the European Union in September. This may lead to generic entry hurting sales significantly.

Merck’s Animal Health segment generated revenues of $1.5 billion and remained flat year-over-year.

Margin Discussion

Adjusted gross margin was 74.7% compared with 76.5% reported in the year-ago quarter, reflecting lower margins from Lagevrio due to the profit-sharing with Ridgeback.

Selling, general and administrative (SG&A) expenses were $2.4 billion in the reported quarter, up 7% year over year due to higher administrative costs. Research and development (R&D) spending was $2.5 billion reflecting a decrease of 34.9% year-over-year. In the year-ago quarter, R&D costs included a $1.7 billion charge related to the acquisition of Pandion, which was absent in the second quarter of 2022.

2022 Guidance

Merck raised its sales guidance for 2022. Merck expects revenues to be in the range of $57.5-$58.5 billion in 2022 compared with the previous guidance of $56.9-$58.1 billion. The guidance range indicates growth in the range of 18-20%. The Zacks Consensus Estimate for 2022 revenues is pegged at $58.13 billion.

MRK tightened its earnings guidance for 2022. Adjusted earnings per share are expected to be between $7.25 and $7.35 compared with the previously guided range of $7.24-$7.36. The Zacks Consensus Estimate for 2022 earnings per share is pegged at $7.30.

Adjusted operating costs are expected to be in the range of $20.5 to $21.5 billion compared with the earlier expectation of $20.3 to $21.3 billion.

Our Take

Merck’s second-quarter results were better than expected, as it beat estimates for both earnings and sales. An ongoing recovery from the pandemic and strong global underlying demand across its business, particularly in oncology and vaccines, led to improved sales in the quarter.

The vaccine sales reflect an ongoing recovery from the unfavorable impact of the COVID-19 pandemic. Merck’s view for 2022 also indicates a promising year ahead.

Merck also made meaningful progress in its pipeline in the quarter, including FDA approval for Vaxneuvance for the prevention of invasive pneumococcal disease in infants and children. The European Commission approved Keytruda into four additional indications. The drug significantly boosted the top line during the second quarter and is likely to continue to do so in the rest of 2022.

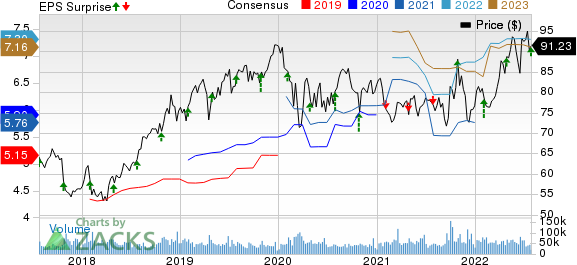

Merck & Co., Inc. Price, Consensus and EPS Surprise

Merck & Co., Inc. price-consensus-eps-surprise-chart | Merck & Co., Inc. Quote

Zacks Rank & Other Stocks to Consider

Merck currently carries a Zacks Rank #3 (Hold). Top-ranked stocks in the biotech sector include ALX Oncology Holdings Inc. ALXO and Precision BioSciences, Inc. DTIL, both sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

ALX Oncology’s loss per share estimates narrowed 1.4% for 2022 and 3% for 2023 in the past 60 days.

Earnings of ALX Oncology have surpassed estimates in three of the trailing four quarters and missed the same on the remaining occasion. ALXO delivered an earnings surprise of 15.48%, on average.

Precision BioSciences’ loss per share estimates narrowed 5.8% for 2022 and 16.2% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Precision BioSciences, Inc. (DTIL) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

To read this article on Zacks.com click here.